Table of Content

Introduction

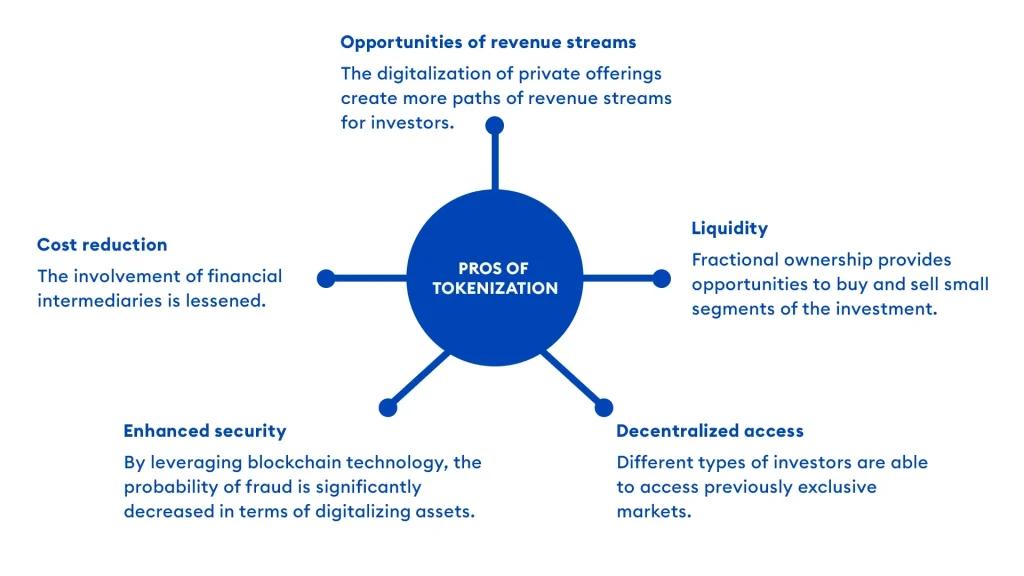

The tokenization of markets is an innovative topic to be discussed. As we know, tokenization provides the following benefits: liquidity, reduced costs, transaction speed, and transparency. Tokenization is the process of converting a person’s rights to an asset into many digital tokens on a blockchain.

A blockchain, in simple terms, is a public ledger that is decentralized and distributed in order to record transactions across multiple computers and makes it impossible to alter any information in a retroactive way without the alteration of subsequent blocks and the consensus of the network.

However, the process of issuing a digital representation of an asset is typically private. Tokenization provides a few easy attractions, such as a 24/7 trading facility, a reduction in the cost of transactions, and increased transparency via immutable blockchain records. It also helps foster a broader base of investors by breaking down high-end assets into small, affordable units.

Understanding Tokenization

Tokens entered the digital space in the early 2000s, when the internet was picking up. 1

This gave companies the chance to collect banking information from their clients for their recurring payments. When this was done, a token was given with all the information linked to the user for a repeat of transactions if needed.

This allowed the user to share information more privately, keeping secondary purchase information safe. Ever since then, tokenization has evolved into a mainstream form of exchanging information and maintaining privacy.

Even though technology has changed drastically over the years, the process of creating, storing, and exchanging tokens has been the same throughout companies, allowing the use of tokens to become widespread. 1

Dr. Merav Ozair, a global expert on web3 technologies, stated, “It seems that there is a growing appetite and sentiment for regulated tokenized asset solutions” in one of the articles published by Nasdaq. 2

This showcases the optimistic overview and future of the tokenization market. In mid-September 2023, Citi Group launched a token service using blockchain technology to offer digital asset solutions for its regulated institutional clients.

The new service, called Citi Token Services, has converted clients’ deposits into digital tokens that can be used for instant cross-border payments, liquidity, and automated trade finance solutions around the clock. 2

“Digital asset technologies have the potential to upgrade the regulated financial system by applying new technologies to existing legal instruments and well-established regulatory frameworks,” Shahmir Khaliq, Citi’s global head of services, said in a statement. This implies a future outlook for the vast usage of digital assets in the financial industry.

In a financial context, the tokenization of assets is the process of providing a digitalized token containing knowledge of its transaction and other contents that run on a blockchain. This is regardless of the nature of the asset (tangible or intangible). LSEG (London Stock Exchange Group) is one of the companies, aside from JPMorgan, Citi Group, and UBS Asset Management, that is drawing up plans for a digitalized marketplace that is going to use blockchain technology and be a separate entity 2

Mechanics and Benefits of the Tokenization Market

The liquidity factor is a very highly required factor in the assets of a company. The higher the liquidity ratio in a company, the easier it is to acquire more assets for expansion, and debt payoffs.

The increased liquidity factor comes from the features that remove the liquidity premium associated with illiquid assets, fractionalization, and globalization.

The liquidity premium is mostly associated with assets such as land and fine arts (in this case, NFTs). Therefore, introducing the liquidity factor helps introduce fair prices, as some assets have difficulty being transported.

Tokenized assets also enable fractionalization of assets, which is infeasible when using traditional instruments. 3

The moment these investments are fractionalized, they will increase in value and liquidity as more investors bring in more demand to own a part of a prestige asset, and they will be able to afford fractions of them rather than paying the full price for the full asset.

When it comes to reducing transaction costs and increasing transaction speed, digitalized assets have taken the forefront. The digitalization of the majority of services and products worldwide has shown an increase in the efficiency of day-to-day processes.

However, when the asset is tokenized, the majority of the previously required processes for intermediaries have been automated or can be automated. This leads to more cost-efficient and faster transactions with better processing, which benefits investors and traders.

Tokenization of assets provides near-instant settlement, whereas, in the traditional finance process, settlement and clearing are two complicated processes that require various intermediaries to carry out and complete the process.

The tokenization process reduces the time, cost, and stress that come with it. Transaction speeds are increased, and transparency throughout the procedure is similar to mobile online banking. The receipt received when a transaction is done, in terms of examples, is always available in the digital book and receipt log of the application. Sharing or taking screenshots of the receipt or transaction details is sometimes blocked by applications themselves or websites themselves, where the details of the two parties are in the open for a moment. 3

Challenges and risks in tokenization market

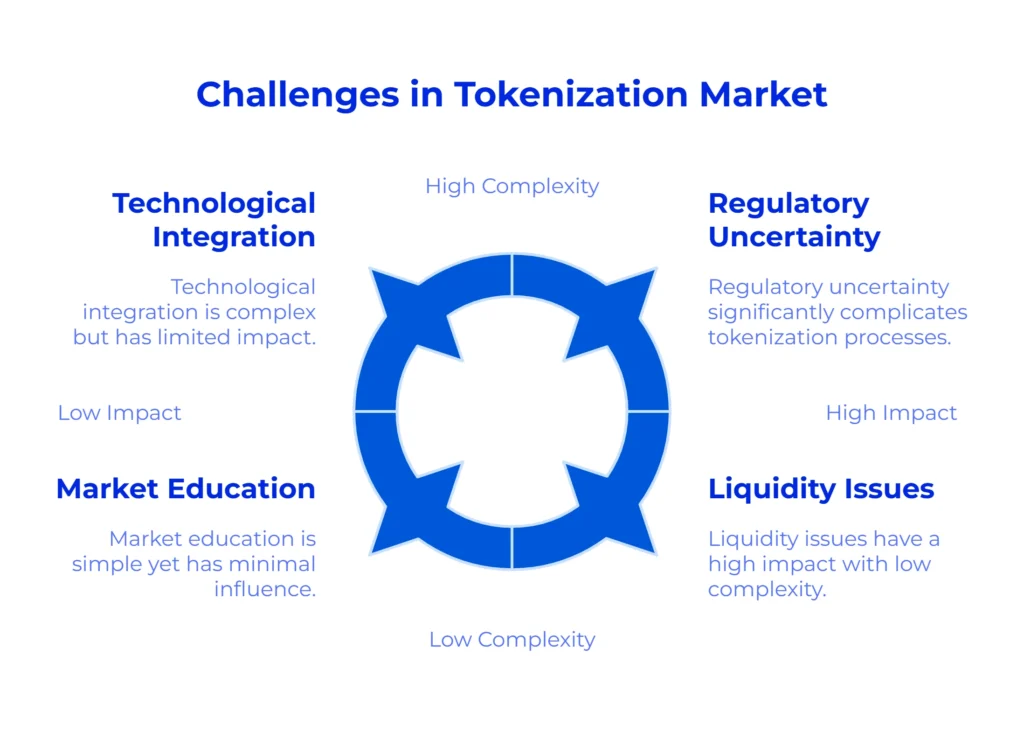

Every step forward in the sense that development brings in bigger advantages and challenges at the same time: a good anecdote would be playing a game; the higher the level of progress, the more experience points you get, but tougher than the challenges of the previous level or something completely new. Similarly, we have to face a similar situation with tokenization. Now that we have looked into what tokenization is, the mechanics of it, and the benefits that we receive from it, let’s understand a bit about the risks. According to Mark Lewis, a managing editor at ‘Kaleido’, with asset tokenization, it is important to attack regulatory uncertainty, technological integration, tradability in the secondary market and liquidity, education in the market, and its level of acceptance. 4

The lack of regulatory uncertainty around blockchain technology puts on another complex layer regarding the process and whether it will work according to absolute expectations when a firm wants to tokenize its assets. Making, forming, and keeping up with regulations as to how blockchains should be handled and their maintenance with a high level of transparency is additional work that is time-consuming. Scalability is when banks must ensure that their system and infrastructure can keep up with the constant growth of the market in tokenized assets and keep up with the number of transactions increasing per day, along with the complexity that comes with it. Scaling blockchain systems also presents challenges for stakeholder management, as both teams and investors have to have the same alignment when it comes to the value, risks, and opportunities that these tokenized assets present. Technological integration and the education of the system along with its acceptance all fall into line as they are risks of ‘new technology’. When new technology is integrated, it takes time for it to be used to the ongoing systems; maybe a software or hardware upgrade is required in the company that it is being installed in. This will add to the subscription price, the buying price of the system, and the installation cost. After this, constant maintenance of the system will be done by the software company itself or the employees who are trained. Which brings us to the next part of the technological issue, which is teaching or educating the existing team on how to use the system and the IT team on how to adjust, update, and maintain the system in case of any issue. Moreover, the newer the trends and the faster they change with new systems, it is going to be a hassle to identify the best trend, new system, or software. When it comes to acceptance, most of the time we can see existing companies unwilling to adapt new methods and technology, work ethics, and the stubbornness to move on to something new, hence making it a bit difficult in specific firms, and sometimes employees who refuse to make the necessary changes. 5

The future outlook of the tokenization market

The process of tokenizing real-world assets has taken the blockchain community by surprise with its continuous exponential growth in the finance industry. Stocks, bonds, and derivatives are converted to digital tokens, which are expected to have massive growth in 2024.

This technology has expanded into processing unconventional assets such as intellectual property, carbon credits, and trade finance receivables. This offers the investors the opportunity to diversify their portfolio into new avenues of revenue streams. 6

The significance of tokenization is increased when it is integrated with blockchain technology. Since tokenization is being utilized in the payment industry, when coupled with blockchain, these tokens can be transferred easily without any involvement from 3rd party intermediaries. Overall, with the swift introduction of AI’s and IoT, the future of tokenization is predicted to be a huge player for the world of digital currencies 7

- Tokenization: https://www.okta.com/identity-101/tokenization[↩][↩]

- Tokenization: https://www.nasdaq.com/articles/the-evolution-of-finance-regulated-tokenized-assets[↩][↩][↩]

- Tokenization: https://www.nasdaq.com/articles/what-tokenization-is-and-how-it-can-unlock-illiquid-and-opaque-markets[↩][↩]

- Tokenization: https://www.kaleido.io/blockchain-blog/challenges-of-asset-tokenization[↩]

- Tokenization: https://ccecosystems.news/en/tokenization-potentials-challenges-and-use-cases-in-the-financial-industry-environment [↩]

- Tokenization: https://hackernoon.com/navigating-the-future-8-tokenization-trends-and-predictions-for-2024[↩]

- Tokenization: https://forbes.com/sites/forbestechcouncil/2023/03/20/the-future-of-tokenization-exploring-its-impact-on-business-and-technology/?sh=51d6e9d362cb[↩]