While the investment industry has long adopted artificial intelligence (AI), recent rapid advancements indicate that AI holds the potential to be a powerful instrument that could bring about paradigm shifts in businesses in the future.

AI can process vast knowledge, produce clear summaries, and even make forward-looking strategic recommendations when appropriately’ trained’ on relevant data. However, it is crucial to prevent ‘hallucinations,’ which are legitimate AI output errors. This understanding is essential to grasp AI’s potential risks and challenges. AI’s ability to avoid such mistakes can level the playing field between larger businesses with teams of analysts and smaller shops with senior partners and strategists who are just as brilliant and have proprietary IP but need the personnel numbers. 1

The wheels started turning for those in the investment industry as soon as it was realized how Large-Language model-driven AI models might affect many different aspects of the business. Although generative AI models are still in their infancy regarding scaling, the first wave of applications across various industry tasks has begun to appear.

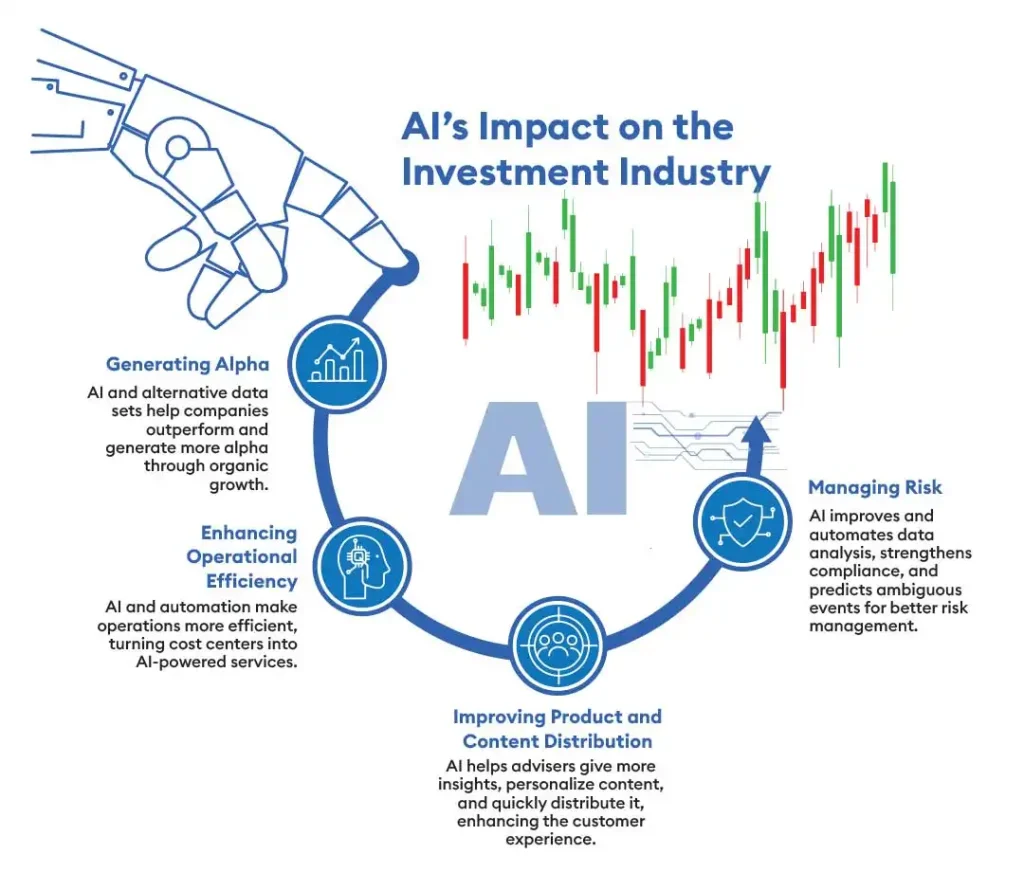

According to the Deloitte Global report on AI, 2, Artificial Intelligence impacts investment management firms in four ways: generating alpha, enhancing operational efficiency, improving product and content distribution and managing risk.

- Generating Alpha: Using AI and alternative data sets has shown to be a differentiator for companies looking to expand organically through outperformance to generate more alpha.

- Enhancing Operational Efficiency: Businesses will use AI and sophisticated automation to run their operations more efficiently. They can also convert conventional cost centers into AI-powered “as-a-service” products.

- Improving Product and Content Distribution: AI enables advisers to provide more insights, personalize content, and distribute it to clients quickly and nimbly. The customer experience is the next front in the war.

- Risk Management: AI is revolutionizing risk management. It allows businesses to improve and automate data analysis, strengthen compliance and risk management processes, and predict ambiguous events.

The introduction of AI into the investment industry is not merely theoretical. AI technology integration has increased dramatically in recent years and language models like ChatGPT are now a source of curiosity and worry.

These instruments bring previously unheard-of complexity, unpredictability, and unrealized potential for data analysis and market forecasting. 3

The widespread adoption of AI technology by market participants and investors indicates that the technology will likely play a long-term role in finance. Regulatory organizations like the SEC will race against time to ensure that the financial sector can exploit AI’s capabilities without falling victim to its potential hazards. AI algorithms are essential to trading strategies, risk assessment, and customer support.

It is still to be seen how these rules will change and if the international financial community can successfully combine security with innovation. The emphasis is moving towards a future where technology and finance merge, but not before a safety net is implemented.

Larger has never necessarily equated to better in the investment industry. Numerous instances exist of smaller investment and advising firms that remain true to their core competencies and provide excellent niche market service. Asset and wealth managers of all sizes may benefit from AI; it has been doing so to varied degrees for years. However, we anticipate seeing more of it in new capacities. 4

How might AI affect the Day-to-day Operations of Investment Managers?

Since many of the market, sector, and industry level reports that both buy-side and sell-side analysts produce may be handled by AI’s generative capabilities and natural language processing (NLP), analysts stand to gain in various ways. Additionally, they can put together reports at the corporate level and provide recommendations for possible investments based on the investment philosophies and methodologies that have been “tuned” or trained upon. The tedious tasks of gathering the data and adding entries to valuation models can be mainly automated. However, the analyst can still review the recommendations to ensure they interpret the correct signals. This should theoretically free up more time for the analyst to undertake more profound and more comprehensive coverage, opening up exciting possibilities for in-depth analysis and insights. AI can provide a level playing field for smaller companies with seasoned portfolio managers (PMs) and asset managers with sizable analytic staffs. 1

The AI wave offers a competitive edge to fund managers, with benefits that were previously unheard of. By uncovering complex insights from raw data, including prospective market trends and in-depth examinations of executive calls, AI equips fund managers to make well-informed and strategic decisions. This competitive edge can be a powerful motivator in a highly competitive industry.

AI’s ability to efficiently process decades’ worth of data and incorporate it into market cycles, patterns, and other macro events provides a sense of reassurance. By offering investment and trading suggestions ‘tuned’ to the current market dynamics and early warning indicators of danger, AI helps fund managers feel more secure and prepared.

It might also locate opportunities that people lack the time or endurance to search for. 5

Functional areas where AI can help asset managers include:1

- Security selection

- Tactical and strategic portfolio construction

- Risk management

- Assessing market sentiment

- Tactical trading strategies (for entering and exiting)

- Auto and algo-driven trading (for additional alpha)

- Sales and marketing

What Negative Effects Might AI Have on the Investment Industry?

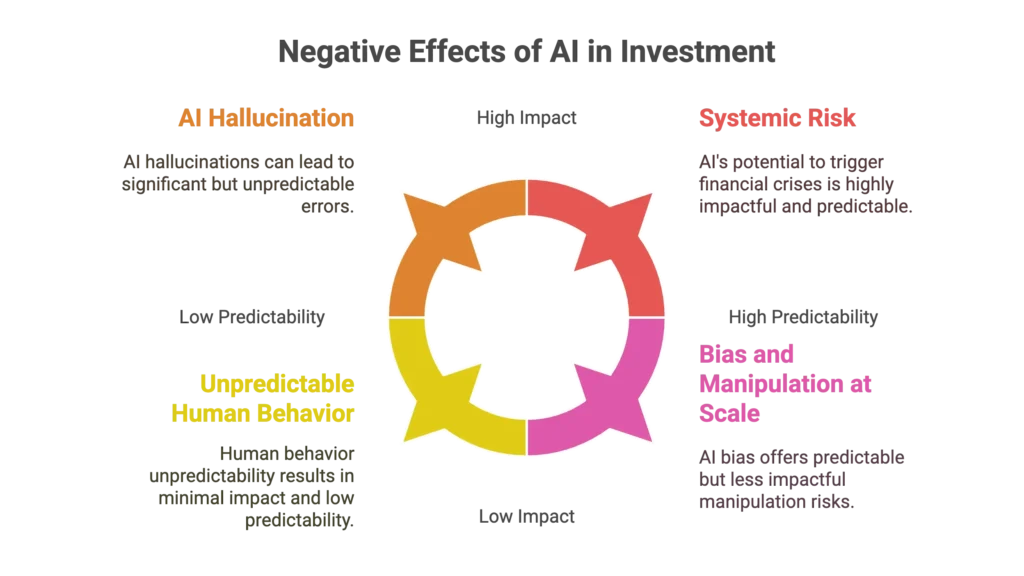

It’s crucial to remember that all the benefits of AI in investing we’ve discussed so far come with a significant caveat-they all require human supervision. This is not a limitation, but a reassurance of the vital role that human oversight plays in AI model investing training. Self-learning models, while powerful, can sometimes make unexpected decisions that lead them astray. We’ve already seen how accurate data can lead GenAI models to produce plausible but correct results. This underscores the importance of human supervision in guiding these powerful tools.

An artificial intelligence engine has a genuine potential of ‘hallucinating’, a term used to describe the situation when AI produces results that are not based on reality but on the whims of data. This can occur in corporate financial reporting and disclosures, where accounting is somewhat of an art and flexible in its application from company to company. Adding ‘irrational’ people to the mix creates significant obstacles to AI model training. Human behaviors frequently throw off models built on previous trends. It can be challenging to detect when a model is ‘learning’ to steer it in a dangerous direction that no human has ever thought of.

Consider that a few market and investment experts may have yet to realize the scope of the events that culminated in significant market shocks like the Enron scandal, the financial crisis, and long-term capital management. These are the genuine drawbacks of artificial intelligence in the investing markets, and they will necessitate safeguards included in model training as well as continuous human review of results.

The US Securities and Exchange Commission (SEC) Chair Gary Gensler has expressed concerns about the possible effects of artificial intelligence (AI) on financial stability amid the growing discourse, comparing the technology to the revolutionary roles that the internet and the Model T formerly had in reshaping sectors. He expressed concerns about the potential problems associated with using AI to create persuasive or predictive information to encourage client engagement. Gensler expanded on his opinions at a recent speech in Washington, DC, at the National Press Club, stressing that AI may be “the center of future crises, future financial crises.”

In addition to highlighting the seriousness of the threat, such a statement underscores the SEC’s proactive approach to addressing any regulatory issues that may arise from these new technologies. This proactive stance should instill confidence in the audience, as it demonstrates the SEC’s commitment to ensuring the safety and stability of the investing markets in the face of AI’s potential risks. 5

A generative AI foundation model, when tailored to the investment philosophies of a specific company or entity, has the potential to produce distorted market forecasts. These forecasts, which may resemble harmless chatbot speech, could be overly optimistic or downplay potential risks. The most concerning aspect is that this could be done at scale, encouraging biased behavior that benefits the adviser, fund manager, or other parties, and potentially fostering herd mentalities similar to the 2021 YOLO/MEME stock trading frenzy.

Will AI affect financial markets as a whole?

Emphasizing the potential of generative AI to significantly boost market efficiency, we could be looking at a future where AI-driven’ active’ solutions cover larger security domains, influencing decisions and making the market more efficient.

AI’s potential to automate most passive management could be a game-changer, significantly reducing fee structures and bringing human and resource efficiencies to active management. This could make even subtle alpha capture more significant for investor returns. With AI’s ability to absorb numerous risks and counterbalance transactions in certain market conditions, avoiding losses and seizing opportunities, product complexity may also increase.

Artificial intelligence is poised to become a vital part of the investment sector. The combination of AI and finance provides unmatched insights, enabling a detailed assessment of risks and identifying market opportunities that traditional human-led trading might overlook. While AI’s transformative impact offers numerous benefits, it also highlights the need for strict control and risk management measures. The future of AI-driven finance appears promising, especially when we prioritize implementing risk-reduction strategies to ensure its successful and secure integration.

Graph Citations:

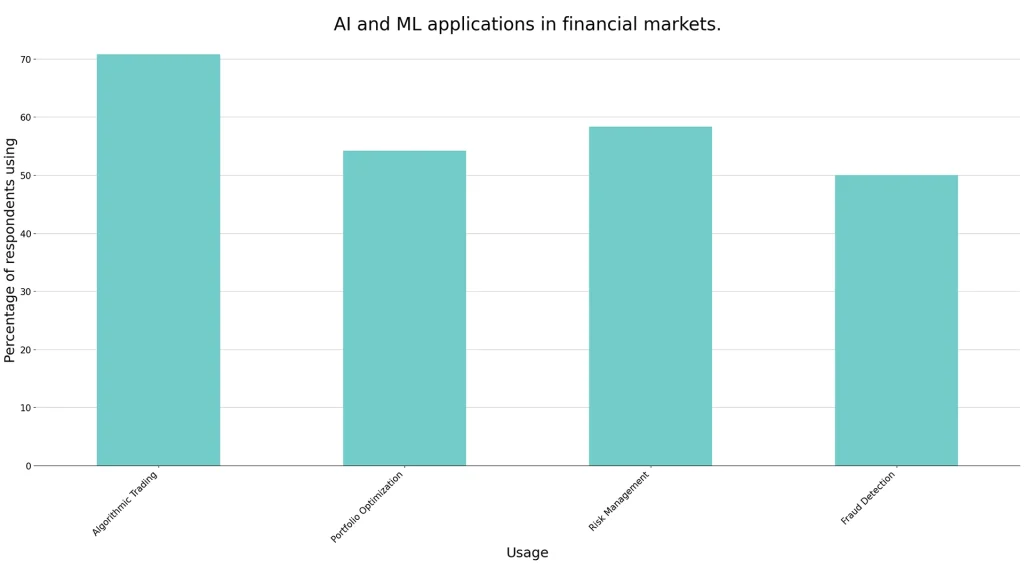

AI and ML Applications in Financial Markets:

- AI and ML Applications in Financial Markets (2024). Mathematics, 16(10), 434. Retrieved from MDPI. Open Access Article.

First Impressions of a Financial AI Assistant:

- First Impressions of a Financial AI Assistant (2024). Retrieved from Figshare. Licensed under CC BY 4.0.

- Investment Management: https://www.lseg.com/en/insights/data-analytics/how-might-ai-impact-investment-management[↩][↩][↩]

- Investment Management: https://www.deloitte.com/global/en/Industries/financial-services/perspectives/ai-next-frontier-in-investment-management.html[↩]

- Investment Management: https://www.jbs.cam.ac.uk/2024/the-power-of-ai-and-how-its-set-to-revolutionise-the-finance-industry/[↩]

- Investment Management: https://rpc.cfainstitute.org/-/media/documents/article/industry-research/future-state-of-the-investment-industry[↩]

- Investment Management: https://www.nasdaq.com/articles/the-impact-of-ai-in-investment-and-financial-services%3A-an-industry-transformation-faces[↩][↩]