Table of Content

Bitcoin halving is a critical event in the world of cryptocurrency, occurring roughly every four years. During a halving, the reward for miners who validate transactions on the Bitcoin blockchain is slashed in half.

This reduction in block rewards is fundamental to Bitcoin’s design, aimed at gradually decreasing the rate at which new bitcoins are introduced into circulation.

The next halving is anticipated to happen on April 20, 2024, when the block reward will drop from 6.25 to 3.125 bitcoins per block. This is part of a predetermined schedule set in Bitcoin’s protocol, with the ultimate goal of reaching a maximum supply of 21 million bitcoins by approximately 2140.

Halving events play a crucial role in Bitcoin’s ecosystem for several reasons.

Firstly, they contribute to the asset’s scarcity, reinforcing its store of value proposition. Additionally, halvings help control inflation by regulating the rate at which new bitcoins enter circulation. As each halving occurs, the reward for miners decreases, making the process of mining more challenging and costly, thus further safeguarding Bitcoin’s scarcity.

Understanding Bitcoin halving is essential for anyone interested in the cryptocurrency market. These events not only impact miners but also influence the broader Bitcoin ecosystem, affecting investor sentiment and market dynamics.

As Bitcoin continues to evolve, halving events serve as reminders of its resilience and long-term value proposition as a decentralized digital asset, challenging traditional financial systems.

Whether you’re a seasoned Bitcoin enthusiast or a curious observer, grasping the significance of Bitcoin halving is fundamental to comprehending its enduring appeal and potential future trajectory.

The next Bitcoin halving, scheduled for April 16, 2024, will cut the mining reward to 3.125 bitcoins per block, halving the rate of new bitcoins entering circulation.

This reduction in supply, occurring approximately every four years, is a pivotal event in the cryptocurrency ecosystem. It not only reflects the protocol’s inherent scarcity but also has profound implications for Bitcoin’s value dynamics.

Bitcoin’s appeal lies in its limited supply, with a maximum cap of 21 million Bitcoins set by the protocol. This fixed supply stands in stark contrast to fiat currencies, where central banks can print money at will, potentially leading to inflation and manipulation.

Additionally, the halving mechanism, a core feature of Bitcoin’s design, reinforces this scarcity principle. Every four years, the mining reward is halved, ensuring a gradual and predictable issuance of new bitcoins.

In May 2020, the mining reward dropped from 12.5 to 6.25 bitcoins per block, and the upcoming halving will further reduce it to approximately 3.125 bitcoins.

This process will continue until all 21 million bitcoins are mined, a milestone projected for around the year 2140. These halving events not only affect the rate of new Bitcoin creation but also contribute to Bitcoin’s narrative as a deflationary digital asset with long-term value potential.

The Impact of Halving on Bitcoin Price

Bitcoin halving events are widely regarded as beneficial for the cryptocurrency’s price, a trend supported by historical data. These events foster optimism among investors, leading to positive price movements afterwards. Several factors contribute to this phenomenon.

Firstly, the reduction in the supply issuance rate highlights Bitcoin’s scarcity, boosting demand and subsequently its price. Furthermore, halving events draw attention to the crypto sphere, attracting new investors and increasing trading activity.

However, it’s crucial to recognize that while halvings historically yield price hikes, the magnitude of these increases may wane with subsequent events. Halving rewards, essentially cutting the rate at which new bitcoins are generated, promotes sustainable growth. This reduction ensures Bitcoin’s supply remains finite, thereby decreasing its inflation rate and limiting new coins entering the market. 1.

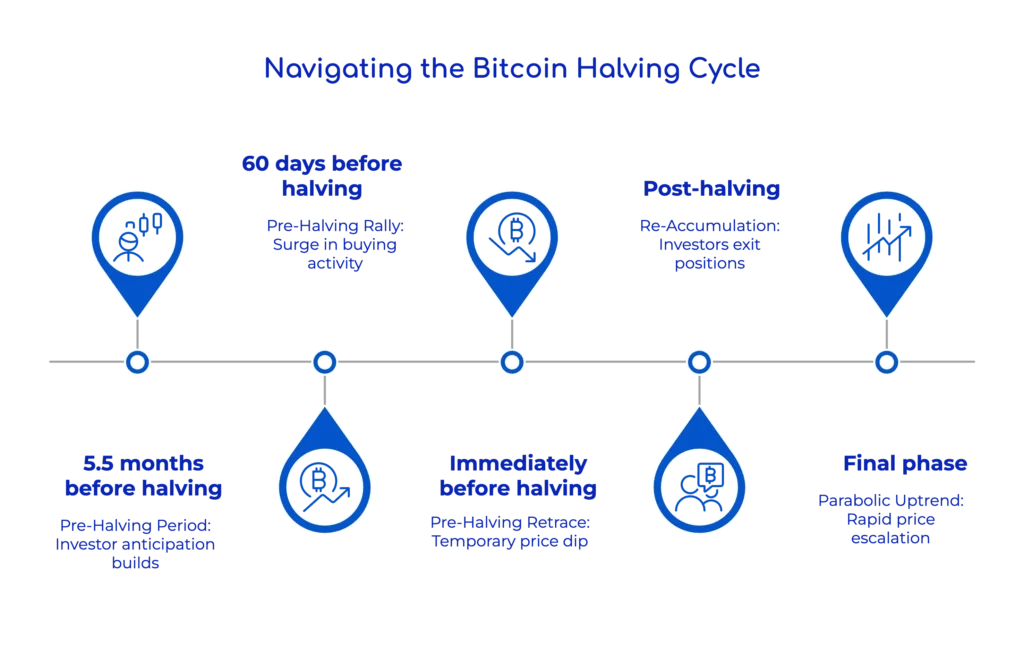

The Halving Cycle: A Detailed Look

- Pre-Halving Period: Leading up to the halving event, which occurs approximately every four years, investors witness about 5.5 months of heightened anticipation. Historical trends suggest that deeper retraces during this period often result in significant returns post-halving, fostering increased purchasing activity and demand for Bitcoin.

- Pre-Halving Rally: Around 60 days before the halving, a pre-halving rally typically takes place as investors capitalize on the hype surrounding the impending event. This surge in buying activity aims to profit from the expected reduction in Bitcoin issuance, often driving prices close to or beyond all-time highs.

- Pre-Halving Retrace: Immediately before the halving, a retracement phase occurs, characterized by a temporary dip in Bitcoin’s price. This pullback, averaging around 20-38% historically, may prompt doubts about the halving’s bullish impact on price.

- Re-Accumulation: Following the retracement, a multi-month re-accumulation phase unfolds, during which many investors exit positions due to impatience or dissatisfaction. However, this stage is crucial for building a strong foundation for future uptrends, offering long-term investors opportunities to accumulate more Bitcoin at lower prices.

- Parabolic Uptrend: The final phase of the halving cycle sees Bitcoin entering a parabolic uptrend, marked by rapid price escalation. Factors driving this surge include reduced Bitcoin supply, increasing institutional adoption, rising public awareness, and positive sentiment. Breaking out from the re-accumulation phase, Bitcoin embarks on a trajectory towards new all-time highs, experiencing accelerated growth.

Understanding these phases can help investors navigate the Bitcoin market, capitalize on opportunities, and brace for potential challenges throughout the halving cycle.

Implications for miners and the mining industry

As we approach the 2024 Halving, scheduled in less than 50 days, it’s essential to understand its significance and the implications it holds for the industry.

During the Halving, the rewards for miners who validate transactions are halved. While this might appear as a challenge for the mining sector, it underscores Bitcoin’s inherent scarcity. With a reduction in the supply of new bitcoins, demand may surge, potentially increasing the value of each bitcoin.

This event prompts miners to enhance their operational efficiency, leading to increased competition and innovation. This drive for efficiency may push the industry towards adopting sustainable practices, aligning with global environmental goals. Miners focusing on eco-friendly solutions like carbon capture and heat waste recycling will likely lead the way in shaping the future of crypto mining.

Halving’s effects aren’t confined to one region but reverberate globally. It fosters a more interconnected and collaborative mining ecosystem, transcending geographical boundaries. From North America to Asia, miners worldwide will adapt to the changes, promoting decentralization.

Effects on altcoins and the overall crypto market with the halving

Following each halving event, where the rate of new Bitcoin issuance is halved, significant shifts occur in market dynamics.

One notable effect of the halving cycle is the redirection of capital towards altcoins, cryptocurrencies other than Bitcoin. As Bitcoin’s price surges post-halving, investors and speculators often diversify their portfolios, allocating resources to altcoins. This influx of investment into the altcoin sector leads to short-term increases in their valuations, accompanied by heightened market volatility.

Historical data from past halving events, particularly the second and third ones, demonstrates a substantial shift in market behavior favoring altcoins. After the second halving, Bitcoin dominance, a measure of Bitcoin’s market capitalization relative to the total cryptocurrency market cap, plummeted by 63%, reaching a low point 552 days later. Similarly, following the third halving, Bitcoin dominance decreased by 42%, hitting a low 848 days post-halving.

Bitcoin dominance serves as a critical indicator in the cryptocurrency market. An increase in Bitcoin dominance suggests a preference for Bitcoin over altcoins, indicating heightened confidence in the leading cryptocurrency. Conversely, a decline in Bitcoin dominance reflects a broader distribution of capital across the altcoin market, signaling growing investor interest and investment diversification within cryptocurrencies. In essence, the Bitcoin halving cycle catalyzes a reconfiguration of capital flows within the cryptocurrency market, influencing investor behavior, market sentiment, and the relative valuations of Bitcoin and altcoins. Understanding these dynamics is crucial for navigating the volatile cryptocurrency landscape and making informed investment decisions.

Post-Bitcoin Halving Trends

Initial Volatility: Following a Bitcoin halving, the market often experiences increased volatility as it adjusts to new supply dynamics. This volatility can persist for weeks or even months, driven by speculative trading and profit-taking.

Mid- to Long-term Appreciation: Historically, Bitcoin tends to appreciate significantly in the months and years following a halving event. This appreciation is fueled by the reduced issuance of new bitcoins, coupled with growing demand and adoption of the cryptocurrency.

Institutional and Mainstream Adoption: With each halving, there is a growing trend of institutional and mainstream adoption of Bitcoin. Institutional investors are attracted to Bitcoin as a hedge against inflation, while mainstream acceptance increases due to positive sentiment and media coverage post-halving.

Heightened Regulatory Scrutiny: Governments and regulatory bodies often increase scrutiny of crypto markets post-halving, considering policy changes and clearer regulatory frameworks. This uncertainty can impact market sentiment until regulatory clarity is achieved. 2.

- coindesk.com:https://www.coindesk.com/learn/bitcoin-halving-explained/[↩]

- cointelegraph.com: https://cointelegraph.com/news/bitcoin-halving-2024[↩]