Introduction :

Get ready to dive into the exciting world of MicroStrategy’s Bitcoin strategy! Imagine being the first publicly traded company to invest in Bitcoin and now holding a whopping 140,000 coins worth over $4.17 billion.

This move, seen as “daring” and “bold” by many industry analysts, has caught the attention of big players like Tesla and Square, who are also jumping on the Bitcoin bandwagon.

Founded in 1989 by Michael Saylor and Sanju Bansal, MicroStrategy specializes in software for data analysis to enhance business decision-making. Despite facing challenges, including an SEC fine in the year 2000, MicroStrategy remains a dominant player in the industry, continuously innovating and developing new products.

In 2020, MicroStrategy’s CEO, Michael Saylor, took the decision to convert some of the company’s reserves into Bitcoin. This move was driven by concerns about the increase in money supply due to central bank policies during the pandemic.

Many analysts see this as Saylor’s belief that Bitcoin is a way to safeguard against fiat currency devaluation. The company acquired 21,454 BTC for $250 million at an average price of $11,652 per coin. During June 2023, MicroStrategy purchased over 12,000 Bitcoins for $347 million despite facing paper losses. 1

MicroStrategy’s investment in Bitcoin has yielded remarkable success, with a 206% surge in its stock price since unveiling its Bitcoin strategy on August 10, 2020. This surge from $123 to over $375 per share is notably attributed to the company’s strategic move.

Over the same period, Bitcoin’s value also rose by 145%, from $11,600 to about $29,400. Despite Bitcoin’s market fluctuations, MicroStrategy remained steadfast, amassing 152,800 Bitcoins at an average price of $29,672 each, totaling $4.53 billion. This performance has far outpaced traditional investments like stocks, gold, silver, and bonds, reinforcing MicroStrategy’s Bitcoin-focused approach. 2

Unveiling the Decision behind MicroStrategy’s Bitcoin Choice

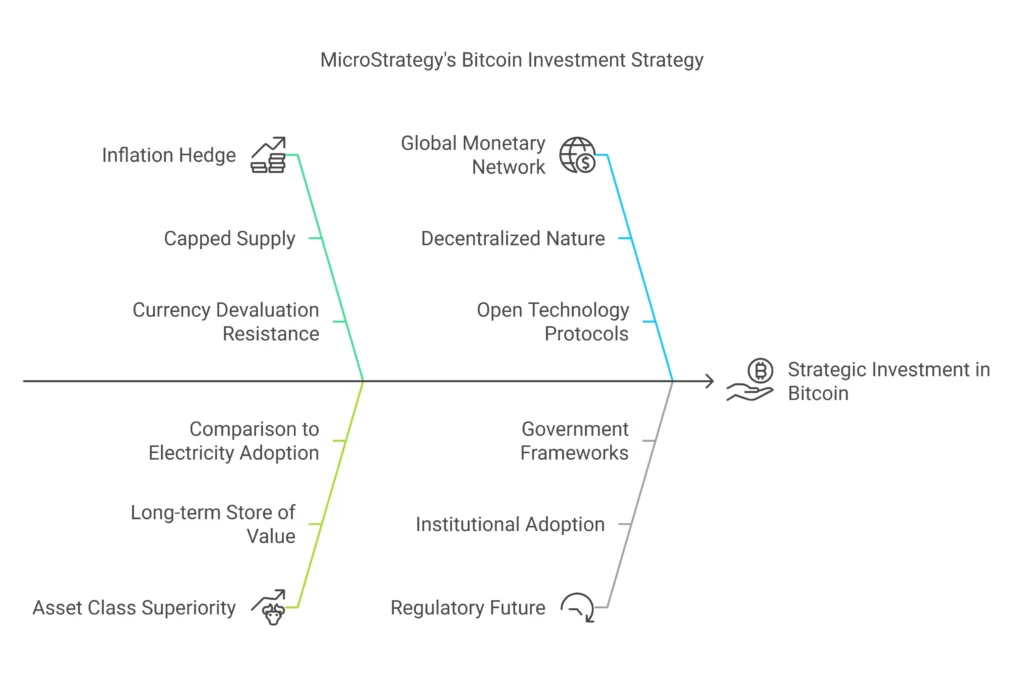

MicroStrategy’s decision to invest in Bitcoin rather than other options stems from its CEO, Michael Saylor’s, belief in the cryptocurrency’s potential as a hedge against inflation and a superior asset class. Unlike traditional currencies and assets, Bitcoin’s capped supply of around 21 million coins makes it resilient to the devaluation caused by excessive money printing.

Saylor views Bitcoin as a long-term store of value, comparing it to the adoption of electricity in the early 20th century – a paradigm shift that people eventually embraced despite initial skepticism. He sees Bitcoin as a global, decentralized monetary network based on open technology protocols, capable of providing a rational alternative for individuals and corporations in countries with volatile currencies.

For countries facing capital flight due to economic instability, like Venezuela, Nigeria, or Turkey, Bitcoin offers a safer haven. Saylor envisions a future where governments respond to the growing importance of Bitcoin by establishing regulatory frameworks, enabling wider adoption by institutions. MicroStrategy’s investment strategy reflects their belief in Bitcoin’s potential to outperform traditional assets in the long run. Saylor’s vision aligns with creating a decentralized, universally accepted monetary system, with both individuals and corporations embracing Bitcoin as a rational store of value and safeguard against currency fluctuations.

MicroStrategy’s Impact on Bitcoin Market

MicroStrategy’s purchases have consistently impacted the Bitcoin market positively, with average returns of approximately 6.2% during its buying periods. These purchases establish a steady buying presence. However, the market tends to react negatively when focusing on the announcements of MicroStrategy’s acquisitions. On average, Bitcoin’s price decreases by 2.2% on announcement days and exhibits slightly negative weekly returns at -0.2%.

The recent news of MicroStrategy’s latest purchase resulted in a 3% drop in Bitcoin’s value. This pattern suggests that while MicroStrategy’s buying supports the market, the market responds less favorably to their purchase announcements.

Conclusion

In conclusion, MicroStrategy’s pioneering move into Bitcoin as a corporate treasury management strategy, driven by Michael Saylor’s vision of Bitcoin as an inflation hedge, has initiated a significant shift in how traditional companies approach cryptocurrencies. This bold approach has sparked debates about centralization versus decentralization in Bitcoin’s design, as the accumulation of the digital asset in a few hands challenges its original intent. However, as more companies consider similar moves, the discourse around centralization will remain a crucial and evolving aspect of the cryptocurrency market.

Saylor’s confidence in MicroStrategy’s unique strategy, setting it apart from traditional ETFs, is reflected in his anticipation of the potential impact of a Bitcoin ETF approval. While comparing MicroStrategy to a nimble “sports car” and a potential ETF to a slow-moving “supertanker,” he foresees significant investments entering the crypto space, especially from large hedge funds.

Despite stock fluctuations, Saylor maintains his optimism about MicroStrategy’s role in the Bitcoin ecosystem. The company’s aggressive investment approach and the potential Bitcoin ETF approval could reshape crypto investments and create new opportunities for all participants. With its substantial Bitcoin holdings and ongoing acquisitions, MicroStrategy’s influence remains prominent, positioning it as a key player in the Bitcoin market’s future. 3

- Microstrategy: www.microstrategy.com[↩]

- Cointelegraph: https://cointelegraph.com[↩]

- Thefinancialtechnologyreport: https://thefinancialtechnologyreport.com/[↩]