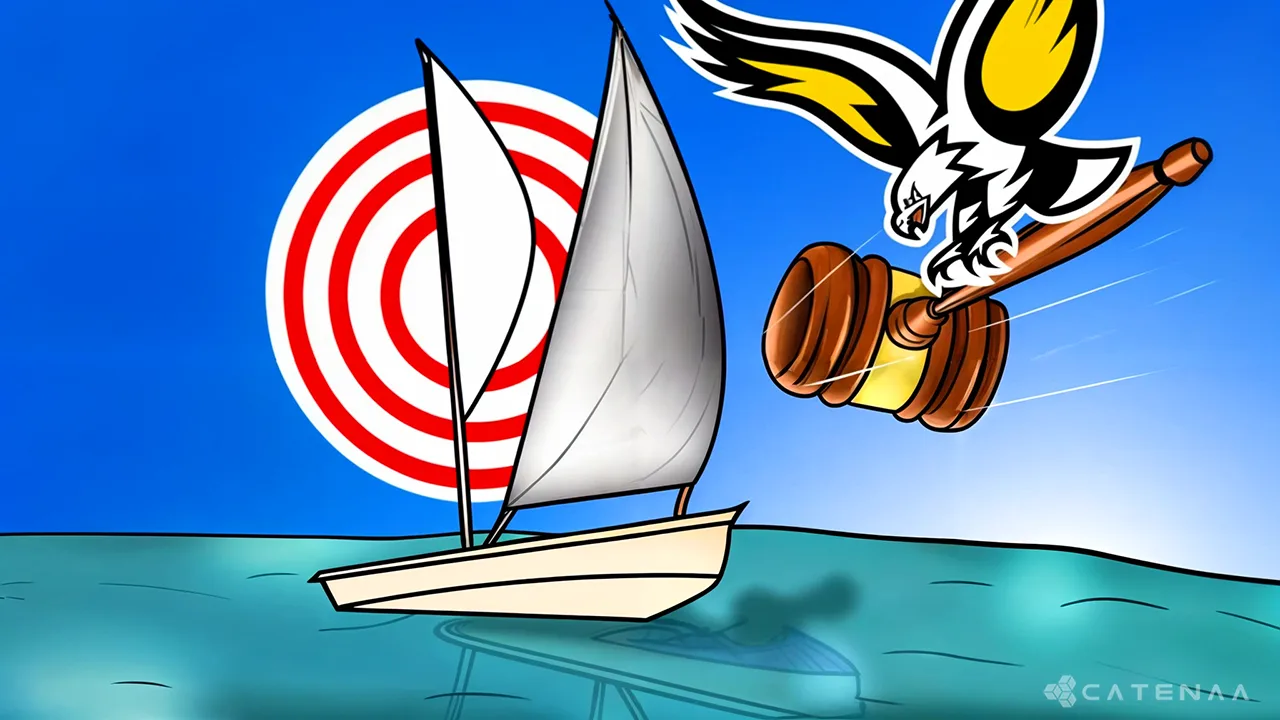

New York, Wednesday, September 04, 2024-The US Securities and Exchange Commission (SEC) has signaled its potential opposition to FTX’s plan to repay creditors using stablecoins.

In a court filing on August 30 with the U.S. Bankruptcy Court in Delaware, SEC attorneys noted that while stablecoin repayments aren’t inherently illegal, they could challenge such transactions, especially those involving U.S. dollar-pegged crypto assets.

FTX, which collapsed in November 2022, has been exploring various options to compensate creditors, including liquidating assets and settling claims based on their value at the time of bankruptcy.

The current proposal would allow creditors to be repaid in either cash or stablecoins.

However, the SEC’s filing suggests that the agency remains wary of these transactions under federal securities laws.

Needless to say the move by the SEC has sparked criticism from the crypto community.

Some accused the SEC of “jurisdictional overreach,” highlighting the agency’s previous actions against other stablecoin issuers, like its dropped case against Paxos in July.

Critics argue that the SEC has favored enforcement actions over establishing clear guidelines, leading to growing tensions between the regulator and the crypto industry.

A coalition of seven U.S. states has also challenged the SEC’s authority, accusing the agency of stifling innovation.