While the current cryptocurrency market has come a long way since its inception back in 2009, there are still numerous challenges to overcome. For example, the volatility of prices and uncertain trust in central authorities pose significant problems. Enter stablecoins: instead of issuing new cryptocurrencies that track an index or basket of other assets, these peg their value to another asset. This asset can be a fiat currency (such as the US Dollar), a basket of existing cryptocurrencies, or any other asset generally accepted by speculators and investors. The most common use case for stablecoins is to allow for greater security than can be achieved with cryptocurrencies, as they typically have lower volatility and offer more liquidity than crypto assets that are limited in supply.

The crypto world has seen many similar projects over the last few years. Finally, however, we see more and more stablecoins launch as institutional investors begin to notice.

Stay ahead with the latest trends in this article and learn everything you need to know about stablecoins today.

Understanding Stablecoins

A stablecoin is a digital currency that is designed to minimize price volatility. They are typically tied to the US dollar or other well-known assets, like the Euro, and can be used as a payment or store of value. This means they’re tied to regulatory standards and therefore considered safer than other cryptocurrencies like Bitcoin. The goal of these are to provide a more predictable form of payment. For example, if you’re sending money from California to Manila, there’s a considerable risk of the value changing or the transaction costing too much.

Cryptocurrencies are susceptible to these problems due to price volatility, but these are designed to keep their value stable. So, why is stability such an essential feature of a currency? As we’ve seen over the last few years, the value of cryptocurrencies can change rapidly in both directions. If you have USD 100 in your account today and transfer it to someone over in Spain, you can be pretty sure it will still be worth $100 tomorrow. 1

Types of Stablecoins

There are many stablecoins, differentiated primarily by the asset that backs them. Here are the major types:

- Commodity-Backed – Commodity-backed stablecoins are stabilized with complex assets such as gold or real estate. Gold is the most commonly used asset to collateralize stablecoins, although many use diversified baskets of precious metals.

- Fiat-Backed – Stablecoins backed by fiat currencies like the Chinese yuan keep a reserve of that currency as collateral. Other forms of fiat include precious metals such as platinum or silver and commodities such as corn or oil. Most fiat-backed stablecoins are backed with dollar reserves. The reserve for the currency is administered through an independent custodian that is audited on a scheduled basis to ensure compliance.

- Crypto-Backed – Crypto can back other cryptos as well. Such is the case with crypto-backed stablecoins. To counteract the higher relative volatility of backing stablecoins through crypto, the coin will maintain an overcollateralized position.

In other words, the stablecoin will circulate a much lower supply against the reserve than fiat-backed currencies. For instance, a crypto-backed stablecoin may issue only $500 worth of coins for every $2,000 crypto in funds rather than keeping a 1-to-1 ratio. - Seigniorage Style – Seigniorage is governed through and backed by an algorithm or process rather than another asset or currency. The idea of seigniorage as backing came from a whitepaper from noted cryptographer Robert Sams. They proposed a Federal Reserve coin (fed coin) that could function as such. Smart contracts deployed on decentralized platforms could serve as an autonomous “backer” for these coins. 2

The Best Stablecoins Right Now

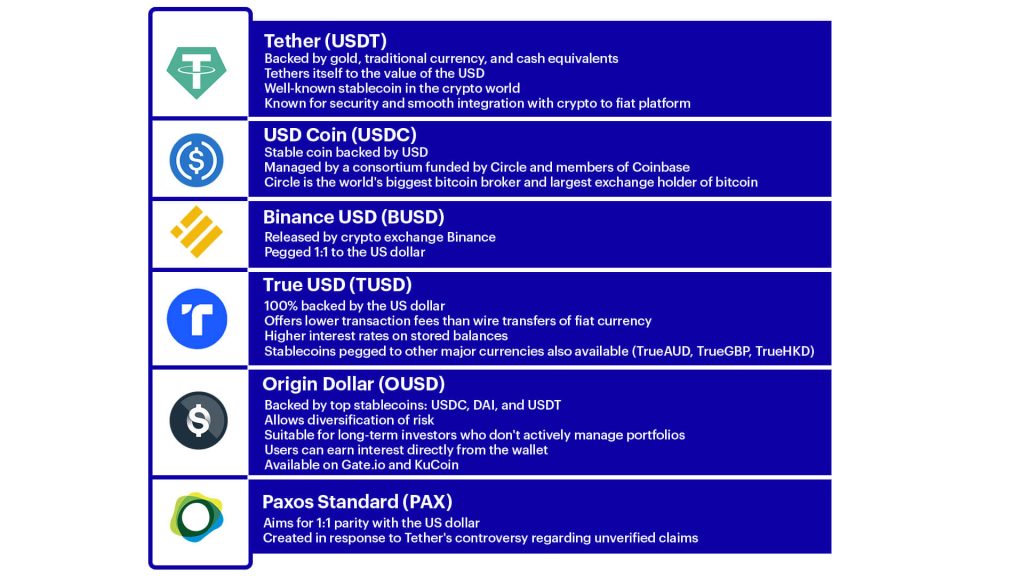

Not all stablecoins are created equal. With the number of stablecoins growing, it is good to grasp the most valuable and well-anchored choices. Here are the stablecoins right now by market cap:

How Does a Stablecoin Work?

A stablecoin is permanently pegged to a specific fiat currency. For example, tether (USDT) is always worth one US Dollar in terms of its backing in US dollars. There are a few different ways stablecoins can be created. The first is to use an existing cryptocurrency. For example, bitcoin can be turned into a stablecoin through a process called “tokenization.” This means that instead of owning a certain number of tokens as you do with regular Bitcoin, you now own shares in a company that owns Bitcoin.

Why is It Needed?

There are several reasons why a stablecoin is needed. For starters, it provides a reliable store of value. It also eliminate the volatility associated with cryptocurrencies since fiat currencies back them, like the US dollar or the Euro. Finally, stablecoins allow users to make payments across borders without requiring access to local currency.

Another reason why these are so vital is that they offer more transparency and accountability than other cryptocurrencies. This is because fiat currencies back these, so their price is always linked to the underlying asset. In contrast, cryptocurrencies like Bitcoin and Ether don’t have any real-world backing. Cryptocurrencies are digital currencies that any government or central bank does not back. Instead, the value of cryptocurrencies is based on the public’s belief in a particular project.

Stablecoins are an essential part of the crypto ecosystem – and everyone should get into it sooner rather than later. 2

Pros and cons of Stablecoin

A stablecoin is a cryptocurrency with low volatility, meaning it can be more easily used in commerce. These are not intended to replace fiat currency but rather to complement it by providing people with an alternative that can be used in everyday transactions without any risk of volatility or loss in value due to speculation.

There are some potential downsides of stablecoins as well. The biggest downside is that there’s no guarantee that these will maintain their value. Like any other asset, it could decline in value due to decreased demand for it. Plus, it’s worth noting that most financial institutions don’t use cryptocurrencies like Bitcoin and Litecoin, so they may not see the need for these. This could also be a barrier to adoption. 3

Risks Associated with Stablecoins

There are several risks associated with these. First, like other cryptocurrencies, there is always the possibility of a security breach. Second, because fiat currencies back these, they could experience hyperinflation. Finally, because these coins are centralized, they can be susceptible to political interference.

There are also risks associated with holding stablecoins in general. First, because they are less volatile than their fiat counterparts, they have less potential to generate short-term profits. Second, because they are less liquid than their fiat counterparts, they may be more difficult to sell when the time comes to cash out. And finally, they may have higher transaction fees than their fiat counterparts due to the lower liquidity.

These are an excellent solution for online transactions and trade. They offer stability in value and don’t fluctuate, making them useful for online commerce. One advantage is that they are backed by the currency issuer, meaning there is no inflation risk over time. 3

Conclusion

It like USDT & USDC are designed to maintain a fixed value in a specific fiat currency like the US dollar. They are meant to be safer than cryptocurrencies like Bitcoin and are more predictable, but they don’t have a guarantee of maintaining their value. These cryptocurrencies will likely have a place in the future, but they’re in their infancy right now.

- Grayscale: https://grayscale.com/learn/holding-steady-the-rise-of-stablecoins[↩]

- investopedia.com: https://www.investopedia.com/terms/s/stablecoin.asp[↩][↩]

- IMF: https://www.imf.org/en/Blogs/Articles/2019/09/19/blog-digital-currencies-the-rise-of-stablecoins[↩][↩]