Humans wrap themselves in different materials to explore different environments. For example, divers put on wetsuits, while astronauts wear spacesuits. Similarly, cryptocurrencies require a form of wrapping to venture off into other blockchains. Hence Cardano cBTC.

What is Cardano cBTC?

Cardano cBTC is a cryptocurrency that is built on the Cardano blockchain and is a version of Bitcoin that has been adapted for use on the Cardano network. This process of adapting a cryptocurrency to other blockchains is known as ‘wrapping’ and was first seen in the Ethereum ecosystem with the introduction of wrapped Bitcoin. Wrapped tokens are essentially stable coins as they are pegged to the value of another asset, in this case, Bitcoin. The value of the wrapped token is maintained by locking up an equivalent amount of the underlying asset as collateral. This significant milestone paved the way for Cardano to access almost half a trillion dollars of liquidity and was facilitated by AnetaBTC, a BTC wrapping protocol on Cardano. 1

How Does Cardano Work?

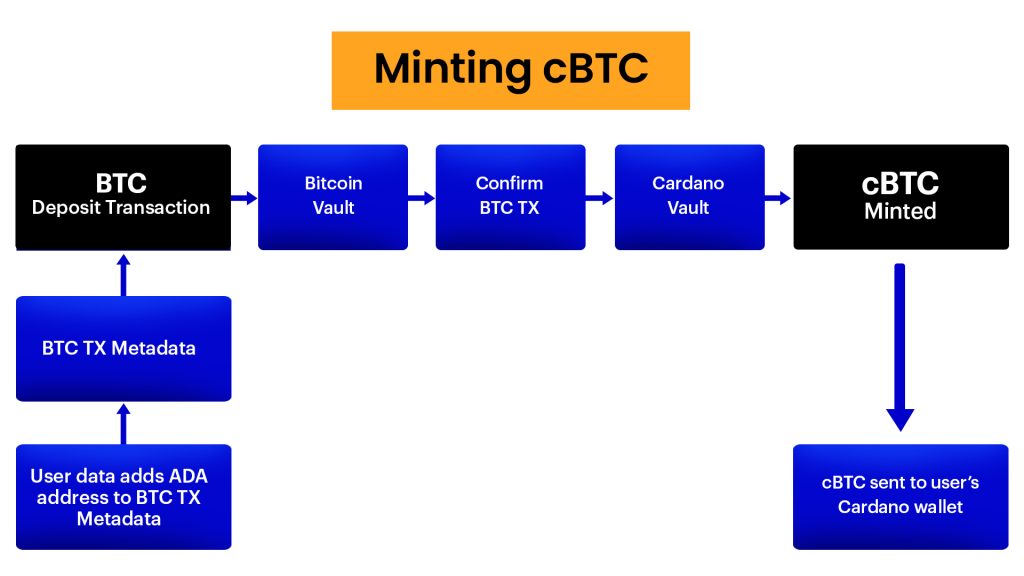

Similar to how wBTC works on Ethereum, users must first deposit bitcoin into anetaBTC’s Bitcoin vault and connect their ADA address to BTC transaction metadata. Then, after confirming the BTC transaction, cBTC is minted from the Cardano vault and sent to the user’s Cardano wallet.

Unlike wBTC on Ethereum, cBTC does not use a centralized custodian. Instead, the entire process is done by decentralized open-source smart contracts, ensuring the security of the collateral bitcoin and a smooth unwrapping process.2

Benefits of Using Cardano

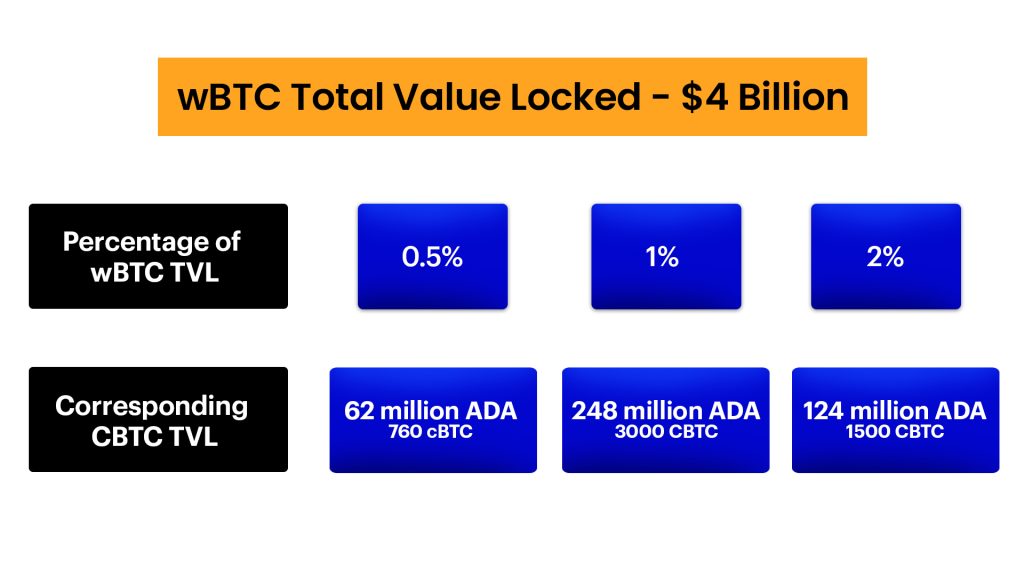

The introduction of cBTC on the Cardano blockchain has several benefits. One of the major advantages is improved liquidity, as cBTC can potentially enable the flow of half a trillion dollars in bitcoin liquidity to Cardano. The asset can be traded on decentralized exchanges, which increases liquidity and provides easier access for trading. The diagram down below illustrates the liquidity injection that Cardano will receive as a percentage of wBTC’s TVL (total value locked).

Another advantage is the ability for Bitcoin holders to access the decentralized finance (DeFi) ecosystem on the Cardano blockchain using cBTC. This opens up opportunities for lending, borrowing, trading, and other DeFi applications. In addition, using cBTC on Cardano can result in faster transaction times and lower fees, as Cardano has faster transaction times compared to the Bitcoin network.

The interoperability of cBTC on Cardano also enables the easy transfer of value between the two networks. The Cardano blockchain also has strong security features that can make it more difficult for hackers to steal cBTC. Overall, the introduction of cBTC on Cardano provides several benefits that can potentially enhance the user experience and security of the asset.

How to store cBTC?

Any native Cardano wallet, such as Uphold or Daedalus, can store cBTC, allowing it to be used in Cardano’s DeFi ecosystem. Using various dApps, users can stake cBTC to earn a yield. Further, cBTC can also be used to trade on a DEX on Cardano, such as MinSwap.

Start Exploring the Possibilities with Cardano

cBTC provides users with the ability to access Bitcoin’s benefits while utilizing the advantages of the Cardano network. By using cBTC, users can participate in decentralized finance (DeFi) applications, access improved liquidity, and benefit from faster transaction times and lower fees. However, it is important to consider the risks involved in using cBTC, such as potential security vulnerabilities and the possibility of losing the original Bitcoin asset if the wrapping process is not properly executed. As the blockchain industry continues to evolve, it will be interesting to see how cBTC is adopted and utilized in various applications and how it contributes to the overall growth and development of the decentralized ecosystem on both the Bitcoin and Cardano blockchains.

- u.today: u.today[↩]

- @anetaBTC Medium: medium.com[↩]