- Understanding Bitcoin, Blockchain, and Mining

- How does mining work and why is there so much buzz around it?

- Can anyone mine with their PCs or Mobiles?

- The mining process is broken down

- Number of rewards a miner earns and difficulty adjustment

- What happens if two miners mine identical blocks simultaneously?

- Benefits

- The downsides of Bitcoin mining

- Bottom-line

Mining is a crucial part of the functioning of cryptocurrencies. Even though it has served its purpose since its creation, criticism is also levelled against Bitcoin, as the energy needed to run the network is high. Bitcoin mining involves solving intricate mathematical puzzles and adding the resulting solutions to the public ledger, which enables the creation of new bitcoins and the verification of transactions.

This process is referred to as mining, just like gold or any other natural resource; Bitcoin has also proved to be highly valuable and finite as other natural resources; hence it has been given the moniker of “Internet Gold”. This makes it very competitive compared to other digital assets.

Although many assume that Bitcoin and cryptocurrency are same Bitcoin is known for its halving cycles and the new surging All Time Highs (ATH).

For the uninitiated, Bitcoin is a decentralized digital currency created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, enabling secure and transparent peer-to-peer transactions without the need for a central authority like banks or governments. 1.

Understanding Bitcoin, Blockchain, and Mining

Although Bitcoin is primarily used for investment purposes nowadays, during its early days, it was used to purchase goods and services.

The underlying concept for this process is Blockchain. Blockchain is a distributed public ledger. These transaction records will be packed into small units called “blocks” and added individually as a chain of blocks. Once a block is added to the previous block, it cannot be altered.

Since we have only one public ledger to display the transactions when many people are trying to make transactions at the same time, there could be shortcomings in the process of verifying said transactions; as a solution to this issue, Satoshi Nakamoto proposed a way to verify those transactions and add them to a sequential block.

To successfully add a block one by another, two concepts are working behind the scenes. (?) They are the PoW alias Proof-of-Work concept and the SHA-256 algorithm. As stated earlier, mining can be referred to as creating new Bitcoins. But mining is more than that. It is a complicated process of verifying the transactions and adding them to the public ledger records by solving complex cryptographic puzzles through guesswork. While the SHA-256 algorithm limits public access by using its hash function, then as per the PoW concept, miners validate transactions by solving puzzles. By solving those puzzles, they can be able to generate a hash. In the Bitcoin mining race, miners with immense computational powers get many chances to solve the cryptographic puzzle and get rewarded with new bitcoins. These newly minted or mined bitcoins will later be brought into circulation.

How does mining work and why is there so much buzz around it?

What you need for mining

Let’s break down the mining process to understand the operation and requirements. To perform mining, you first need powerful hardware resources, then mining software – linked with a wallet to perform the action and store the newly minted bitcoins. So, in short,

- Powerful Graphics Processing Unit (GPU) and SSD or a specialized device called ASIC (Application Specific Integrated Circuit) to handle the processing.

- Mining Software to connect the Hardware with the Blockchain network. It is free to download and can be run on Windows and Mac OS.

- Bitcoin Wallet to store your rewards in.

- Mining Pool, instead of going solo, joining a mining pool is wise since the competition in this space is relatively high

Can anyone mine with their PCs or Mobiles?

While anyone can participate in Bitcoin mining, the competition is fierce. In addition, domestic devices are different from institutional-level equipment, making competing impractical. In theory, you can still participate in mining, but the rewards and chances of your device finding the hashes will be thin.

Bitcoin mining started 10 years ago, and at that time, mining with your personal PC was a big deal. Now computers with ASICs are used. As its name suggests, they can be built according to your requirements. But it costs you around 10,000 US Dollars. In addition, they consume enormous amounts of electricity and need a proper cooling and ventilation mechanism to increase efficiency.

Does mining on your PC damage your Hardware or GPU?

Yes. According to the current difficulty levels, it significantly strains your devices. Mining is very resource-intensive. Even though you have prepared your setup with powerful resources, keeping the surroundings at a moderate pace [ventilation and heat distribution] and with a sufficient power supply is necessary.

Different mining methods

There is not only one specific way but many ways to perform mining. According to their algorithms and Hardware, the size of the mining unit and ROI will differ 2.

- CPU mining

This means we are processing the calculations with the computational power of a computer’s CPU.

As more people started to mine with their PCs in the early days, the network’s hash rate increased, profitability became difficult, and the rise of specialized mining hardware such as ASIC rose. As a result, CPU mining is not a viable option these days.

- GPU mining

GPU usually refers to multi-tasking and helps process graphical aspects of applications. As a result, GPUs are a relatively cheaper option than ASICs. But their efficiency depends on many things.

- ASIC mining

Application Specific Integrated Circuits are designed to process a specific task. Unlike GPUs, ASICs are highly efficient but expensive.

- Pool mining

Since mining is a random game, the probability of finding a block hash is tiny if you are about to participate in the network alone. That’s where mining pools come into play. Mining pools are operated by third-party entities that coordinate groups of individual miners. By mining together, all participants will share the rewards as per their computational power. You will likely pay a commission fee to the pool provider when you get your share.

- Cloud mining

Just like renting a VPS (Virtual Private Server) from cloud service providers, you can rent out mining hardware from the providers. It may sound like a deal, but it’s not. Because it usually requires committing to a contract, and if crypto prices fall, you’re unlikely to break even. And, because of the volatile nature of Bitcoin, you can’t be able to make a steady flow of income that will overcome your rental charges.

The mining process is broken down

We can look at the mining process in 4 steps.

- A user making transactions and hashing process

Once a new transaction is made, it will be sent to a memory location called “Mempool” 3. Then, the mining block will take unverified transactions from the Mempool and assemble them into a candidate block through a hash function.

The hash function is generally when we input data; the hash function will do some encryption and give us back a string, including numbers and letters. It’s called a hash. The blocks in the candidate block are named with these hashes. This will work as an identifier. Additionally, the miner adds a custom transaction called “Coin base”, which directs them to get the block rewards after every successful iteration.

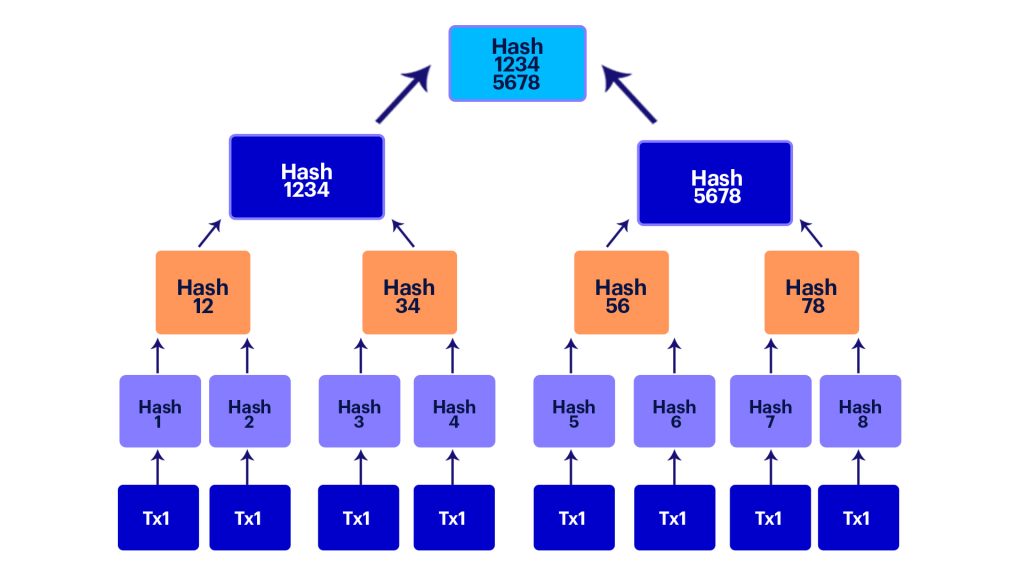

- Merkle tree

After successfully hashed transactions, hashes will be organized into a tree format. This is called “Merkle Tree”. This is a data structure of the hashes in a block and acts as a summary of all the transactions in the block. New hash outputs will pair with another (pre-existing) hash. This is a repetitive action that lasts until the root hash is created or in other words, lasts until only one hash represents the entire tree. Then, the root hash will represent all the previous hashes used to generate that main hash. For example, refer to the image below.

- Finding the valid block header

For each individual block, there will be a block header working as an identifier. As the miner’s duty is adding records to new blocks, they must combine three things.

- The root hash, which we got from the Merkle tree

- The hash of the previous block

- Nonce, a pseudo-random number, is utilized as a counter

After combining these three things, this string will go through a hash function to create a hash that meets specific requirements. The miner can’t perform any changes in the root hash or the hash of the previous block. The only thing that they can do is keep guessing the nonce until a valid hash is found. The validity of the output hash or the block header is determined by being less than a particular target value determined by the protocol. For example, in Bitcoin mining, the block hash must start with a certain number of zeros. This is the thing that we call the difficulty of the network.

- Broadcasting the mined block

After the miner successfully guesses a valid nonce value associated with the block header, they will broadcast that mined block to the entire network. So, other nodes can check whether the hash is valid. If the nodes confirmed that the newly added block is valid, they would add it to their copy of the blockchain.

This is where the candidate block we talked about in the first and second steps becomes a confirmed block and the rest of the miners who couldn’t find a valid hash on time give up their guessing on the candidate block and move on to finding another valid block.

Number of rewards a miner earns and difficulty adjustment

A miner earns certain rewards for successfully mining a block on a Blockchain network. The rewards earned can vary depending on the specific blockchain and its associated consensus mechanism.

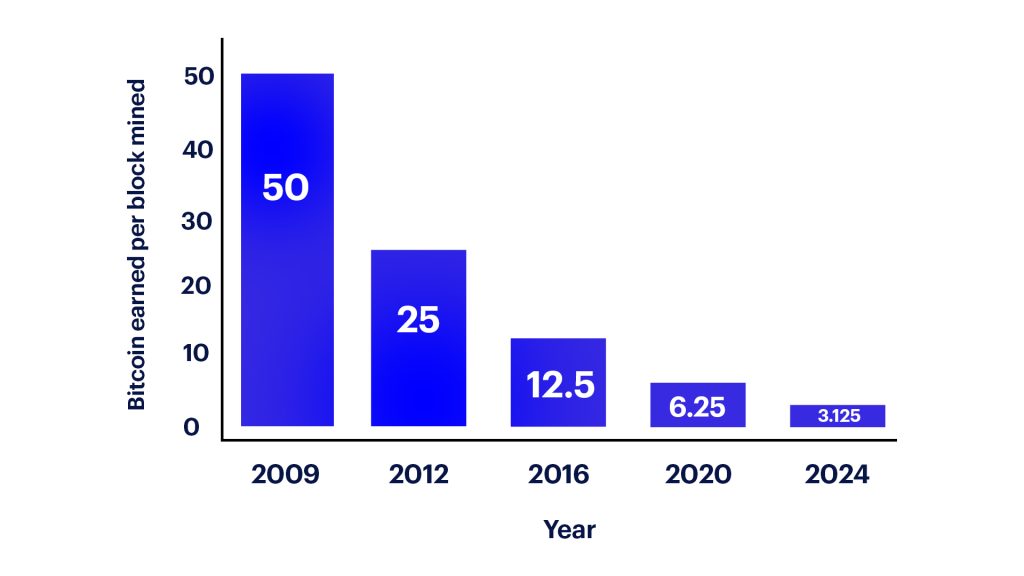

For example, on the Bitcoin network, a miner currently earns 6.25 Bitcoins for each block mined. The difficulty of mining refers to how hard it is for miners to successfully mine a block and earn the associated rewards. Therefore, the network adjusts the problem to ensure a consistent block production rate. This is what makes the issuance of new coins predictable and steady. With an increase in the number of miners on the network, the difficulty of mining a block also rises, making it increasingly challenging for individual miners. However, this difficulty adjustment mechanism ensures that new blocks are mined consistently, preventing them from being mined too rapidly or sluggishly.

In most PoW-based Blockchains, the difficulty is adjusted after every block. In contrast, the problem will settle if many miners leave the network.

In summary, the blockchain’s consensus mechanism determines the number of rewards a miner earns. The mining difficulty represents the level of complexity for miners to successfully mine a block, which is modified to sustain a stable pace of block production on the network.

Rewards

The block reward is what the miner gets for successfully mining the block. This distribution is designed to “halve” for every 2016 block mined. This is what we call the halving process, and it usually happens every four years. The most recent halving happened back in May 2020. Since 2020, the rewards distribution has been cut down in half from 12.5 BTC. The halving process will persist until the final block and coin is mined. Here is a brief summary of previous rewards:

2012: 25.00 BTC

2016: 12.50 BTC

2020: 6.25 BTC

What happens if two miners mine identical blocks simultaneously?

It happened a few times and can occur in the future too. This issue will arise when the two miners broadcast a valid block simultaneously to the entire network. This will end up in two valid blocks. Then miners will continue with their guessing game for the next block. This results in a temporary split of the network. Because one side of the network participants will have a block end, and the other side of the participants will have a different ending. This competition will happen until the next block is mined; once the next block is mined, the “previous hash” for the blocks that those two miners mined will differ. This is because Bitcoin network participants always trust the longest chain (the tail that the majority of the participants worked on), so if two blocks are mined at the same time, it’s up to (51% of) the miners to decide which is going to be ‘accepted’ and which is going to be worthless. So, whichever block convinced/broadcasted most of the network will be considered the winner. And the abandoned one will be called an “orphan block” or a “stale block”.

Is mining legal?

This depends on the jurisdiction you are in. However, since the concept of decentralized finance and peer-to-peer transactions are the biggest threat to the banking system and the existence of fiat currencies, the government may tend to regulate them over time.

Bitcoin transactions and mining are legal in some countries. But also, according to a report from 2018, countries like Egypt, Bangladesh and Qatar banned these things. So, it is always better to gather advice from local experts.

Is Mining Profitable?

It depends. We have established that Bitcoin mining is complex. Even if some of the miners are successful, it is not clear that their efforts will be profitable due to the high upfront equipment costs and ongoing electricity costs.

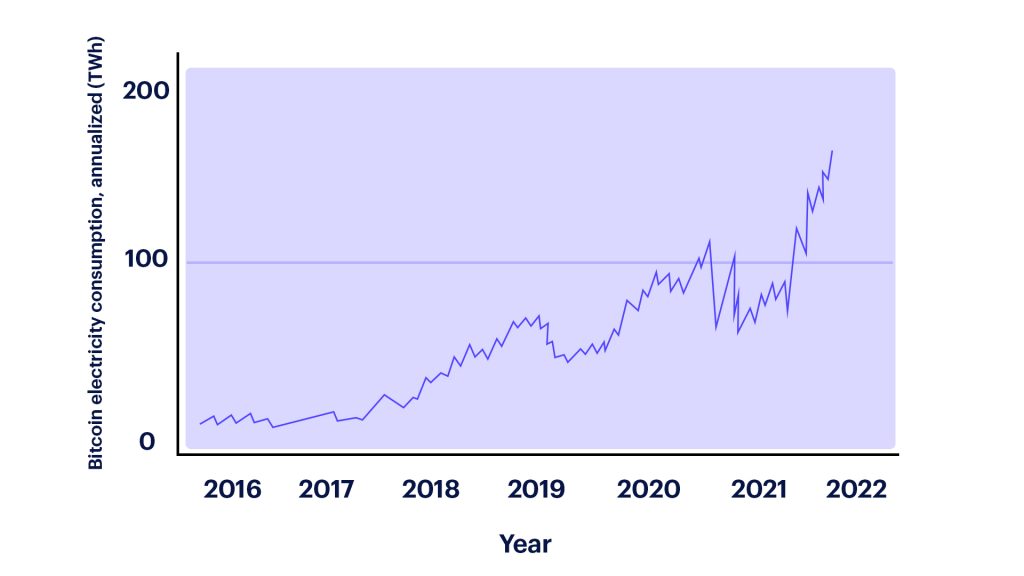

With the rise in difficulty and complexity of Bitcoin mining, the necessary computing power has also escalated. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin mining now consumes roughly 94 terawatt-hours of electricity annually, surpassing the energy consumption of most countries. As of August 2021, mining a single bitcoin requires approximately nine years of electricity an average US household uses 4 5.

And there are only 21 million Bitcoins available, so when 21 million Bitcoins come into circulation, miners will be compensated only by transaction fees.

But you probably won’t be there in 2140 to see this happening. ASICs and other hardware costs vary. So, you must invest in the hardware, electricity, and maintenance of a moderate environment. This can only be considered a long-term investment. If you are into monthly passive income, it won’t work. If you get block rewards in BTC, it will never give you a steady income flow due to its volatility.

Studies show it usually takes 2-3 years to break even on the cost you have spent on the hardware and energy. In summary, you are about to consider these things,

- Cost of the hardware

- Hash rate volatility

- Energy consumption

- Price volatility

- Block rewards and difficulty adjustments

How long does it take to mine 1 BTC in 2023?

There are no explanations for this. Because there are many things to consider here, as we discussed above. But some websites, known as Bitcoin mining calculators, let you see the profit you can get from mining.

Benefits

The commonly stated benefit is that you can get block rewards whenever you mine a new block. These rewards can be substantial, depending on the value of the cryptocurrency. Since Bitcoin is deflationary, consider this a long-term investment. But always keep in mind that it is highly volatile.

Mining pools are a viable option for reducing the high expenses associated with Bitcoin mining. By collaborating with other miners in a pool, they can share resources and enhance their capabilities. However, shared resources also imply shared rewards, reducing the potential payout for individual miners in the pool. It can be achieved by efficient hardware and lower power costs, but it takes time.

The downsides of Bitcoin mining

The risks are often financial and regulatory. As we mentioned in the profitability, you can’t get a steady income flow from this. But many people still think that and being manipulated as they can get a passive income monthly from mining.

Even if you can afford to buy high-end hardware and the energy consumption is not an issue, you are advised to double-check with your government regulations, as they could be a crucial factor. For example, learning about your country’s regulations on digital currencies and mining before investing in hardware is a good idea. Finally, even if you are all settled down perfectly with the investment and the regulations, the growth of mining will happen with the increase of the mining difficulty, which will cost you to upgrade the mining hardware and cut down on the rewards. If you join a pool, you must pay them a commission also. There are also major global concerns about the carbon footprint left by mining.

Bottom-line

Mining is the process of adding new Bitcoins to circulation. Miners perform this and get rewards for their efforts. Bitcoin Mining is very resource-intensive, which will cost you a considerable amount of money, and the profitability is subjective. Because you must look at many different aspects starting from price volatility and regulations. By verifying transactions on the blockchain, miners are helping keep Bitcoin secure from fraudsters and hackers.

They also help ensure that all Bitcoin users have access to accurate information about past transactions on the network. While it sounds appealing to read and hear about, the reality of mining is complex. However, according to theories, several aspects can affect mining profits. Crypto mining does not guarantee profits; hence, before engaging in it, it is essential to conduct thorough research and evaluate all possible risks (Do Your Own Research – DYOR). If your sole purpose is to invest and own a Bitcoin, you should consider exchanges to buy a portion of it for yourself. And remember that mining is not the only way to grow your crypto holdings.

- Bitcoin.org: https://bitcoin.org/en/bitcoin-paper[↩]

- The Mining Ecosystem, from Bitcoin Wiki: https://en.bitcoin.it/wiki/Mining#The_mining_ecosystem[↩]

- The Mempool, open source project: https://mempool.space/[↩]

- Cambridge Bitcoin Electricity Consumption Index: https://ccaf.io/cbnsi/cbeci[↩]

- Bitcoin Mining Statistics: https://www.bankrate.com/investing/what-is-bitcoin-mining/[↩]