Table of Content

Fractional NFTs are unique digital assets that confirm ownership and authenticity of data. Unlike interchangeable cryptocurrencies like Bitcoin and Ethereum, where any two coins are identical to each other, NFTs are not exchangeable. NFTs have gained popularity in various sectors, from Art to Virtual Real Estate.

NFTs are created using blockchain systems like Ethereum and Binance Smart Chain. These blockchains maintain a public ledger, which verifies the ownership and authenticity of each NFT.

How do Fractional NFTs work?

If an NFT is a whole picture, the fractional NFT represents a segment of that whole NFT. NFTs are usually owned by a single person, and in certain circumstances, it is risky depending on their price and market. Hence NFT is divided into portions so multiple investors can buy it.

In addition, fractionalized NFT has helped increase the NFT market and improve accessibility for buyers.

In the mechanics of fractional NFTs, the process begins with an NFT being locked within a smart contract. The NFT owner determines how many parts the NFT will be divided into, along with its price. Remarkably, the NFT can be divided into as many parts as the owner desires.

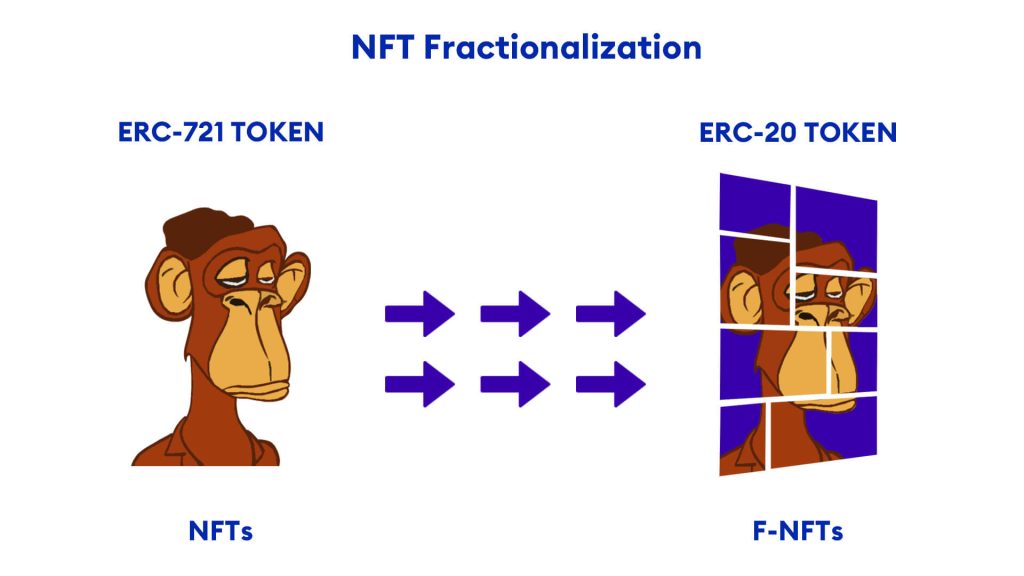

The smart contract then transforms the ERC-721 token into a set of interchangeable ERC-20 tokens, creating fractional shares of the original NFT. (ERC-721 is an Ethereum-based open standard for creating and managing NFTs).

These ERC-20 tokens represent fractions of the original NFT and can be sold at fixed prices. Buyers acquire these F-NFTs and resell them in secondary marketplaces without impacting the value of the original token.

It’s worth mentioning that the fractionalization process can be reversed. The smart contract includes a buyout option, allowing the fractional NFT holder to acquire the entire remaining original NFT by initiating the buyout option.1

Use Cases of Fractional NFTs

Fractional NFTs exhibit a wide range of practical applications, showcasing their adaptability and potential utility across various sectors.

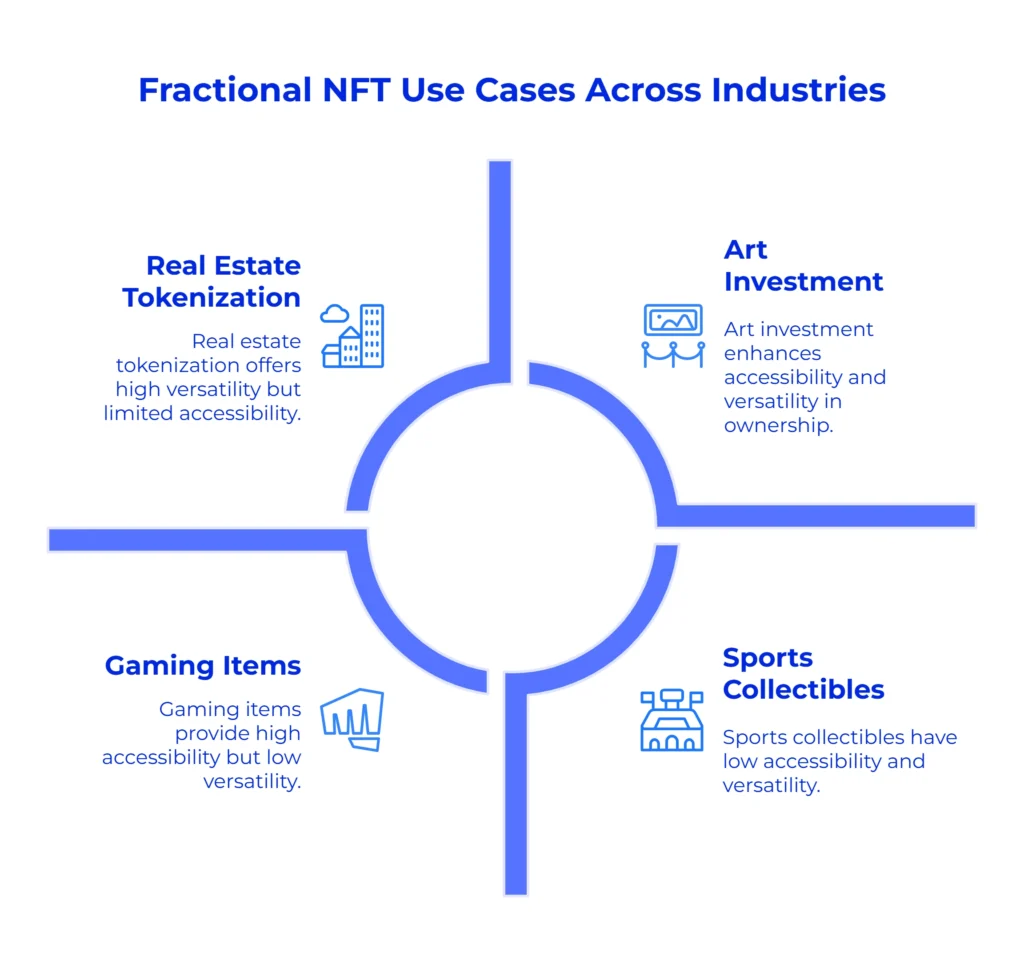

In the art world, they allow people to invest in valuable digital artworks by owning a portion of them, making art ownership more accessible.

In real estate, they can streamline property transactions by turning properties into digital tokens and allowing multiple individuals to invest in one property that may be too expensive for one person. Gamers can buy a fraction of rare in-game items, like special characters, enhancing their gaming experience. Moreover, they can be used for philanthropy, letting people collectively support charitable causes through tokenized contributions. In sports, fans can own parts of event tickets or collectibles, fostering a connection to their favorite teams. These examples showcase how fractional NFTs are changing how we own, invest, and access valuable assets across different industries, making them more accessible and versatile than ever before.

Pros and Cons of F-NFTs

Fractional NFTs offer a range of advantages in the digital asset space.

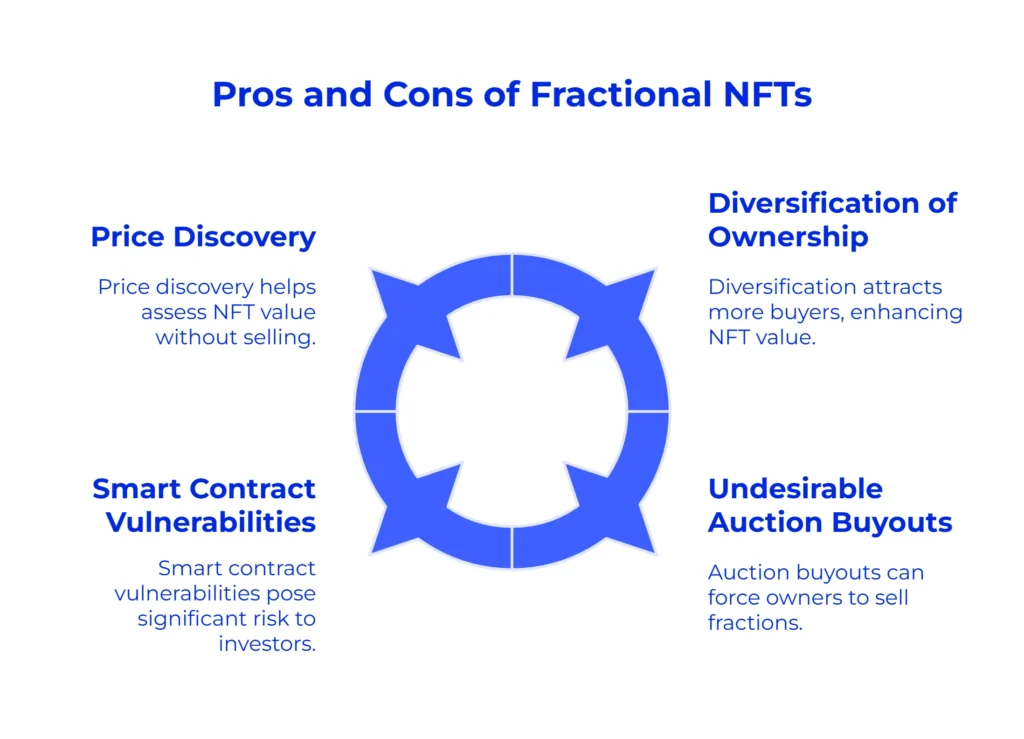

First, they provide high liquidity, making it easy for small investors to participate in the NFT market and facilitating swift transactions that reduce waiting times from weeks to mere minutes. Additionally, fractionalization enables price discovery, allowing NFT owners to assess the value of their assets without selling them outright. This process provides valuable insights into market demand and the willingness to pay, helping creators refine their strategies.

Moreover, fractional NFTs promote diversification of ownership, attracting a broader range of buyers and potentially increasing the overall value of NFTs. Shared ownership also spreads the risks, further enhancing the appeal of fractionalization.

These markets allow for revenue-sharing, which benefits both artists and purchasers by creating a more equitable system. In summary, fractional NFTs represent a significant innovation that addresses key issues in the NFT space while opening new opportunities for a wider range of participants.

Just as there are benefits to fractionalization, there are also many risks to owning and trading fractionalized tokens.

First, the owner can be subjected to undesirable auction buyouts, F-NFT buyouts let the original owner regain full ownership of an NFT. If the remaining fraction owners outbid the individual who initiated the auction, they can retain their ownership share, but at an increased cost.

On the other hand, if the person who started the auction outbids the other owners, the payment they make will be distributed to everyone based on the percentage they own.

So even though you still get paid for your share, this process might force you to sell your fraction even If you didn’t plan to. Also, NFTs and F-NFTs depend heavily on the crypto market, which is extremely volatile. There have been lots of cases where highly valuable NFTs lost their worth in a few months after being bought.

There is also a smart contract risk. Since F-NFTs are governed by smart contracts, smart contract failures or vulnerabilities are always at play. Investors must thoroughly review the smart contract’s code to ensure that there are no flaws or weaknesses that could be exploited.2

Final thoughts…

Fractional NFTs offer exciting potential for NFT owners and creators by increasing demand for stagnant tokens and providing visibility for artists and musicians.

The future of fractional NFTs depends on regulatory support; if well-regulated, they could thrive across various sectors. However, without proper regulation, the market may face challenges and slow down.

The integration of fractional NFTs with DeFi protocols is also promising, allowing users to earn yields on their holdings and potentially revolutionizing the NFT ecosystem by attracting more participants and enhancing the financial potential of fractional digital assets.

- Binance: https://www.binance.com[↩]

- Medium: https://medium.com/[↩]