Washington, DC, Wednesday, January 10, 2024 – Amidst great anticipation the US Securities and Exchange Commission (SEC) today (Wednesday, January 10, 2024) approved the listing and trading of multiple Spot Bitcoin exchange-traded products (ETPs), marking a milestone for the cryptocurrency market. The decision comes after years of SEC resistance to Bitcoin ETFs, with Chair Gary Gensler citing investor protection concerns and the need for a regulated market.

The decision was announced via a Statement by Gensler, on Wednesday. The SEC Statement can be seen here.

In the statement, Gensler acknowledged the court case involving Grayscale’s proposed ETP as a key factor in the change of stance.

He emphasized that the approved ETPs will meet certain investor protection requirements, including full disclosure and listing on regulated exchanges.

However, he reiterated the SEC’s neutrality towards Bitcoin itself, highlighting its speculative nature and potential illicit use.

It’s essential to note that this regulatory green light specifically pertains to ETPs holding Bitcoin and does not encompass a broader range of cryptocurrency assets.

The approval, accompanied by stringent investor protection measures, mandates that the endorsed ETPs adhere to SEC disclosure requirements and secure listings on regulated exchanges underscoring the evolving landscape of cryptocurrency investment products in the US market.

The SEC announcement signals a turning point in the SEC’s stance towards Bitcoin and opens the door for increased investor access to the cryptocurrency through regulated products.

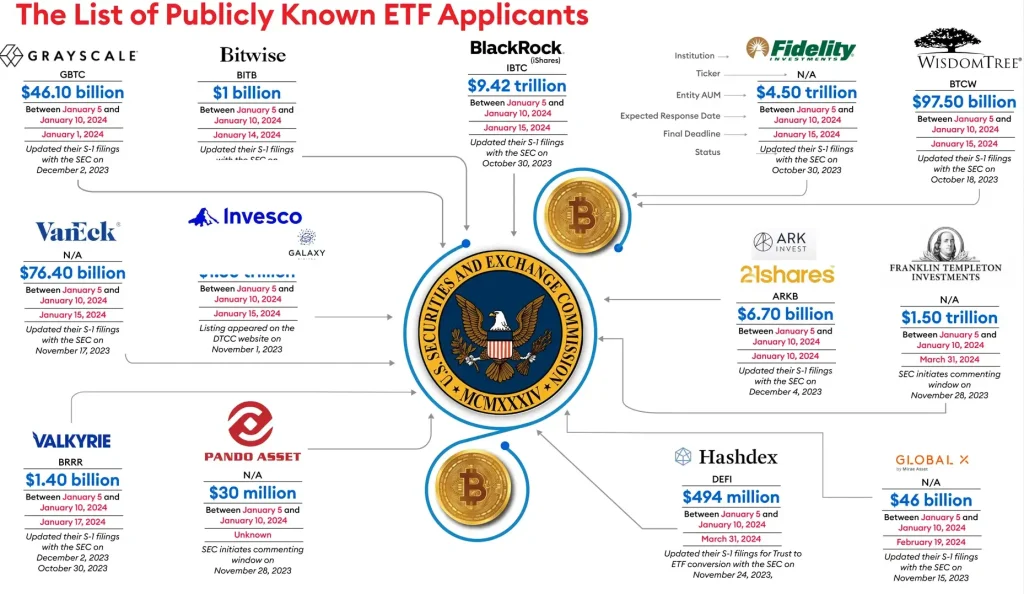

Among the top Fund Managers who have publicly applied for the ETF as Grayscale Investments, Ark Invest, VanEck, Valkyrie Investments, WisdomTree Investments, Franklin Templeton, Fidelity Investments, Bitwise Asset Management, Galaxy Digital Investments, BlackRock, Pando Asset Management, Hashdex Asset Management, Tuttle Capital Management.

This list only includes publicly announced applications. Other companies may have submitted applications confidentially.

Decade of delay

It is now about a decade since the Bitcoin Exchange-Traded Fund (ETF) proposal has been embroiled in a complex regulatory tussle with the SEC.

Those who led the charge are Bitcoin companies like Gemini (founded by the Winklevoss twins) and VanEck, along with major financial institutions like BlackRock and Fidelity.

They claim an ETF is a crucial step towards making Bitcoin more accessible and mainstream, attracting traditional investors and boosting liquidity. This, they argue, would stabilize Bitcoin’s price and propel the broader cryptocurrency market forward.

However, the SEC as the regulatory gatekeeper, said its primary concern was in protecting investors from potential market manipulation and ensuring proper compliance within the largely unregulated crypto sphere.

SEC said it was concerned about market manipulation issues like Wash Trading (Creating artificial trading volume) and the lack of established oversight mechanisms in the crypto exchanges where Bitcoin trades.

The first Bitcoin ETF proposal surfaced in 2013, but the SEC repeatedly rejected them, citing these concerns.

This created a sense of frustration and uncertainty within the crypto community, who saw it as a hurdle to wider adoption.

In 2017 the SEC raised concerns about potential market manipulation and the lack of a robust regulatory framework.

Other established financial players like SolidX and VanEck faced similar rejections in subsequent years, casting a shadow of uncertainty over the industry’s aspirations.

The tide began to turn in 2021, with institutional giants like BlackRock and Fidelity venturing into the Bitcoin space.

This influx of established players like BlackRock and Fidelity bolstered the industry’s image and fueled optimism for regulatory acceptance.

President Biden’s executive order on digital assets in early 2023 further stoked hopes, hinting at a more comprehensive regulatory framework that could pave the way for ETF approvals.

While the SEC remained cautious, it took a tentative step forward in 2021 by approving several Bitcoin Futures ETFs.

During the last two months of 2023, the SEC formally engaged with asset managers ahead of the much-anticipated decision on whether the regulator should approve a Bitcoin exchange-traded fund.

According to various news sources, the SEC met with many high-profile crypto asset and Bitcoin-related people over Bitcoin Spot ETF applications these days.

November:

- Hashdex: SEC officials discussed concerns about market manipulation and investor protection, specifically focusing on the use of cash creations and redemptions and the acquisition of spot Bitcoin from physical exchanges.

- Pando Asset: This Swiss firm filed its application for a Spot Bitcoin ETF in November.

December:

- Grayscale Investments: Along with Franklin Templeton, Grayscale met with the SEC on December 8th to discuss their applications. Reportedly, Grayscale argued for offering both in-kind and cash create and redemption models.

- BlackRock: BlackRock met with the SEC on December 7th, along with representatives from Coinbase and the Nasdaq.

- Fidelity Investments: Fidelity held its meeting with the SEC on December 6, 2023.

- Valkyrie Funds: Valkyrie met with the SEC in December, naming Jane Street and Cantor Fitzgerald as its authorized participants.

SEC officials also met with representatives from Nasdaq in November 2023.

SEC Chair Gary Gensler has always been skeptical regarding cryptocurrencies.

However, he has indicated in recent public statements that he was open to considering his staff’s perspectives on the possibility of a Bitcoin ETF.

Notably, as Grayscale has brought John Hoffman, a seasoned Invesco ETF executive, on board as a Managing director.

In his new role, Hoffman is expected to lead distribution and strategic partnerships for Grayscale, signaling the crypto asset manager’s preparations for the potential launch of the fund following approval.

The SEC’s relationship with the cryptocurrency world isn’t solely defined by Bitcoin.

The ongoing lawsuit against Ripple Labs and many others also exemplifies the regulatory complexities surrounding digital assets.

The Supreme Court ruling in favor of Ripple in 2023 is also seen as a turning point in SEC stance.

The SEC alleges XRP is an unregistered security, while Ripple maintains it’s a utility token. This case carries precedent for the industry, potentially influencing the SEC’s stance on Bitcoin and future ETF decisions.

The increasing belief among market participants that a Bitcoin ETF will ultimately receive approval seems to have positively influenced the price of Bitcoin.