Table of Content

What exactly are Bitcoin Ordinals?

Bitcoin Ordinals are Satoshis that have been ordered by giving them a serial number based on the order in which they were mined. “Satoshis”, which is derived from the pseudonym that is used to identify the person/s that developed Bitcoin, are the smallest denomination of Bitcoin, which contains an equivalence of 0.00000001 BTC.

These ordinals keep track of the Satoshis, their whereabouts, and who owns them. By leveraging Taproot, these ordered satoshis are inscribed with a piece of information in the form of a text or an image, which in turn makes them unique and turns them into a de facto NFT (almost similar in characteristics to a traditional NFT). 1

When compared to traditional Bitcoin transactions, the only similarity these two possess is that they interact with the blockchain in the same way.

- While traditional Bitcoins are primarily designed for the purpose of transferring value between users, Bitcoin ordinals mainly focus on inscribing data onto individual Satoshis.

- In traditional Bitcoin transactions, they only consume limited block space and generally don’t impact the network’s scalability significantly. But in Bitcoin ordinals, it can involve larger data inscriptions, leading to increased block sizes and higher transaction fees, which is concerning in regards to scalability.

Traditional Bitcoin transactions still remain the foundation of the bitcoin system, providing secure value transfer methods. Although Bitcoin Ordinals offer up new ways to engage with the blockchain, there are concerns related to their novelty and possible effects on the network. Ordinals require caution and careful research on the investors’ and users’ part and should carefully balance the inherent uncertainties against the potential rewards.

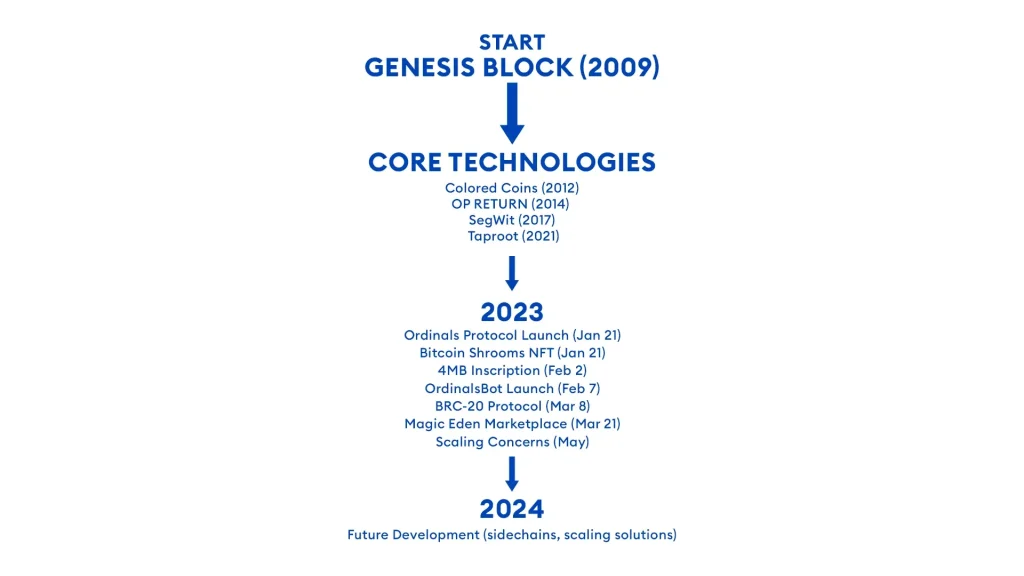

The Creation and Evolution of Bitcoin Ordinals

Bitcoin, long regarded as the digital gold standard, was formerly assumed to be incapable of supporting NFTs. Ordinals, the brainchild of software programmer Casey Rodarmor, arrived in January 2023 and changed all of that. However, this innovation wasn’t just produced overnight; rather, it was the result of years of planning and a unique approach.

Taproot, a 2021 upgrade that enables flexible transaction scripting, sowed the seeds. This enabled the possibility to conceal data, essentially, inscriptions within Bitcoin transactions. Casey Rodarmor took advantage of the opportunity.

He created “Ordinal Theory,” a mechanism that assigns sequential numbers to each individual ‘Satoshi’ based on previous community efforts. This, together with Taproot’s data-hiding capabilities, enabled users to inscribe unique material onto specific satoshis, thereby minting them as NFTs directly on the Bitcoin blockchain.

Ordinals arrived without gaining much public attention, unleashed by Rodarmor on his own. Nonetheless, the concept of “Bitcoin-native NFTs” sparked interest in the community.

Images, videos, and even complete video games were engraved, stretching Bitcoin’s functionality to its limits. Transactions increased dramatically, and Ordinals became a hotly discussed topic. Rodarmor’s contribution has been critical. He not only created the technical foundation but also actively promoted it by creating tools and documentation. Despite concerns about potential network pressure, he believes Ordinals are a logical progression of Bitcoin, broadening its use case without compromising its essential principles.

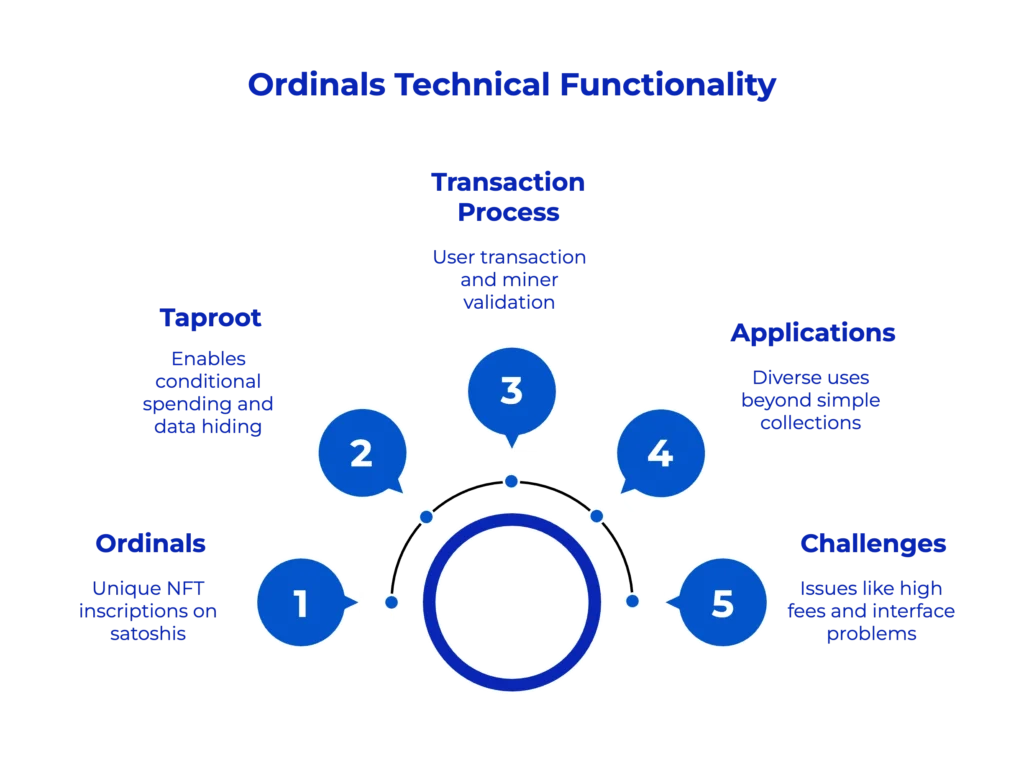

How exactly do ordinals function technically?

How do these “NFT inscriptions” on individual satoshis work? Let us unravel the technical fabric of Ordinals, diving into inscriptions and their potential implications.

Taproot, as mentioned earlier, allows for conditional spending and data hiding, creating the foundation for inscribing information onto the blockchain. The process of the data getting etched onto the satoshi involves two key steps.

- Users create a Bitcoin transaction using a Taproot-compatible wallet. Instead of merely delivering sats, they provide an output with a MAST (Merklized Alternative Script Trees. It’s a technical feature introduced in the Taproot upgrade to Bitcoin) that contains the inscription data. This data can be incorporated directly (raw inscription) or accessed from external storage for larger files (indirect inscription).

- Miners validate the transaction, assuring valid signatures and accurate MAST building. If the transaction is accepted, the inscription is permanently embedded on the linked satoshi.

Once inscribed, the data becomes intrinsically connected to the satoshi, and ownership changes hands along with the satoshi. As a result, each inscribed satoshi becomes a unique and non-fungible token, resulting in the NFT characteristic of Ordinals. 2

The applications of inscriptions are just as diverse as the data itself. Ordinals have displayed artwork such as photos and music, historical texts, and even interactive games. However, the promise goes beyond simple collections. This opens the door to new applications like decentralized identities, data storage, and potentially on-chain governance.

However, this innovation is not without its difficulties. Inscriptions with high data payloads raise transaction fees and can potentially strain network capacity. The lack of dedicated wallets and user-friendly interfaces raises additional challenges for mainstream usage.

How do Bitcoin NFTs differ from their traditional counterparts?

- Technology: Traditional NFTs rely on smart contracts to mint and manage ownership. Bitcoin Ordinals use Taproot’s data concealing capabilities and Ordinal Theory for inscription and tracking, providing a unique technological approach.

- Transaction Fees: Minting and trading fees for Bitcoin Ordinals are closely related to Bitcoin transaction fees, which can be significantly higher than those on specialist NFT platforms. This can be an entry barrier for some users.

- Platform: Bitcoin NFTs are based on the Bitcoin blockchain, which has a reputation for security and immutability. Traditional NFTs are often hosted on specialized platforms such as Ethereum or Solana, with differing degrees of decentralization and security assurances.

- Fungibility: Traditional NFTs exist on distinct blockchains with their own fungible coins (ETH, SOL, and so on). Bitcoin Ordinals, on the other hand, are engraved onto indivisible satoshis, inheriting Bitcoin’s essential virtue of fungibility. While the imprinted data makes each satoshi unique, the underlying value remains fungible in terms of Bitcoin itself.

Advantages and Disadvantages of Ordinals

The direct inscription of digital assets onto the Bitcoin network via Ordinals has sparked a flurry of debate. While the potential benefits are appealing, the consequences for the Bitcoin network and the broader crypto ecosystem should be carefully considered.

Advantages

- Decentralization and Censorship Resistance: Inscriptions are permanently engraved onto the Bitcoin blockchain, making them unchangeable by any single entity.

- Enhanced Security and Immutability: Ordinals, in contrast to other specific NFT platforms, take advantage of Bitcoin’s famed security and immutability, providing a safe shelter for precious digital assets.

- Scarcity and Uniqueness: The finite number of satoshis limits the number of Ordinals, potentially increasing their value and collector interest.

- New Use Cases and Innovation: Ordinals open the door to innovative applications such as on-chain data storage, decentralized identities, and even interactive games.

Disadvantages

- Security Concerns and Vulnerabilities: Novel features, such as data hiding within MASTs (Merkelized Abstract Syntax Tree), may bring unanticipated security issues that must be carefully investigated.

- Technical Complexity and Accessibility: Utilizing Ordinals currently requires advanced technical knowledge, creating a barrier to mainstream adoption.

- Environmental Impact: Mining Bitcoin inherently consumes energy, and large-scale Ordinal inscriptions could further exacerbate environmental concerns.

- Network Strain and Fees: Increased data inscription can raise transaction fees and potentially strain the Bitcoin network, impacting scalability and usability.

The influence of Ordinals on the Bitcoin network and the broader crypto ecosystem is still being felt. Some think that broadening Bitcoin’s use cases strengthens the Bitcoin story, while others are concerned about potential network pressure and environmental effects.

What does the future outlook for Bitcoin Ordinals look like?

The future of Ordinals depends on careful development, responsible adoption, and ongoing dialogue within the community.

Despite the potential of Ordinals, their long-term success is dependent on resolving a number of major obstacles.

To begin with, user-friendly tools and wallets are required to improve accessibility and demystify technical difficulties.

Secondly, techniques for managing transaction fees and network strain are critical for ensuring long-term growth without overburdening the Bitcoin network.

To address environmental concerns, it is also vital to investigate energy-efficient mining processes and promote responsible Ordinal creation. Finally, keeping an eye on the changing regulatory landscape surrounding NFTs and digital assets is critical for avoiding potential stumbling blocks and promoting responsible adoption. Addressing these issues head-on will determine whether Ordinals become a pillar of the crypto ecosystem or fall into irrelevance.

- coinmarketcap.com: coinmarketcap.com[↩]

- investopedia.com: investopedia.com[↩]