If you are a crypto enthusiast, you may have come across the term liquidity mining, but are unsure about it. The most common investment approach in this field is HODLing, which means buying and keeping the assets in their wallets until the market prices rise.

However, there are many passive income ways to grow your assets. Liquidity mining is one of them. Following the boom of DeFi and DEX between the years 2017 and 2020, more than 130 DeFi platforms are successfully running and serving the swap options for over 100 billion worth of assets locked in them as of now, according to DeFi pulse. So, is it beneficial to put our assets here, rather than just HODL them? Here is a detailed guide on what it is and how it works.

What is liquidity mining?

Liquidity mining is a yield farming method, a passive way of earning by contributing to liquidity pools. You are getting rewarded with tokens according to the amount you are locking. So, you can ask us where I need to lock my assets or what the benefit is for them by just keeping our assets on our behalf. This is where you must understand things like volatility and liquidity.

Crypto is a highly volatile market; whenever a trader or an end-user wants to participate in a trade, sufficient funds must be available. If you are going to the bank and want to withdraw the lumpsum money you have deposited for a longer period. The bank should be aware of this and need to have that huge amount of money readily available whenever required.

Just like that, liquidity is the availability of assets in a market, to put it simply. Users who contribute liquidity guarantee that there are sufficient assets accessible for trade, which can assist in lowering price volatility and increase the market’s overall efficiency.

DeFi terminologies associated with the Liquidity Mining

Before going further, it is better to be aware of these terms associated with Liquidity mining, which will be covered in this article.

DEX

Unlike the centralized exchanges (eg: Binance or Coinbase), all operations of DEXes are decentralized and automated. Facilitates Peer-to-peer transactions efficiently with smart contracts. Your coins and tokens will be handled by you, and you own your private keys as well.

DEXes can be further divided into three categories: on-chain order books, Off-chain order books, and Automated Market Makers.

Order books

Traditional exchanges use order books to proceed with transactions. If you want to buy/sell any assets you can only proceed with that transaction when another buyer or seller from another side quotes the same price to transact as same as yours. Then, the system will match both requests and proceed with the transaction.

Automated Market Makers

As we have mentioned Order books are for traditional exchanges, have you ever thought of DEXes? Since order books are a very inefficient method as if you want to sell an asset, there must be another buyer waiting for you to sell it at a particular price.

This is where Liquidity Pools and Automated Market Makers (AMM) come into play. AMM is a type of decentralized exchange. Instead of processing a trade with another buyer/seller waiting in line, users can process the trade with these algorithms.

AMMs buy and sell assets on a regular basis and profit from the gap between the highest buy offer and lowest sell offer. One great example of an AMM is Uniswap.

Liquidity pools

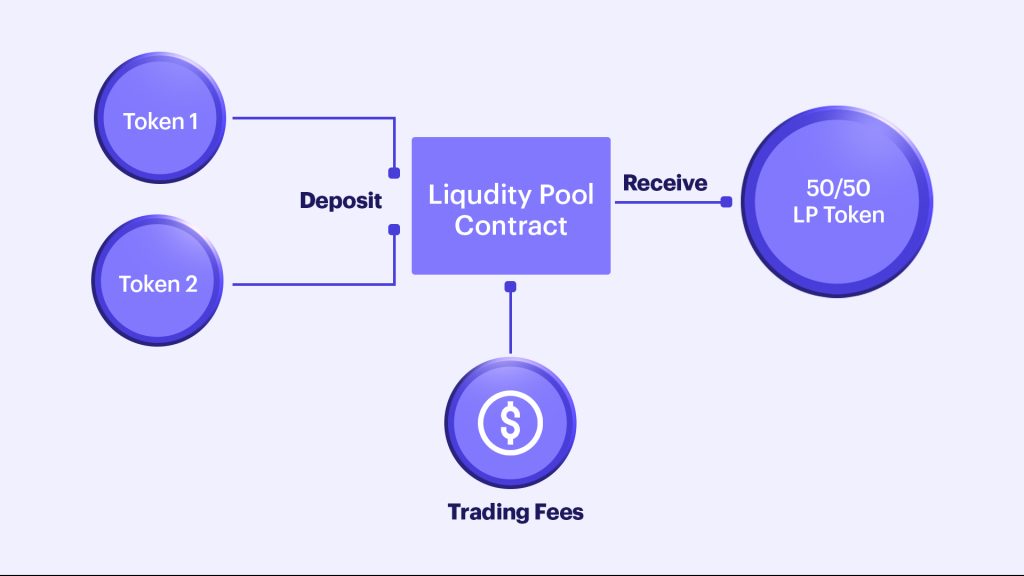

These are the underlying concepts of DEXes. As Chainlink’s education portal states,1 “Liquidity Pools are crowdsourced collections of crypto assets that the AMM uses to trade with people buying or selling one of these assets. The users that deposit their assets to the pools are known as liquidity providers (LPs).”

Simply put, liquidity pools are required to enable asset pairs’ liquidity, so those pairs can be traded. Every asset pair listed in the DEXes has its own liquidity pool; sometimes, a liquidity pool contains a pair of assets, and sometimes, it may be more than two.

How it works

When a user subscribes and puts his assets in the liquidity pool, those funds will be utilized to provide the liquidity of the particular asset/ asset pair. The user can earn a part of the money according to the amount they are locking in, which is charged as fees from the traders using the platform. Some platforms pay the benefit amount in the form of APY (Annual Percentage Yield) or APR (Annual Percentage Rate), and some platforms feature reward incentives such as Governance tokens.

Those earnings are subjective and usually depend on,

- Size of the trading pool

- The overall trading volume of the particular asset pair

Once the user successfully locks up a pair of assets, they will be provided with LP tokens (Liquidity Provider tokens). Those are the proofs that you have locked your assets in. Risky and uncommon pairs usually offer higher APR. Stablecoin pairs are low risk, and their APR typically varies around zero percent.

The more a person owns an LP token, the more a share of the rewards will also increase.

Types of protocols

There are different types of liquidity mining protocols.

- Fair decentralization protocols

These protocols focus on developing a fair playing ground for all users and distributing native tokens equally among active users and early users.

- Progressive decentralization protocols

- Marketing-oriented protocols

Liquidity Mining vs Yield Farming vs Staking

Yield Farming is a broad category of lending assets and earning a passive income from them in the form of fees and interests.

Liquidity Mining is a form of yield farming that lends assets to the liquidity pools of the DEXes. By helping the DEXes provide liquidity for a particular pair, the liquidity provider earns a passive income through transaction fees every time another user swaps their token for another token inside that DEX.

Staking: Simply refers to locking assets to help secure a blockchain network and validate transactions of PoS chains. `

Benefits of Liquidity Mining

- Passive income

It is a great way of earning an amount rather than just HODLing your assets. It also comes with the potential for higher yields and as well as higher risks. That is directly proportional.

- Fair distribution of native tokens

This concept of providing liquidity gives equal opportunity for the individual as well as institutional investors to obtain native tokens or governance tokens. These tokens give the voting power, with the ability to

- Vote on the development proposals for the ecosystem

- Vote on crucial changes to the protocol

Risks of Liquidity Mining

- Impermanent Loss

One of the crucial risks associated with Liquidity mining is the possibility of price fluctuations.

- Rug pulls

Rug pulls means that the core team behind that DeFi project runs away and disappears with people’s money. This is a common scenario in the DeFi space, and putting your money into reliable projects is important. 1

- Chainlink: https://chain.link[↩]