Ethereum… the brainchild of Vitalik Buterin, has and continues to change the digital landscape by providing an all-in-one platform for the creation of decentralized finance (DeFi) applications, decentralized exchanges (DEXs), and the issuance of non-fungible tokens (NFTs).

At the heart of Ethereum is the Ethereum Virtual Machine (EVM), a virtual machine that runs smart contracts written in Solidity, Ethereum’s programming language. The EVM is essentially a decentralized, globally distributed computer that executes the code of smart contracts in a trustless manner.

Ethereum was designed to function as a global computer, but its creators did not foresee an adoption rate as rapid as this, which led to a significant scalability issue. Ethereum is notorious for its scalability and exorbitant gas fees. For example, in May 2022, eth gas fees were seen at $1961. For a platform that was built to reduce transaction fees by removing intermediaries, it was not living up to its promise.

Many different solutions were introduced to tackle this scalability issue, and each had its unique way of increasing transaction throughput. In this article, we will dive into one of the new kids on the block, Arbitrum, and how it is tackling Ethereum’s scalability problem.

Introduction: Exploring the Basics of Arbitrum – Ethereum One and How it Works

Arbitrum One is a layer-2 blockchain built to efficiently scale Ethereum, mainly its smart contract capabilities. This is developed by Offchain Labs. It achieves this through the use of rollups, specifically optimistic rollups. Let’s break it down and understand it.

A layer-2 blockchain is a secondary blockchain built on top of an existing blockchain; in this case, it is Ethereum. These types of solutions are usually employed to enhance the scalability, efficiency, and functionality of the layer-1 blockchain.

Arbitrum One uses rollups to group and condense multiple transactions into a single transaction. This single transaction is then later submitted to Ethereum to secure it. By performing the computation work outside the main chain, significant performance boosts can be achieved.2

Rollups are mainly of two types, optimistic and zero-knowledge (ZK). Optimistic Rollups assume that off-chain transactions are valid and do not provide Validity Proof. ZK Rollups, on the other hand, publish cryptographic proofs of validity. In order to prevent bad actors from abusing the network, Optimistic Rollups have a time window where the rollup can be challenged by submitting a fraud-proof. Therefore, when compared to ZK Rollups, Optimistic Rollups offer greater scalability, hence its use in Arbitrum One.

Arbitrum does not have its own native token as of the time this article was written, and any Ethereum-based cryptocurrency can be used in it. This allows for greater interoperability and has helped the network gain popularity. However, there are rumours circulating that an “ARB” token is on its way. The Arbitrum bridge can be used to transfer ERC-20 tokens to Arbitrum One from the Ethereum mainnet, or users can directly withdraw tokens from a CEX like Binance to Arbitrum.

Exploring the Benefits of Smart Contract Deployment and Execution

The Ethereum Virtual Machine (EVM) was developed to run the network’s computational needs and to execute smart contracts. Due to Ethereum’s high gas fees, smart contracts on the EVM were not economically feasible. Hence, Arbitrum was developed as a solution to this problem, and it achieves this by using a unique approach that allows for the off-chain execution of smart contracts while maintaining the security and decentralization of the underlying blockchain. Now let us look at a few key benefits offered by Arbitrum for smart contract deployment and execution.

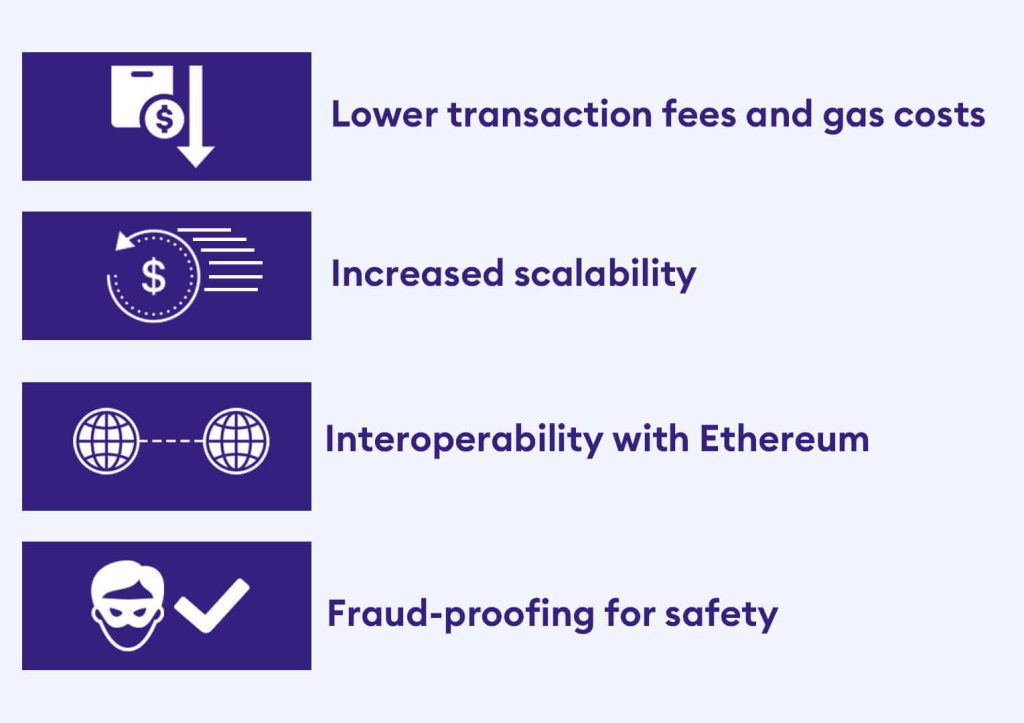

Users of Arbitrum can enjoy lower transaction fees and gas costs. This is because smart contracts’ off-chain execution eliminates the need for costly on-chain computations, which lowers transaction fees.

The ability to materially increase the Ethereum network’s scalability is one of its main advantages. Faster confirmation times for transactions and in turn, processing a higher volume of transactions per second have been made possible thanks to Arbitrum’s off-chain strategy. This is due to the speed at which smart contracts can be verified and executed off-chain as opposed to on-chain.

Arbitrum is designed to be fully interoperable with Ethereum, so smart contracts deployed on Arbitrum can easily interact with those deployed on the Ethereum Mainnet. This makes it simple for developers to create decentralized applications (dApps) that can utilize the advantages of both networks.

To ensure the safety of smart contract execution, it employs a novel approach known as fraud-proofing to detect and prevent malicious behavior, ensuring that all network transactions are secure and trustworthy.2

How Developers Build Faster & More Secure Dapps

As explained above, Arbitrum offers many benefits for developers, and they are most definitely taking note. This is evident by looking at Arbitrium’s TVL (Total value locked). The TVL of Arbitrum has increased by more than 200% from its July lows and is currently ranked 4th behind Tron.3

Currently, there are many noteworthy DeFi projects on Arbitrum. Uniswap, Sushi, Aave, and GMX are to name a few. Further, it is important to note that many other projects are looking to build on Arbitrum to leverage the network’s infrastructure. A key factor in Arbitrium’s rise is its EVM (Ethereum Virtual Machine) compatibility. This allows developers to use existing tools to build and run unmodified EVM contracts. Coinbase, one of the largest centralized exchanges, recently announced the integration of Arbitrum onto its platform. Users can now transfer assets to and from Arbitrum to trade on Coinbase. This will significantly boost Arbitrium’s usage.

What are the Potential Drawbacks of a Scaling Solution?

Arbitrum is a promising solution for enhancing Ethereum scalability, but it’s not without any drawbacks. Offchain labs have designed Arbitrum in a way to maximize transaction throughput, it achieves this by using a small set of validators to verify transactions, but that leads to centralization.

Another shortcoming of Arbitrum is its long withdrawal times. This issue is common with optimistic rollups. The delay is due to the challenge window set as a security mechanism to compensate for assuming all transactions are valid. On the bright side, there are DeFi protocols in place to reduce this withdrawal window, such as the Hop protocol and Celer bridge. 4

The Future of Development with Ethereum-Compatible Solutions

A layer-2 arms race is currently underway, and rollups are at the forefront of it. Many arguments have been made to decide the superior version between optimistic and ZK rollups. Both have their advantages and disadvantages. While Optimistic rollups have higher transaction throughput, the long withdrawal times and weaker security compared to ZK rollups are some of its weaknesses. Hence, ZK rollups can be considered the better option, but in the current state, they cannot match user demand. An ideal solution would incorporate features from both to leverage the most out of Optimistic and ZK rollups.

That being said, Arbitrum is currently leading the layer-2 race by allowing users to access Ethereum’s decentralization and security without compromising on scalability. As more and more businesses adopt these solutions, Ethereum-compatible solutions like Arbitrum will pave the way for the next wave of blockchain adoption, leading to innovations and developments in the blockchain space.

- Ethereum gas fees: https://www.sofi.com/learn/content/what-is-ethereum-gas/[↩]

- dailycoin: https://dailycoin.com/arbitrum-scaling-solution-everything-to-know/[↩][↩]

- DefiLlama: https://defillama.com/chain/Arbitrum[↩]

- Uniswap: https://support.uniswap.org/hc/en-us/articles[↩]