Table of Content

- Low Interest Rates: An Overview

- Global Wealth Redistribution:

- Investment Revolution

- Disposable Income and the Pursuit of Financial Freedom

- The Meteoric Rise of Cryptocurrencies

- Success Stories and Cautionary Tales

- The Power of Crowdfunding

- The Critical Role of Financial Literacy

- Navigating Tomorrow: Charting the Course to Financial Freedom through Smart Investing

Low Interest Rates: An Overview

Low interest rates, typically established by central banks as part of their monetary policy, are intended to spur economic growth by reducing the cost of borrowing and promoting increased spending and investment. Such an environment can significantly impact market liquidity, affecting asset prices, consumer behavior, and business investments.

Global Wealth Redistribution:

Using low-interest rates as a means of wealth redistribution is based on the belief that making credit more affordable can empower a wider range of individuals to invest, spend, and enhance their financial position. In order to ensure that the advantages of low rates are distributed fairly, it is crucial to implement comprehensive policies that prevent the wealthy from receiving an unfair share of the benefits. Instead, the aim should be to extend these benefits to low-income individuals and communities.

Strategies for Redistribution:

- Encouraging Home Ownership: Low interest rates have the potential to make mortgages more affordable, opening up opportunities for more individuals to purchase homes and potentially contributing to their long-term financial well-being.

- SME Financing: Small and Medium Enterprises (SMEs) have the opportunity to access more affordable loans, which can help them expand their businesses and potentially contribute to job creation and economic growth.

- Educational Loans: Lowering interest rates on student loans has the potential to make higher education more accessible, allowing individuals to gain valuable skills and enhance their employment opportunities.

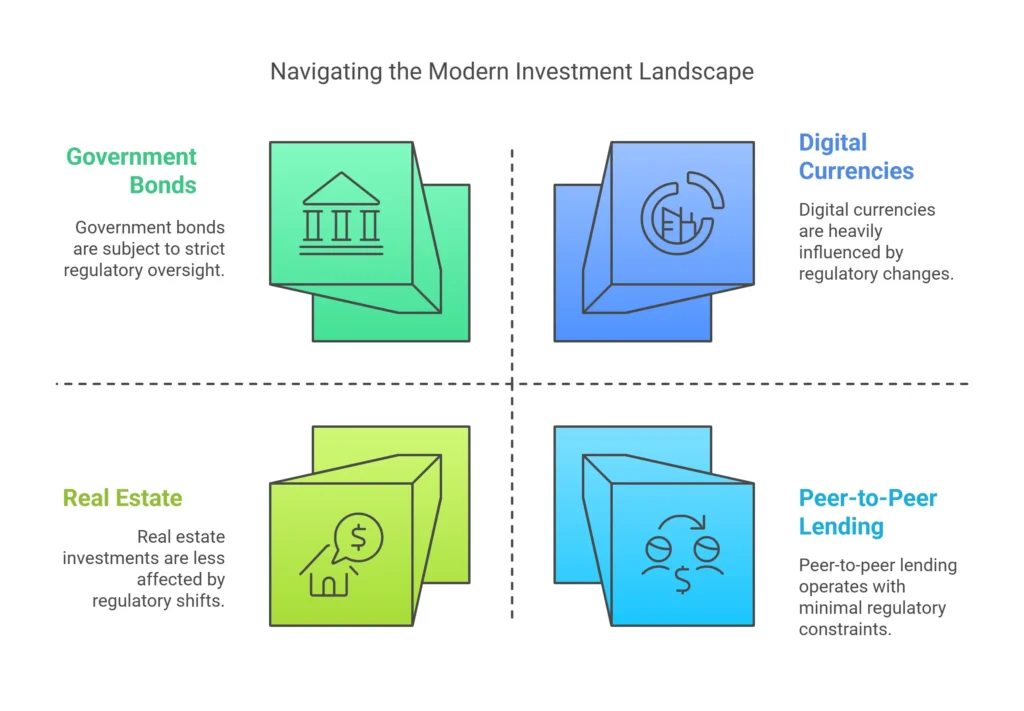

Investment Revolution

Low interest rates have a profound impact on the investment landscape. Investors are increasingly drawn to equities, real estate, and alternative investments due to the lower returns offered by traditional savings accounts and bonds. This transition has the potential to attract more investment into forward-thinking industries and technologies, potentially sparking a wave of funding for sustainable and socially conscious ventures.

Harnessing Investment Flows:

- Green Bonds and ESG Investing: Fostering the issuance of green bonds and incorporating environmental, social, and governance (ESG) criteria in investment decisions can effectively direct capital towards sustainable projects.

- Crowdfunding and Peer-to-Peer Lending: These platforms create arenas, allowing small businesses and startups to access capital and bringing more diversity to the investment landscape.

- Fintech Innovations: Technology-driven financial services have the potential to revolutionize how people save, invest, and manage their money, opening up financial markets to a wider range of individuals.

Disposable Income and the Pursuit of Financial Freedom

Disposable income, which refers to the net income available to households after taxes and social contributions, significantly impacts the overall well-being and economic stability of societies. When people have disposable money, it not only helps them cover their basic expenses easily but also gives them the room to pay off debts, save, and by extension, invest. This creates an impression of financial stability and independence.

The Psychological Enrichment

Rising disposable income enhances material well-being and positively impacts psychological health. Individuals can improve their mental well-being by shifting from relying on paychecks to making financial decisions aligned with personal goals. This allows for savings, investment in personal development, and enjoyment of leisure activities without guilt. Financial stress and worry decrease, promoting a sense of security and independence.

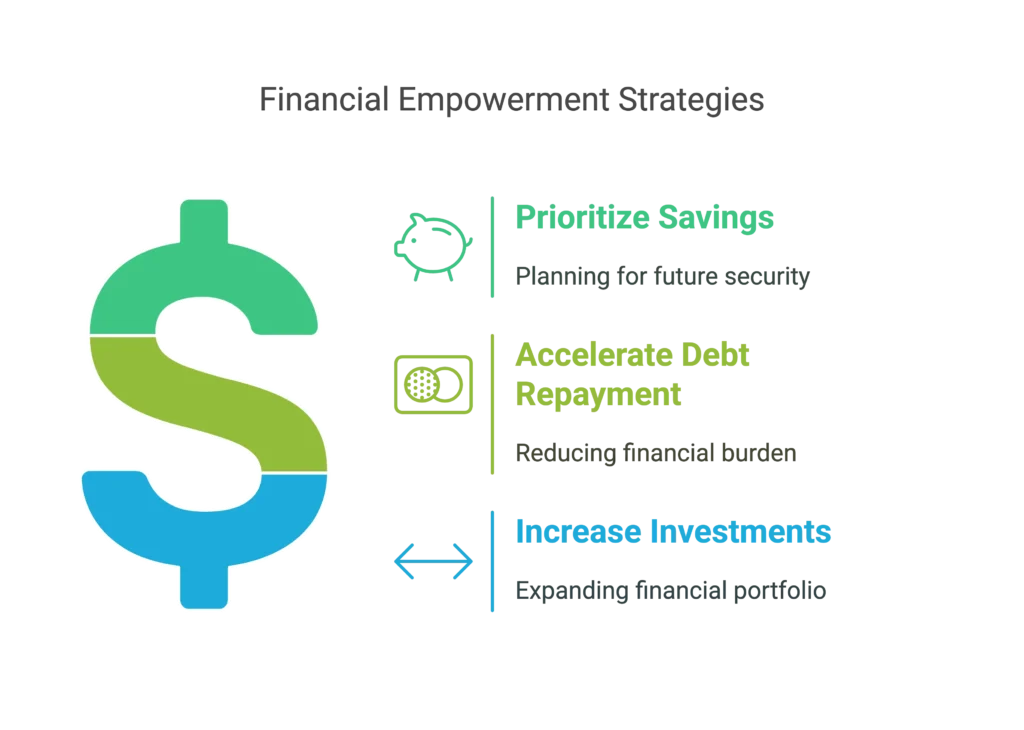

The Economic Empowerment

In the realm of economics, individuals gain authority by having more control over their financial choices. With more disposable income, individuals can:

- Prioritize Savings: This demonstrates a proactive mindset towards finance, where individuals proactively plan for unexpected events, retirement, or future financial objectives. Saving money can provide a sense of security, knowing that there’s a financial safety net.

- Accelerate Debt Repayment: Accelerating debt repayment relieves the financial burden and minimizes the overall interest paid in the long run. Effectively allocating funds towards debt repayment can greatly expedite the journey to financial freedom, allowing for more productive financial goals.

- Increase Investments: Having more disposable income enables individuals to broaden and enhance their investment portfolios. A wide range of investment options are available, including the stock market, real estate, personal education, and startup ventures. Investments of a similar type can generate both financial gains and foster personal development and social advancement.

Societal Transformation

Financial independence transforms society by focusing on sustainability, education, and innovation. This shift can potentially drive economic growth, reduce inequality, and improve social mobility. As individuals make smarter choices with their money, it can profoundly impact society as a whole, leading to a stronger and more vibrant society.

The Balancing Act

Achieving financial equilibrium is challenging due to various factors like economic conditions, personal circumstances, and unforeseen events. Understanding how to manage finances is crucial for making wise decisions, emphasizing the importance of financial literacy and tools that empower people to make informed choices about their money.

The Pursuit of Financial Freedom

Individuals should make effective choices aligned with their objectives, principles, and ambitions to achieve financial freedom. This approach minimizes financial stress, allowing for greater freedom to pursue meaningful activities. Having more disposable income is a measure of financial success and a valuable resource that can enhance one’s life and bring greater fulfillment if managed wisely.

The Investment Paradigm Shift: Beyond Traditional Markets

The shift towards alternative assets is not just a change in investment strategies but a complete reimagining of portfolio construction and management in the modern financial world, driven by technological advancements and a growing focus on financial education, fundamentally changing the perception and access to non-traditional investments.

Beyond Traditional: The Allure of Alternative Assets

Alternative assets, such as real estate investment trusts (REITs), commodities, hedge funds, private equity, and digital currencies, provide distinct advantages. These factors encompass a variety of benefits, such as protection against market fluctuations and rising prices, as well as the potential for significant profits.

Alternative assets offer a unique advantage over traditional stocks and bonds by having a minimal correlation with the stock market. This characteristic allows for diversification, effectively lowering the overall portfolio’s risk.

The Meteoric Rise of Cryptocurrencies

The popularity of cryptocurrencies and tokenized assets has skyrocketed, driven by the promise of secure and decentralized investment opportunities blockchain technology offers. These digital assets present a significant shift from conventional investment options, providing unparalleled accessibility, liquidity, and potential for growth despite the attributed increased volatility and regulatory uncertainty.

The rise of cryptocurrency as a popular investment option signifies a groundbreaking milestone in history. Having emerged from cyberspace less than two decades ago, cryptocurrencies such as Bitcoin, Ethereum, etc have evolved phenomenally, becoming significant assets in many investors’ portfolios. Delve into the fascinating world of cryptocurrencies, examining their rapid transformation, growth trends across different regions, success stories, and cautionary tales that define this era of investment.

Success Stories and Cautionary Tales

Cryptocurrency has both success stories and cautionary tales. Success stories often highlight individuals who became millionaires overnight, while cautionary tales emphasize the importance of thorough research, risk assessment, and understanding the unpredictable nature of cryptocurrency markets. Both stories highlight the importance of retaining assets during turbulent times and avoiding significant losses due to market unpredictability and fraudulent activities.

The Power of Crowdfunding

Crowdfunding platforms are a classic example of the growing trend towards more inclusive investment methods. They allow individuals to support projects or companies right from the start. This method offers financial support to startups and projects that may face difficulties in obtaining conventional funding. It allows investors to invest in potential high-yield avenues and economies to foster SMEs.

The Critical Role of Financial Literacy

In today’s ever-evolving investment landscape, the significance of financial literacy cannot be overstated. A comprehensive understanding of various investment types, the associated risks, and the strategies to manage these risks effectively is essential. Education is crucial in this context, as numerous online resources, webinars, and workshops can provide investors with the necessary knowledge to navigate these waters confidently.

Navigating Tomorrow: Charting the Course to Financial Freedom through Smart Investing

Low interest rates drive a global shift towards wealth redistribution and revolutionize investment strategies. This transformation is driven by technological advancements and a growing focus on inclusivity, leading to a more fair distribution of wealth. Sustainable and socially responsible investing is also on the rise, reflecting a shift in investors’ mindsets. They now prioritize financial returns and their investments’ social and environmental impact.

However, navigating this ever-changing financial landscape can be challenging. Investors are drawn towards non-traditional assets, digital currencies, alternative investments, and the constantly changing regulatory landscape. The interplay between policy, regulation, and financial innovation takes on even greater significance. The policies of regulatory bodies will significantly impact the future of investing as they work to keep up with rapid changes in financial innovation. By carefully navigating transparency, investor protection, and sustainable practices, we can unlock the full potential of low-interest rates for global wealth redistribution and investment revolution.

As we face a momentous shift fueled by low interest rates, pursuing financial independence and astute investment strategies is crucial. Adopting a strategic mindset that values financial literacy, a deep comprehension of regulatory environments, and a strong dedication to ethical investment practices is essential. Through informed investing, diversification, and a focus on the long-term, investors can successfully navigate the intricacies of this modern era, taking advantage of opportunities for wealth redistribution and contributing to a global investment movement that prioritizes both financial gains and societal benefits.