Table of Content

Following the SEC’s conclusion that Ethereum is not a security, the prospect of a Spot Ethereum ETF approval by “the end of summer” has sent ripples of excitement through the cryptocurrency world. The regulatory stance marks a positive step forward, paving the way for Ethereum to enter the mainstream financial arena.

ETFs have gained immense popularity due to their ease of access, liquidity, and diversification benefits. They enable investors to gain exposure to various asset classes without directly owning the underlying assets.

Introducing an Ethereum ETF would mark a milestone, making it easier for mainstream investors to participate in the cryptocurrency market. This would enhance Ethereum’s accessibility, potentially increasing its adoption and acceptance in financial markets.

Moreover, an ETH ETF would provide a regulated and secure way to invest in Ethereum, addressing concerns over the volatility and security of cryptocurrency investments. As regulatory frameworks evolve, approving an ETH ETF could significantly impact the market, offering new opportunities and increasing institutional interest in digital assets.

The potential approval of a Spot Ethereum ETF is particularly anticipated, as it would provide more direct exposure to Ethereum’s price movements.

In June, SEC Chair Gary Gensler indicated that Ethereum ETFs are likely to be approved by “the end of the summer.” 1

The approval process for spot Ethereum ETFs involves the SEC reviewing and approving the S-1 forms, the second step after approving the 19b-4 forms in May.

Initially, the approval for Ethereum spot ETFs was expected by July 2. However, the U.S. Securities and Exchange Commission (SEC) has requested issuers submit revised filings by July 8.

How It Works

Ethereum ETFs track the price of ETH by holding physical Ethereum or derivatives such as futures contracts. The role of custodians is crucial, as they securely store the underlying ETH, ensuring it is safe from hacks and theft. Custodians must comply with regulatory standards to maintain investor trust.

Fund managers oversee the ETF portfolios, making decisions on asset allocation and rebalancing to closely match ETH’s price movements. They also handle operational tasks such as reporting and compliance, ensuring the ETF functions smoothly and efficiently.

Key Similarities and Differences In Ethereum

Ethereum ETFs are similar to traditional ETFs in that they are pooled investment vehicles traded on stock exchanges. However, unlike traditional ETFs, which often consist of stocks or bonds, Ethereum ETFs focus on digital assets, presenting unique volatility and regulatory challenges.

Both ETFs offer investors a way to participate in the cryptocurrency market without dealing with the complexities of owning digital coins.

However, there are differences in their market dynamics. Ethereum is often associated with smart contracts and decentralized applications, while Bitcoin is primarily seen as a store of value.

While Ethereum ETFs share similarities with traditional ETFs in structure and trading, they introduce specific challenges and opportunities unique to the cryptocurrency market.

Their comparison with Bitcoin ETFs highlights differences in underlying assets and potential use cases, making them distinct investment options in the broader digital asset landscape.

Historical Context and Market Reactions

The approval of ETH ETFs marks a significant milestone in the evolution of cryptocurrency investments, drawing parallels to the launch of Bitcoin ETFs. Historically, the success of Bitcoin ETFs provided a gateway for institutional investors, significantly impacting the cryptocurrency’s adoption and price dynamics.

This precedent suggests that ETH ETFs could similarly drive mainstream interest and legitimacy for Ethereum. The anticipation surrounding the potential approval of a Spot Ethereum ETF has already influenced market sentiment.

Historical Precedents: Learnings from the Success of Bitcoin ETFs:

Bitcoin ETFs opened the door for traditional investors to enter the crypto market without holding the underlying asset. This move increased Bitcoin’s liquidity and contributed to its price appreciation. The introduction of ETH ETFs could replicate these effects, enhancing Ethereum’s market presence and potentially accelerating its adoption in various sectors.

Market Sentiment:

Investor sentiment surrounding the approval of ETH ETFs has been predominantly positive. Analysts view it as a crucial step in legitimizing Ethereum as an investment asset. In an effort to attract institutional investors, several ETF issuers have decided to waive fees for their spot Ethereum funds. This approval is expected to boost confidence among cautious investors hesitant to enter the crypto space directly.

Predicted Inflows and Price Impact

Experts predict substantial inflows into ETH ETFs, which could significantly impact Ethereum’s price. In a bull case scenario, increased demand from institutional investors might drive prices higher, potentially leading to a new rally. Conversely, the bear case suggests that the price impact may be limited or negative if inflows do not meet expectations or broader market conditions are unfavorable. Overall, the introduction of ETH ETFs is likely to play a pivotal role in shaping the future market dynamics of Ethereum.

The regulatory landscape

The regulatory landscape for Ethereum (ETH) and Ethereum-based exchange-traded funds (ETFs) has seen significant developments. The U.S. Securities and Exchange Commission (SEC) declared Ethereum non-security, clarifying its regulatory status. This decision provides a foundation for ETH ETFs, allowing them to operate with more regulatory certainty.

The clear regulatory stance on Ethereum positively impacts ETH ETFs and investors by reducing uncertainty and fostering a more stable investment environment. It enables the creation of diverse investment products, attracting both institutional and retail investors. This clarity also encourages innovation within the crypto space, as firms can develop new financial instruments without fear of regulatory backlash.

Industry experts express optimism about the current regulatory environment, viewing it as a pivotal step toward broader acceptance of cryptocurrencies in mainstream finance. They predict further developments, suggesting that ongoing regulatory clarity will continue to enhance market stability and investor confidence, driving the growth of ETH and its associated financial products. As the landscape evolves, stakeholders remain attentive to future regulatory updates that could shape the trajectory of ETH ETFs

Benefits of Ethereum ETFs

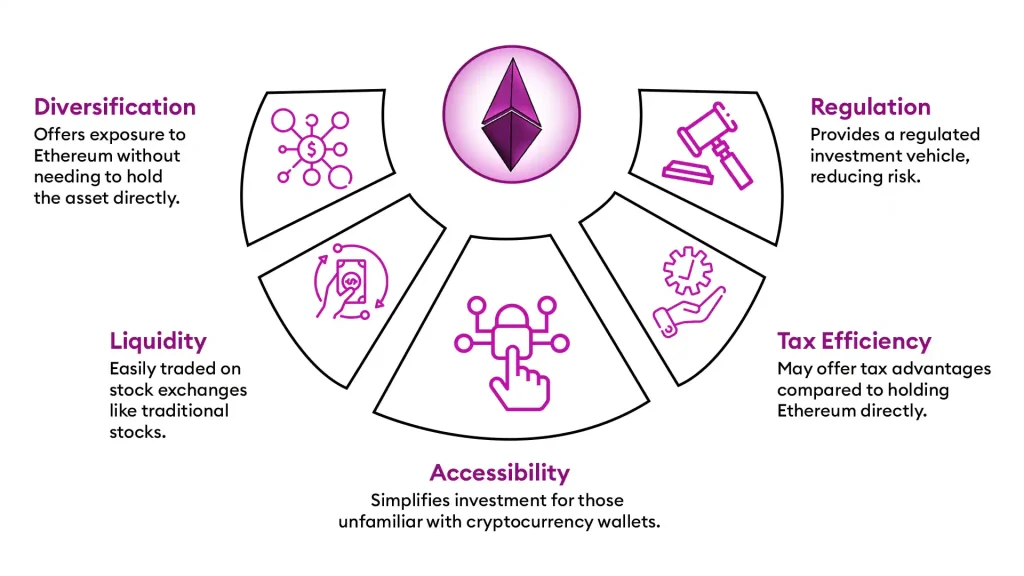

Accessibility and Simplification

Investing in Ethereum through ETFs simplifies the process, removing the complexities of buying and securely managing ETH directly. This approach allows investors to participate in the Ethereum market without needing specialized knowledge about wallets or exchanges, broadening the pool of potential investors.

Diversification and Market Stability

Including ETH ETFs in a portfolio can enhance diversification, providing exposure to the digital asset class while balancing risk across different sectors. This diversification contributes to market stability, as institutional investments through ETFs can reduce the volatility traditionally associated with cryptocurrencies.

Enhanced Liquidity and Price Discovery

ETH ETFs improve liquidity in the Ethereum market by pooling investments, which can lead to more efficient trading and tighter bid-ask spreads. Additionally, the involvement of institutional investors can help legitimize Ethereum, promoting a robust framework for price discovery that reflects its true market value.

Impact on Broader Ethereum Ecosystem

The introduction of ETH ETFs has significant implications for the broader Ethereum ecosystem, including DeFi, NFTs, and Web3 applications. Increased investment through ETFs can drive growth and innovation in these areas, attracting more users and developers and potentially leading to a more mature and expansive blockchain ecosystem.

ETH ETFs present a compelling option for investors by providing simplified access to Ethereum, enhancing portfolio diversification and liquidity, and supporting the broader growth of the Ethereum ecosystem

Institutional Investment in Ethereum and Mainstream Adoption

The role of institutional investors in the cryptocurrency market has been pivotal, signaling a shift in market dynamics. Their growing interest in Ethereum and related assets has increased liquidity and added legitimacy to the market. For instance, investments by major financial institutions have demonstrated the potential for substantial returns, attracting further interest from other institutional players.

Case studies of previous institutional investments highlight the transformative impact on the cryptocurrency landscape. For example, firms like Grayscale and Fidelity have ventured into cryptocurrency funds, providing a precedent for others. These investments have often led to increased market confidence and price stability, showcasing the positive outcomes of institutional participation.

The introduction of Ethereum ETFs could significantly drive mainstream adoption of Ethereum. By offering a regulated and accessible investment vehicle, these ETFs open the market to a broader range of investors, including those hesitant to engage with cryptocurrencies directly. This move democratizes access and reinforces Ethereum’s position as a mainstream asset, potentially leading to increased usage and further innovation within the Ethereum ecosystem.

Potential Risks and Challenges in Ethereum

Investing in ETH ETFs comes with several potential risks and challenges.

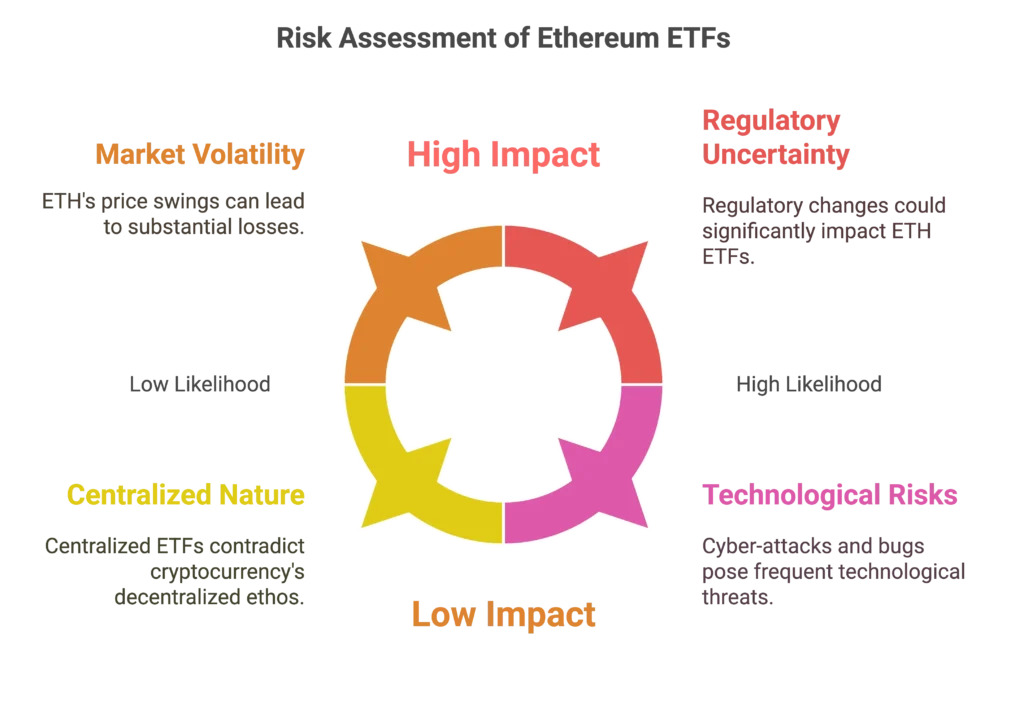

One primary concern is the centralized nature of ETFs. These involve a middleman for trading and custody, somewhat countering the decentralized ethos of cryptocurrencies. This dependency can introduce points of failure and additional costs.

Market volatility is another critical factor. Cryptocurrencies are known for their price swings, and ETH is no exception. These fluctuations can lead to significant losses for investors and affect the stability of ETH ETFs.

Regulatory uncertainty is a looming challenge. While there is some regulatory clarity, future regulation changes could profoundly impact ETH ETFs. Regulatory bodies might impose stricter rules affecting these funds’ creation, trading, and management.

Technological and operational risks also pose threats. Although robust, the underlying blockchain technology is not immune to cyber-attacks, bugs, and operational failures. Moreover, the processes involved in creating and redeeming ETFs can encounter technical issues, leading to potential delays or losses.

Lastly, market saturation and investor behavior are noteworthy risks. As more ETFs enter the market, competition intensifies, potentially diluting individual ETF performance. Additionally, behavioral finance aspects, such as “sell-the-news” events and speculative trading, can lead to irrational market movements, impacting the value of ETH ETFs.

In summary, while ETH ETFs offer a structured way to invest in Ethereum, they have inherent risks that investors must consider carefully.

Future Outlook for Ethereum and the Crypto Market

As the cryptocurrency market evolves, Ethereum and ETH ETFs are poised for significant growth. One predicted trend is the increasing integration of Ethereum-based products into traditional financial markets, reflecting a broader acceptance of digital assets. The rise of ETH ETFs exemplifies this shift, offering investors a regulated and accessible way to gain exposure to Ethereum.

Institutional adoption is expected to accelerate, driven by growing confidence in Ethereum’s potential as a viable investment asset. This trend is underscored by the increasing number of financial institutions exploring ETH ETFs, which provide a bridge between conventional finance and the burgeoning crypto market.

Technological advancements, such as Ethereum’s Layer-2 solutions and recent upgrades like the Merge and Shanghai, are set to enhance scalability and transaction efficiency. These improvements are crucial for the sustainability of ETH ETFs, as they ensure the underlying asset remains robust and capable of supporting diverse financial products.

In the long term, the broader cryptocurrency market stands to benefit from continuous innovation, with Ethereum at the forefront. Developing new financial products based on Ethereum could lead to greater market diversification and attract more investors. As these trends unfold, the potential for further growth and innovation within the crypto space remains substantial, reinforcing Ethereum’s role as a cornerstone of the digital financial ecosystem.

Ethereum ETFs represent a pivotal advancement in bridging the gap between traditional finance and the dynamic world of cryptocurrencies. By offering a regulated, simplified means to invest in Ethereum, they cater to both institutional and retail investors, enhancing liquidity and market legitimacy.

While potential risks such as regulatory uncertainties and market volatility remain, the benefits of accessibility, diversification, and increased adoption outweigh these challenges. As the regulatory landscape evolves and technological innovations continue, Ethereum ETFs are poised to play a crucial role in the broader acceptance and integration of digital assets into mainstream finance, driving future growth and stability in the cryptocurrency market.