In October 2022, the European Union unveiled the Markets in Cryptoassets (MiCA) Regulation. Approved by the European Parliament, it is the world’s first crypto-asset regulatory framework, addressing key crypto investing concerns.

Most crypto-assets, excluding those like security tokens and central bank digital currencies, now find their regulatory home within MiCA. This includes:

- E-money tokens

- Asset-referenced tokens

- Utility tokens

Further, public offerings of crypto-assets (except e-money or asset-referenced tokens) also come under MiCA. This underpins the aim of a comprehensive regulatory approach.

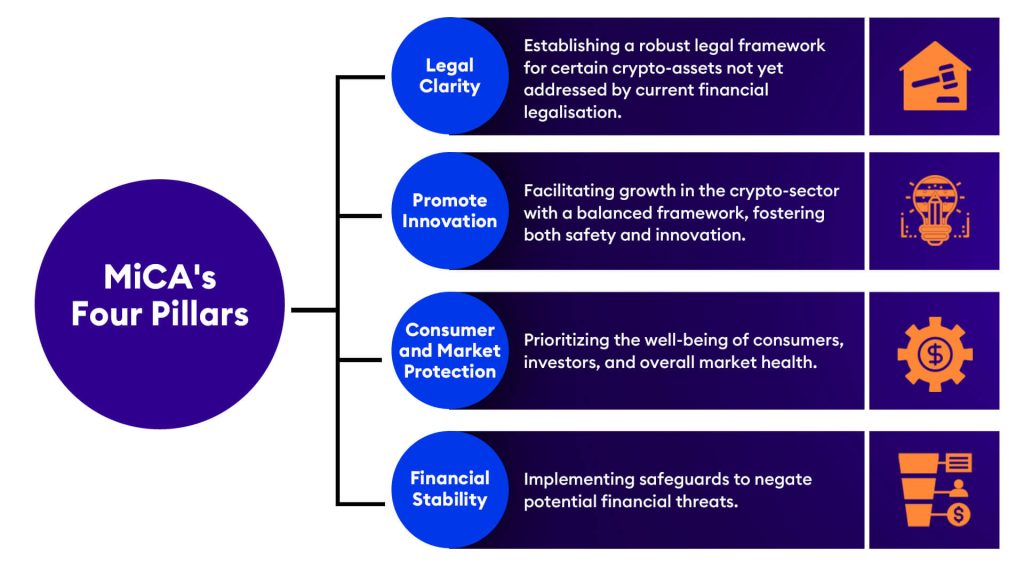

MiCA’s Four Pillars:

- Legal Clarity: Establishing a robust legal framework for certain crypto-assets not yet addressed by current financial legislation.

- Promote Innovation: Facilitating growth in the crypto-sector with a balanced framework, fostering both safety and innovation.

- Consumer and Market Protection: Prioritizing the well-being of consumers, investors, and overall market health.

- Financial Stability: Implementing safeguards to negate potential financial threats.

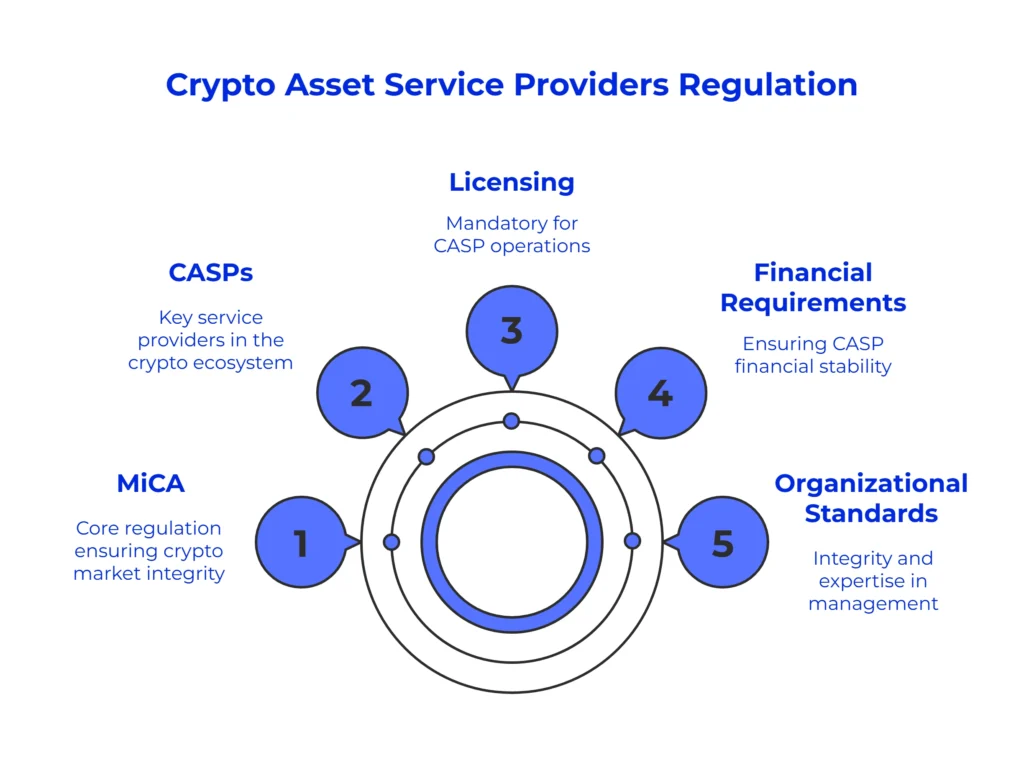

Crypto Asset Service Providers (CASPs) Overview & Licensing Requirements

In the dynamic realm of cryptocurrencies, Crypto-Asset Service Providers (CASPs) shine as the guiding stars, aiding users in managing, trading, and safeguarding their digital riches. As we step into a new era of regulation, MiCA (Markets in Crypto-Assets) emerges as a transformative force, bringing clarity and accountability.

Picture this: a comprehensive framework, MiCA, designed to bring harmony and security to the crypto landscape. MiCA is expected to capture and oversee the essential services that CASPs provide.

From guarding and managing crypto assets for third parties to offering insightful advice on these digital treasures, CASPs stand at the forefront of crypto.

Under MiCA’s purview, CASPs must obtain licenses to operate as trusted service providers. A European passport beckons to those who meet the criteria, reflecting the principles of established financial regulations. Much like the familiar MiFID and market abuse norms, CASPs must adhere to stringent conditions and be prudent.

MiCA also introduced a rule mandating CASPs prove their financial strength. The competent authorities of countries will have to ensure that CASPs have a financial cushion set aside to cover possible losses.

How is this cushion calculated? It is the larger value between a Service-Specific Minimum amount or a Fraction of the CASP’s previous year’s expenses.

This protective strategy not only protects investors and the financial system but also strengthens the overall stability, even during turbulent periods, experts say.

Hold on, there’s more! Along with financial reserves, CASPs must meet rigorous organizational benchmarks. A seasoned management body, adorned with integrity and expertise, takes the helm. Shareholders boasting unblemished records become the pillars of strength. As we embrace this transformation, the future of crypto-asset services shines brighter than ever.

Playing a vital ‘Gatekeeping’ role, CASPs not only uphold the financial system’s integrity but also prioritize their clients’ best interests. MiCA mandates internal control systems that identify and thwart the misuse of clients’ data and orders. As MiCA and CASPs join hands, a new era of accountability and prosperity dawns in the crypto universe. 1

MICA Proposal Impact Brief

The MiCA authorization introduces a unified crypto regime across the EU, negating the need for separate licensing in each Member State. Though initial compliance might dent CASP profits, the long-term vision promises reduced regulatory fragmentation and boosted investor confidence. Expect a larger capital influx into crypto, benefiting from stricter governance standards. As competition heats up, consumers will enjoy superior services and decreased costs.

This regulation also fortifies financial stability, preemptively addressing potential risks in the ever-expanding crypto market. By overseeing CASPs, authorities can seamlessly bridge traditional and digital finance, ensuring a safer financial future.

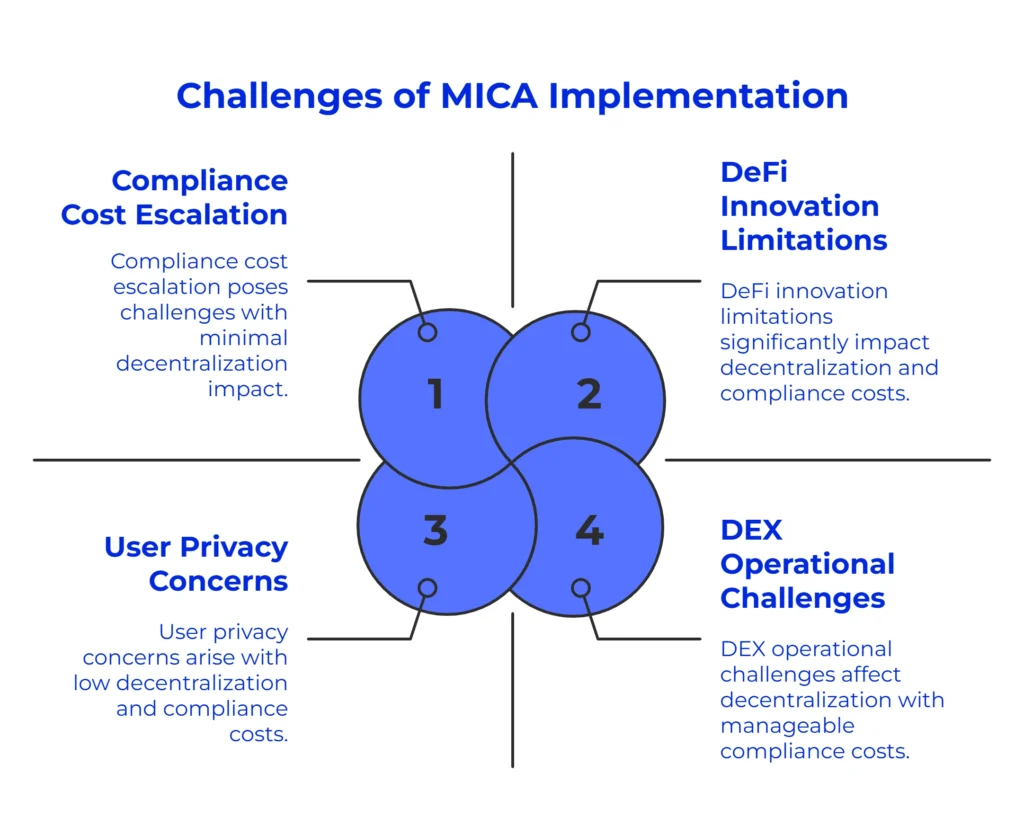

Challenges

The MICA cryptocurrency proposal, while aiming to regulate and secure the crypto landscape, comes with its own set of concerns.

Foremost among these is the looming threat to user privacy. Requiring crypto-asset service providers to amass personal data raises alarms about potential privacy breaches and vulnerabilities to cyberattacks. Furthermore, the implementation of MiCA might escalate compliance costs for DEXs and DeFi platforms. Although MiCA aims to secure the market, aligning with traditional financial regulations could prove burdensome. Decentralized Finance (DeFi) is not left untouched, with the draft lacking clarity on yield-bearing innovations. The decentralized essence of DeFi ecosystems might face limitations due to MiCA, affecting dApps, DEXs, and smart contracts. The path ahead is riddled with challenges and calls for a balanced approach.

- BBVA: https://www.bbva.com[↩]