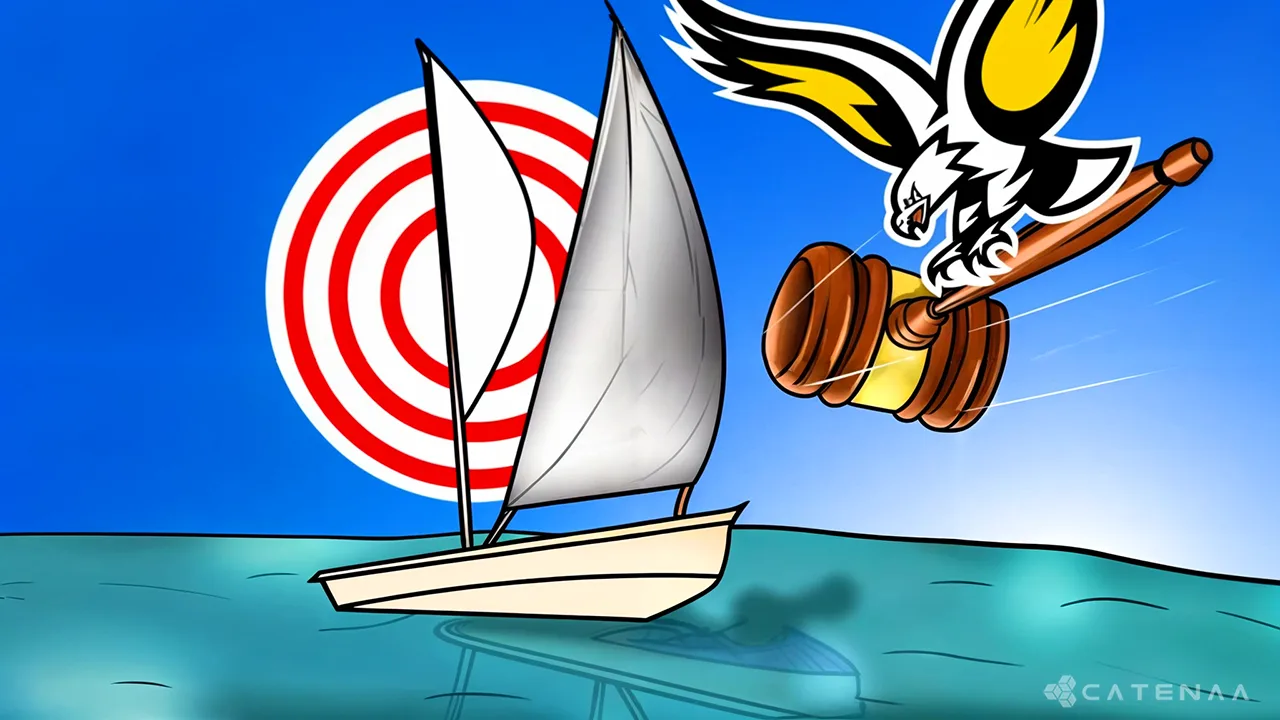

SAN FRANCISCO, Calif., Tuesday, September 03, 2024 – NFT platform OpenSea claimed on X that it also had received a Wells Notice from the US SEC on August 28 indicating a potential lawsuit.

The SEC alleges that certain NFTs traded on the platform may be classified as securities.

This move by the SEC has intensified the already embroiled cryptocurrency vs SEC issues and had raised concerns about the future regulation of NFTs.

“We’re shocked the SEC would make such a sweeping move against creators and artists,” said OpenSea CEO Devin Finzer on X.

“But we’re ready to stand up and fight.”

OpenSea argues that NFTs are fundamentally creative goods, encompassing art, collectibles, video game items, and more.

The company contends that regulating NFTs like traditional financial instruments stifles innovation and harms creators.

OpenSea highlights the potential negative impact on creators, citing student artists who found careers through NFTs and independent game developers who benefited from NFT-powered in-game marketplaces.

In response to the SEC’s action, OpenSea has pledged $5 million to cover legal fees for NFT creators and developers facing similar challenges.

“Every creator, big or small, should be able to innovate without fear,” Finzer concluded.

The SEC had offered no clear classification for NFTs, leading NFT marketplaces to operate under the assumption that NFTs fell outside the SEC’s regulatory scope. With this action against OpenSea, the SEC is attempting to assert its authority over the NFT market.

Crypto companies Ripple, Coinbase, Binance, Uniswap, Kraken, and Consensys were some other companies that have locked horns with the SEC.