Table of Content

- The Importance of Blockchain in Financial Services

- Understanding Blockchain Technology In Finance

- Principles of Blockchain

- Unique Features of Blockchain in Finance and its Benefits

- Blockchain Applications in Financial Services

- Future of blockchain in financial services

- Challenges and Limitations of Blockchain Technology

- Emerging trends and future potential

- Conclusion

The Importance of Blockchain in Financial Services

In an era where the financial industry handles trillions of dollars daily, the need for transparency, security, and cost-efficiency is paramount. Blockchain addresses this challenge by streamlining banking and lending services, reducing counterparty risk, and minimizing issuance and settlement times.

Blockchain, a secure and transparent method of recording information, is transforming the landscape of banking and financial services. Operating as a distributed ledger, it prevents unauthorized alterations, hacks, or manipulations by duplicating and distributing transactions across a network of participating computers.

This technology enables authenticated documentation and real-time verification of financial documents, thereby lowering operational risks. In a world where 45% of financial intermediaries face annual cyber-attacks, blockchain is seen as a promising solution.

By eliminating the need for intermediaries like banks and clearinghouses, blockchain ensures secure, transparent, and cost-efficient digital transactions, marking a significant evolution in enterprise-grade technology over the past five years.

Understanding Blockchain Technology In Finance

Blockchain, born in 2009 with Bitcoin’s emergence, initially faced skepticism due to its Wild West image. However, since 2016, a robust open-source community has transformed it into a reliable technology.

However, governments and businesses now recognize its potential for enhancing security, immutability, traceability, and transparency in the face of cyber threats and data privacy concerns. States and businesses seem to have realized that Blockchain’s decentralized nature positions it as a vital tool in finance and various sectors, changing the usual routine ways in which information is stored and transactions are conducted.

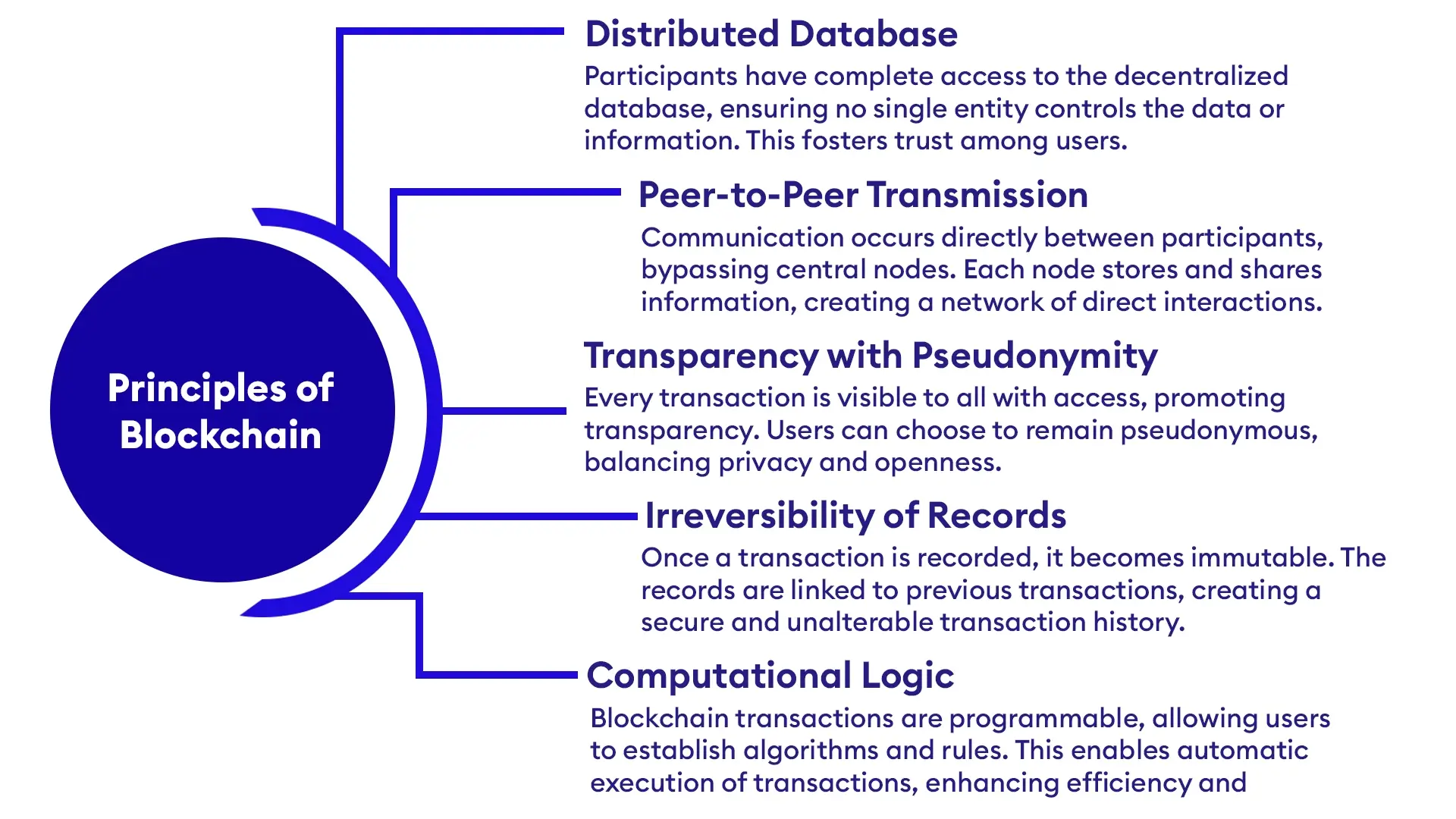

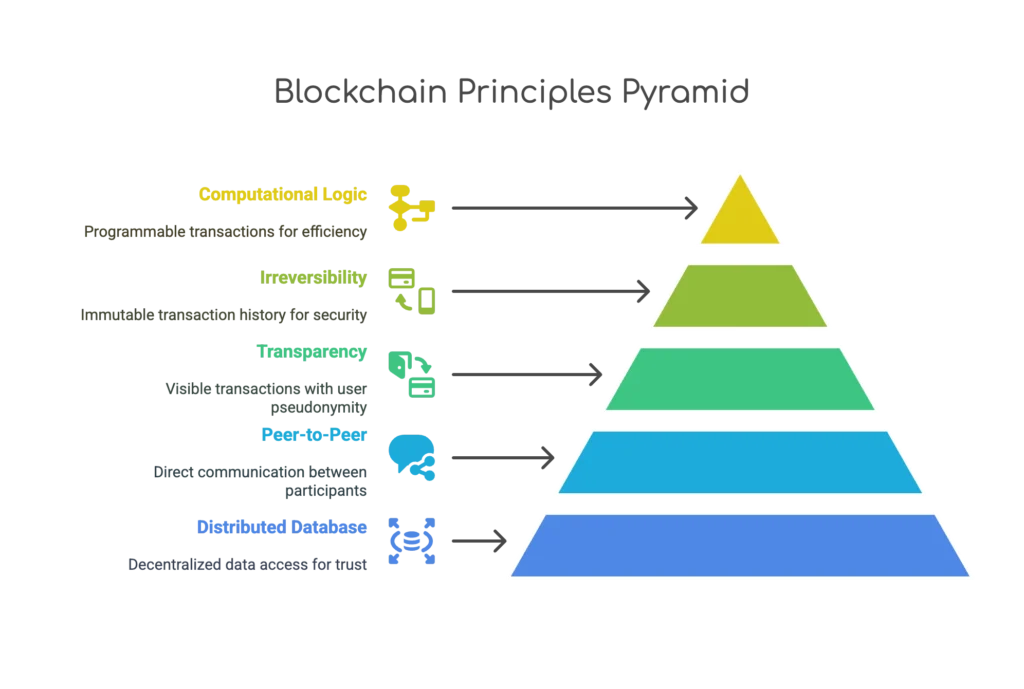

Principles of Blockchain

- Distributed Database:

Participants have complete access to the decentralized database, ensuring no single entity controls the data or information. This fosters trust among users.

- Peer-to-Peer Transmission:

Communication occurs directly between participants, bypassing central nodes. Each node stores and shares information, creating a network of direct interactions.

- Transparency with Pseudonymity:

Every transaction is visible to all with access, promoting transparency. Users can choose to remain pseudonymous, balancing privacy and openness.

- Irreversibility of Records:

Once a transaction is recorded, it becomes immutable. The records are linked to previous transactions, creating a secure and unalterable transaction history.

- Computational Logic:

Blockchain transactions are programmable, allowing users to establish algorithms and rules. This enables automatic execution of transactions, enhancing efficiency and reducing reliance on intermediaries.

Unique Features of Blockchain in Finance and its Benefits

1. Decentralized

Decentralization offers several key advantages.

Firstly, the system is highly organized and fault-tolerant, as it operates independently of human calculations. Additionally, the decentralized nature makes the network less susceptible to failures, making it more resilient against potential attacks. With no involvement of third parties, the system carries minimal added risks. Furthermore, the transparency achieved through decentralization allows for a traceable profile of every participant, ensuring accountability for every change. Ultimately, users gain control over their assets withoutrelyinge on external entities, marking a significant shift in how assets are managed and maintained.

In the centralized financial sector, using blockchain, we eliminate costs associated with bookkeeping, database maintenance, labor, security, intermediary commissions, and value transfer systems.

2. Immutable

Blockchain technology ensures immutability, a key feature that establishes it as a permanent and unalterable network. The blockchain operates through a distributed network of nodes, with each node holding a copy of the digital ledger. Once a transaction is recorded on the blockchain, it becomes a fixed and unchangeable part of the ledger.

The decentralized nature of the system requires the approval of the majority of nodes for a transaction to be added. This democratic consensus mechanism ensures the security and integrity of the blockchain, making it resistant to tampering or unauthorized alterations. Any validated records on the blockchain are irreversible, providing users with a high level of confidence in the authenticity and permanence of their transactions.

3. Distributed

Distributed ledger, a pivotal element of blockchain technology, ensures complete transparency by granting all network participants access to a shared ledger. This public ledger contains comprehensive information about participants and transactions, fostering a decentralized and transparent environment. The distributed computational power across the network’s computers enhances efficiency. In a distributed ledger, changes propagate rapidly, facilitating easy tracking of ledger activities.

Every node in the blockchain network actively maintains and validates the ledger, ensuring a swift approval process for ledger modifications without the involvement of intermediaries.

The addition of a new block requires verification from other nodes, with approval contingent on a majority consensus. This democratic and standardized procedure ensures that no node receives preferential treatment within the blockchain network, promoting fairness and integrity.

4. Secure

Security is at the center when it comes to blockchains. Each record within the blockchain is safeguarded by individual encryption, adding an extra layer of protection to the entire network. With no centralized authority, the process of adding, updating, or deleting data becomes inherently secure. Cryptographic hashing ensures that every piece of information holds a unique identity on the network, with each block cryptographically linked to the previous one. Attempting to tamper with data necessitates changing all hash IDs, a virtually impossible feat, fortifying the integrity of the blockchain.

5. Consensus

Consensus is another crucial element in blockchains, ensuring swift and impartial decision-making among network nodes. This algorithm enables quick agreements, fostering trust in the network’s functionality even when individual nodes may lack mutual trust.

6. Unanimous

In a unanimous network, records undergo majority voting for validation before addition. Nodes require consensus to add blocks, preventing unilateral changes. Updates propagate simultaneously, ensuring alterations only occur with majority node consent.

7. Faster Settlement

Blockchain enables faster settlements, in stark contrast to the delays and vulnerabilities of traditional banking. Transactions are processed swiftly, eliminating the prolonged wait times and susceptibility to corruption, ultimately streamlining and simplifying daily life.

Blockchain Applications in Financial Services

cryptocurrency wallets

A cryptocurrency wallet serves as a digital counterpart to a traditional wallet, holding essential passkeys instead of physical cash. Originally a manual process, today’s wallets automate transactions, simplifying the complex world of blockchain. Satoshi Nakamoto’s and Hal Finney’s pioneering wallets marked the beginning of the cryptocurrency era.

Wallets store public addresses and private keys, which are, crucial for secure transactions. With various types available, each offering distinct features and security levels, these wallets play a vital role in making cryptocurrencies accessible to all. They efficiently navigate the scattered bits of data in a database, allowing users to send and receive cryptocurrencies effortlessly. Cryptocurrency wallets fall into two main types: custodial, where a third party stores keys, and noncustodial, where users manage their keys. They are further classified as hot (internet-connected) or cold (offline), and as software, hardware, or paper. Combinations like non-custodial software and hot wallets offer users diverse options for securing digital assets.

Smart contracts

Smart contracts are also bringing paradigm shifts to enterprise blockchain environments by automating and streamlining business processes. These self-executing contracts, defined by lines of code, automatically execute terms and conditions when specific conditions are met.

The adoption of smart contracts is on the rise due to their ability to enhance efficiency, reduce costs, and foster trust. Businesses can automate tasks such as supply chain management and financial transactions. Smart contracts offer practical applications, such as automatically releasing payment to a supplier upon verified receipt of the transaction. This not only eliminates the need for intermediaries but also significantly reduces the risk of errors or fraud in financial transactions. Despite their potential, challenges like evolving legal frameworks and data accuracy must be addressed for widespread adoption. Smart contracts are poised to reshape how businesses operate, offering significant benefits in automation and trust-building.

Cross-border payments and remittances

In cross-border transactions, traditional banking systems and intermediaries often introduce inefficiencies and barriers, impacting both time and cost. The rise of blockchain and cryptocurrencies presents a compelling alternative. Operating round the clock with minimal transaction costs, blockchain ensures swift and secure settlements, extending financial access globally.

However, challenges persist, with cryptocurrency volatility, regulatory uncertainties, and a learning curve for businesses accustomed to legacy systems. Despite these hurdles, blockchain’s impact on payments is undeniable, representing 44% of global blockchain revenue in 2022.

Projections indicate a robust future, with the global crypto payment gateway market anticipated to hit $5.4 billion by 2031 and blockchain capturing 11% of B2B international payments by 2024. Traditional financial institutions, alongside fintech disruptors, are actively integrating blockchain solutions like Visa B2B Connect and Mastercard Send, indicating a transformative shift in the payments landscape. Collaborations between banks and blockchain companies, exemplified by Ripple’s partnerships with major institutions, further highlight the evolving synergy between traditional and decentralized finance.1

Asset tokenization

Asset tokenization involves creating digital tokens on a blockchain to represent digital or physical assets. Blockchain ensures secure, immutable ownership, with two types: Fungible and Non-fungible asset tokenization.

For example, you own a rare painting worth $1 million. To get $100,000 without selling the painting, you tokenize it into 1 million digital tokens. Each token represents a tiny piece of ownership, like a share.

You put these tokens on a digital platform, allowing people to buy and sell them. Each token is a small part of the painting’s ownership. If someone buys, say, 10,000 tokens, they own 1% of the painting. The total tokens always add up to 100% ownership. Blockchain ensures that once someone buys tokens, their ownership is recorded and cannot be changed. This way, you get money without selling the painting, and others can invest in a piece of it.

Future of blockchain in financial services

- Increasing Adoption: Established financial institutions, governments, and businesses are gradually embracing blockchain technology. With improved user-friendliness and clearer regulations, mainstream adoption is expected to rise.

- Rise of CBDCs: Central banks worldwide are exploring Central Bank Digital Currencies (CBDCs), digital versions of fiat currencies on the blockchain. CBDCs have the potential to transform payment systems and provide governments with enhanced monetary control and financial insights.

- Emphasis on Interoperability and Collaboration: With a growing number of blockchain projects, interoperability between different networks will be crucial for seamless transactions. Collaborative efforts will play a vital role in building a unified global financial ecosystem.

Challenges and Limitations of Blockchain Technology

- A prominent challenge is scalability, notably seen in public blockchains like Bitcoin. The limited transactions per second (TPS) result in slower transaction times and increased costs during network congestion. Solutions are being explored, yet implementing improvements without compromising decentralization proves intricate.

- Blockchain operates in a dynamic regulatory landscape. Uncertainty impacts adoption, as businesses hesitate due to potential clashes with future laws. Anonymity in transactions raises concerns about misuse, necessitating a delicate balance between regulation and innovation across jurisdictions, complicating the blockchain landscape.

- High energy consumption, notably in proof-of-work mechanisms like Bitcoin’s, raises environmental concerns. The energy-intensive ‘mining‘ process has a substantial carbon footprint, emphasizing the urgency for more eco-friendly alternatives.

Integration with traditional financial systems poses hurdles due to diverse platforms and protocols. Achieving seamless interoperability demands significant effort, ensuring a harmonious coexistence between blockchain technology and existing financial infrastructures

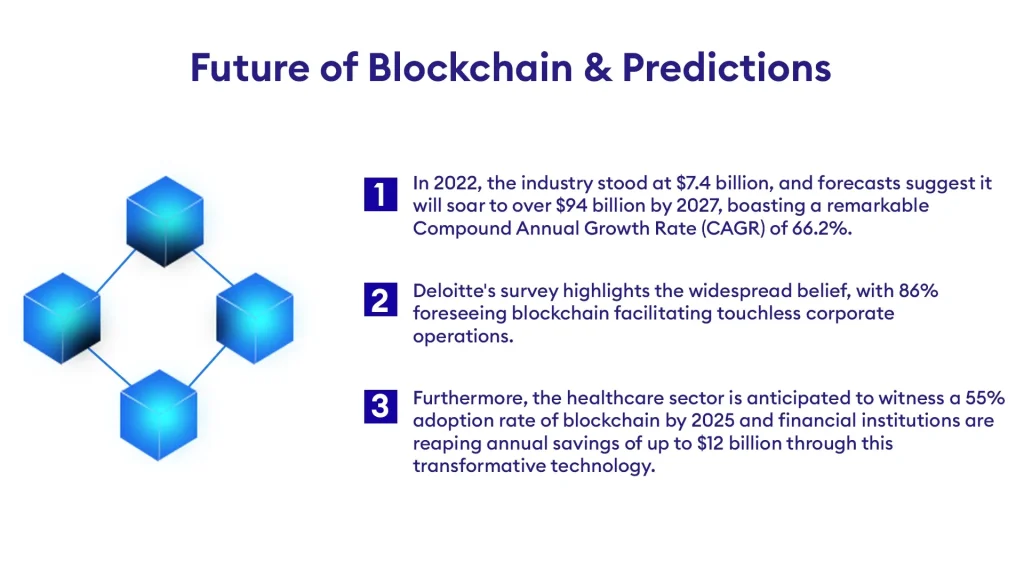

The blockchain industry is on a trajectory of exponential growth, with predictions indicating substantial market expansion. 2

Emerging trends and future potential

Blockchain & AI: The fusion of blockchain and artificial intelligence (AI) is a transformative trend, streamlining workflows and enhancing our understanding of machine learning. AI reciprocally boosts blockchain productivity, eliminating errors and automating processes.

Metaverse Security: In the metaverse, blockchain ensures secure transactions, preventing fraud and forgery. It becomes a linchpin for trust and security, regulating interactions and shaping the foundation of this evolving virtual reality.

Blockchain Interoperability: Enhanced blockchain interoperability efficiently shares information across systems. Developers are creating multi-channel solutions, fostering connectivity and collaboration between diverse blockchain networks, and enhancing versatility and adaptability.

Conclusion

Blockchain in financial services can offer multiple benefits, which can help transform the finance industry. According to KPMG, blockchain can reduce errors by up to 95%, increase efficiency by 40% and reduce capital consumption by up to 75%. Blockchain in finance is an exciting concept with the potential to transform the finance industry.

- Blockchain for Financial Services: https://www.bvnk.com[↩]

- Blockchain for Financial Services: https://www.orientsoftware.com[↩]