The US Securities and Exchange Commission (SEC) is now seriously and closely looking at the crypto space following the recent surge of applications from asset managers aiming to launch the first-ever US Exchange-Traded Fund (ETF) that directly invests in Bitcoin.

The SEC has expressed concerns over the lack of clarity in these applications and has requested additional information before considering them for approval. The SEC is yet to decide how to define cryptocurrencies. The debate is ongoing.

An ETF is a type of investment fund that tracks an underlying asset, such as a stock index or a commodity. ETFs are traded on exchanges, just like stocks, and they offer investors a way to gain exposure to an underlying asset without having to buy the asset directly.

A Bitcoin ETF would allow investors to buy and sell Bitcoin on an exchange, just like they would buy and sell stocks. This would make it easier for investors to get exposure to Bitcoin, and it could also help to legitimize Bitcoin as an investment asset.

The SEC has been hesitant to approve a Bitcoin ETF, citing concerns about the volatility of Bitcoin and the lack of regulation in the cryptocurrency space. However, the recent surge of applications from asset managers suggests that there is growing demand for a Bitcoin ETF.

If the SEC does approve a Bitcoin ETF, it would be a major step forward for the cryptocurrency space. It would legitimize Bitcoin as an investment asset and it would make it easier for investors to get exposure to Bitcoin.

This article explores whether cryptocurrencies can be defined as securities and provides an outline and background on the topic. More insights on Blackrock’s ETF BTC, is detailed in Part 2.

Is Crypto a Security? Understanding the Howey Test

Have you ever wondered how the United States determines whether a particular transaction is considered a Security under Federal Law?

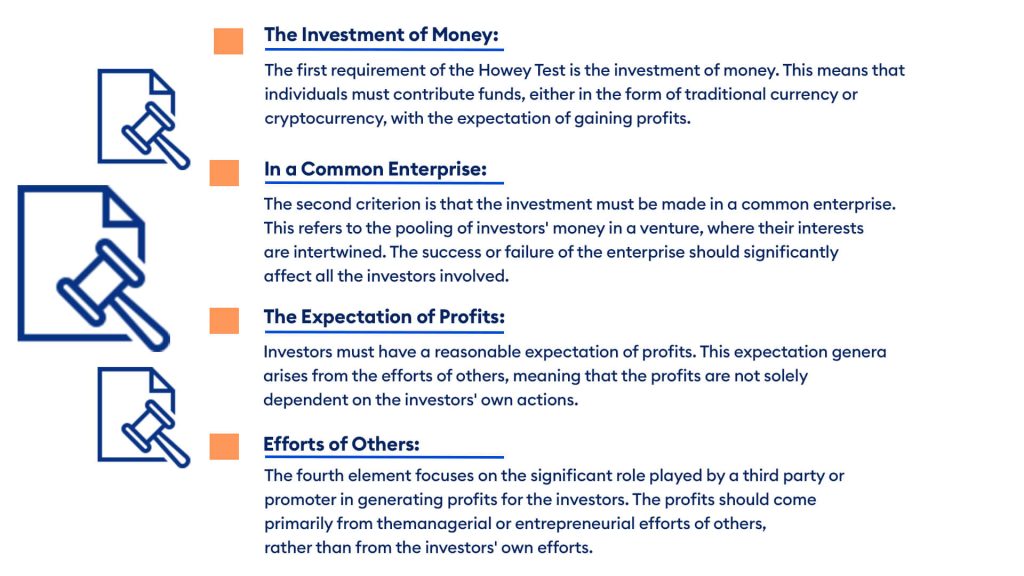

Determining whether a digital asset, such as cryptocurrency, qualifies as Security is an important question within the regulatory landscape. The SEC employs a framework known as the Howey Test to evaluate whether an asset meets the criteria of an “investment contract,” thereby classifying it as a security.

If all four demands of the Howey Test are met, the investment contract may be considered a security, subject to relevant regulatory approval.1

The classification of cryptocurrencies as Securities or Commodities is currently a subject of ongoing debate and regulatory consideration.

In the first half of 2023, the crypto industry experienced a resurgence after a period of losses, but it also revealed vulnerabilities such as risk-taking, illegal promotions, and fraud.

The US Securities and Exchange Commission (SEC) is actively working towards regulating the crypto space, aiming to strike a balance between legitimizing it and preserving its decentralized nature.

The key question is whether cryptocurrencies should be classified as Securities, Commodities, Currencies, or something else, and there is no definitive answer at present.

If considered commodities, the Commodity Futures Trading Commission (CFTC) would likely be the primary regulator overseeing crypto trading, as it regulates currency trading. On the other hand, if crypto is deemed securities, the jurisdiction would fall under the SEC, which oversees stocks, bonds, and exchange-traded funds.

SEC Chair Confirms Bitcoin is Not a Security!

In a significant development for the cryptocurrency world, On June 28, 2022, during an interview with CNBC SEC Chair Gary Gensler officially stated that Bitcoin could not be considered a Security. This announcement brings clarity to the regulatory landscape and reaffirms Bitcoin’s status as a commodity.

Gensler’s statement aligns with his belief that the majority of cryptocurrencies should be classified as securities, as per the Howey Test. However, he specifically exempts Bitcoin, highlighting its role as a replacement for Sovereign currencies rather than a security.

This clarification follows a recent interview with former SEC chairman Jay Clayton, who emphasized that cryptocurrencies like Bitcoin are designed to replace traditional currencies and, therefore, cannot be considered Securities.

Interestingly, the SEC’s lawsuits against Binance and Coinbase, two major players in the crypto industry, did not mention Ethereum (ETH). This omission could be attributed to the Commodity Futures Trading Commission’s previous classification of Ethereum as a commodity rather than a Security. The interplay between regulatory bodies highlights the intricate nature of determining the classification of cryptocurrencies.

While Gensler’s statement offers a favorable outlook for Bitcoin, it is important to remember that the SEC still views the majority of cryptocurrencies as securities, subject to strict regulations based on the Howey Test. However, this news brings a glimmer of hope for the crypto community, signaling a more nuanced approach from the SEC.

How will this affect crypto?

With 86% of crypto trading volume happening outside the United States, it seems that regulatory outcomes within the country may have limited influence on the international adoption of cryptocurrencies. In fact, any strict regulations in the U.S. could potentially drive the adoption of crypto assets beyond its borders.

This opens up opportunities for individuals and businesses to explore offshore options and embrace these assets globally. Additionally, the ongoing court cases will provide crucial answers regarding the classification of cryptocurrencies as securities, bringing much-needed clarity to the industry. Exciting times lie ahead for the world of crypto.2

- SEC.gov: https://www.sec.gov/corpfin[↩]

- Coindesk: https://www.coindesk.com/layer2[↩]