Table of Content

Understanding the intricate workings of financial markets may seem complex, but diving into these waters can be a journey worth taking. One fundamental component that is often overlooked yet plays an indispensable role in the smooth functioning of markets is the Liquidity Provider.

As middlemen in the securities markets, liquidity providers are like the conductors of an orchestra, ensuring each section comes together in harmony, contributing to the seamless flow of transactions.

This article explores the fascinating world of liquidity providers – financial institutions that create a vibrant marketplace for investors, enabling them to buy or sell securities whenever they wish. From purchasing vast volumes of securities from issuers, distributing them to other financial entities, and finally to retail investors – liquidity providers form the backbone of the financial markets. The process is often facilitated by ECN brokers, adding another layer of efficiency to the transactional ecosystem.

By embodying the term ‘core liquidity provider’, these institutions perform a balancing act – buying and selling shares simultaneously with the goal of guaranteeing availability on-demand. They are the market makers, the unseen puppeteers that ensure the curtain never falls on the financial stage.

In modern markets, liquidity providers include banks, financial institutions, and principal trading firms (PTFs), each serving the market distinctively. Banks with large balance sheets can facilitate larger transactions, while PTFs maintain tight bid/ask spreads, optimize price discovery, and offer reliable market liquidity. Their unique strategies and capabilities enable efficient capital deployment and improve overall market functionality.

The Importance of Liquidity Providers

The pivotal role of liquidity providers lies in their ability to link buyers and sellers, aligning supply with demand in a timely manner. By holding positions, they bridge the gap between market participants, creating a marketplace for assets. This enables investors to buy or sell stock on demand and facilitates hedging strategies for various entities, such as farmers and food production companies.

A core aspect of liquidity provision is to consistently trade in and out of short-term positions. Providers adjust their orders in the marketplace based on available asset price information, inclusive of associated risks. Their key characteristic is their continuous provision of liquidity, irrespective of market conditions.

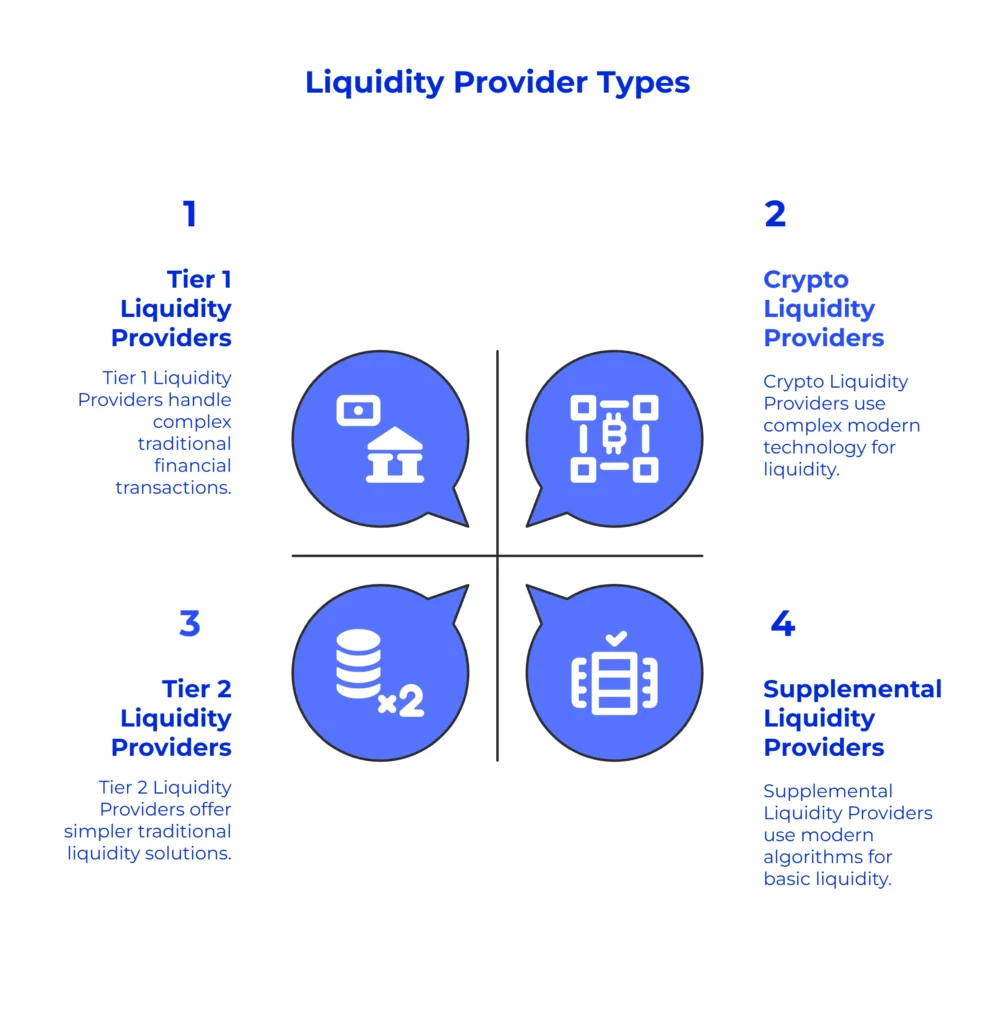

Types of liquidity providers

- Tier 1 Liquidity Providers – Tier 1 Liquidity Providers, also known as premier liquidity facilitators, engage in substantial asset acquisition from issuing institutions. These institutions predominantly consist of banking and financial entities, but may also encompass non-bank foreign exchange providers possessing substantial procurement capabilities.

- Tier 2 Liquidity Providers – These entities act as a bridge between primary liquidity sources and the final users, often being smaller banks or brokers. By partnering with multiple primary sources, Tier 2 suppliers can ensure a deeper and more diverse pool of liquidity for the market.

- Supplemental Liquidity Providers – These entities, referred to as electronic liquidity providers, boost stock market liquidity by executing high-frequency, high-volume trades with algorithms, distinct from traditional liquidity pools, such as ECNs like Match Trade.

- Crypto Liquidity Providers – This involves creating liquidity pools, where traders fund the pools by depositing their unused cryptocurrencies in exchange for token fees. This enables individual liquidity providers to earn tokens and receive fixed fees for trades despite the risk of “impermanent loss” due to sudden asset volatility. Examples: Uniswap, Binance, Pancakeswap, and Bancor.1

Unlocking the Hidden Treasures of Liquidity Providers: Benefits

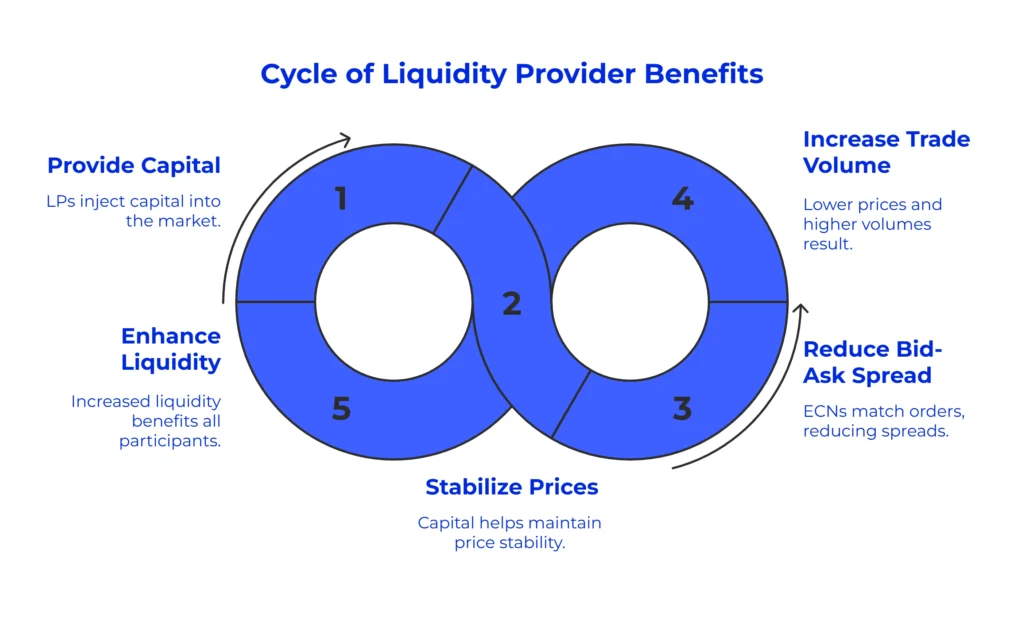

Liquidity providers (LPs) play a critical role in maintaining the vitality of financial markets. They form the backbone of trading operations by acting as consistent buyers and sellers, thereby preventing drastic price fluctuations and ensuring smooth transactions.

With substantial capital at their disposal, LPs not only stimulate market activity but also enable the pricing system to mirror the true value of assets more accurately. This robust trading environment created by LPs allows traders to capitalize on price discrepancies. Furthermore, LPs significantly reduce the bid-ask spread through the use of electronic communication networks (ECNs) that match their orders with those of other market participants. They also act as a safety net during times of high market volatility, injecting the necessary capital to maintain stability. The dynamic trading ensured by LPs eliminates the need for traders to find a counterparty and negotiate prices. Additionally, the constant competition among providers keeps prices low while fostering higher trade volumes, leading to enhanced liquidity and profitability.

Finding the Right Liquidity Provider for Your Trading Needs: Factors to Consider

When selecting a liquidity provider, keep in mind these crucial factors. First, consider their reputation and regulatory status to ensure credibility and security.

Next, assess the size and depth of their liquidity pool, as this affects trading opportunities and minimizes slippage risk.

Additionally, prioritize providers with advanced technology and stable connectivity for efficient trading. Understand the pricing model they offer, and align it with your strategy.

Robust risk management tools and excellent customer support are also essential for a smooth trading experience. Lastly, explore providers offering valuable additional services to enhance your skills and decision-making. Choose wisely to optimize your trading endeavors. 2

- Daytrading: Liquidity Providers – Key Concepts & Impacts For Traders (daytrading.com)[↩]

- B2Brocker: https://b2broker.com[↩]