Table of Content

Cass Information Systems, Inc. is a leading payment processing and information management solutions provider, focusing on transportation, utilities, and financial services. It automates complex accounts payable functions, enhances cost efficiency, and provides financial insights. Its main business segments include payment processing, which ensures accuracy and compliance, and information services, which offer data analytics and reporting solutions.

Industry Positioning & Competitors

Cass is positioned in a competitive landscape with financial technology firms, banks, and specialized payment processors such as Fleetcor Technologies and WEX Inc. Cass sets itself apart from competitors by concentrating on large enterprises, leveraging extensive industry knowledge, and utilizing a proprietary banking subsidiary to optimize liquidity management.

Revenue Model

The company generates revenue primarily from transaction fees, service fees, and interest income from its banking operations. Its revenue stream is diversified across multiple industries, reducing risk exposure.

Strategic Initiatives

Cass is enhancing its capabilities through strategic partnerships and technology innovations, including AI-driven payment optimization, international market expansion, and cloud-based invoice processing solutions, to strengthen its market position and drive long-term growth.

Financial Performance Analysis

- Revenue & Profitability Trends: Cass Information Systems has experienced steady revenue growth over the past five years, primarily due to its expanding payment processing and information services businesses. Annual revenues range between $140 million and $200 million, fluctuating due to macroeconomic factors. Net income averages $25 million to $35 million annually, with net profit margins between 15% and 20%, mainly due to its asset-light business model and transaction processing efficiency.

- Operational Efficiency: Consistent profitability with an operating expense-to-revenue ratio of 75-80%.

- Balance Sheet Strength: Strong balance sheet with minimal debt and highly liquid position.

- Cash Flow Analysis: Positive and stable free cash flow, used for dividends, share repurchases, and reinvestment in technology and service enhancements.

- Return on Equity (ROE): Consistently delivers ROE between 12% and 16% and ROA around 2-3%.

- Dividend Policy & Shareholder Returns: Strong payout ratio between 40% and 50% of net income, consistent dividend growth, and high dividend yield.

Industry & Market Analysis

The fintech and payment processing industry is experiencing significant growth due to digital transactions, automation in financial services, and demand for cost-efficient payment solutions. Key trends include adopting AI and machine learning for payment accuracy and fraud detection, real-time payments and blockchain-based solutions for faster transaction processing, and increasing demand for data analytics and business intelligence in financial decision-making. Economic factors impacting the sector include interest rates, inflation, cost pressures, regulatory shifts, and industry consolidation, with higher interest rates boosting profitability and inflation potentially impacting margins.

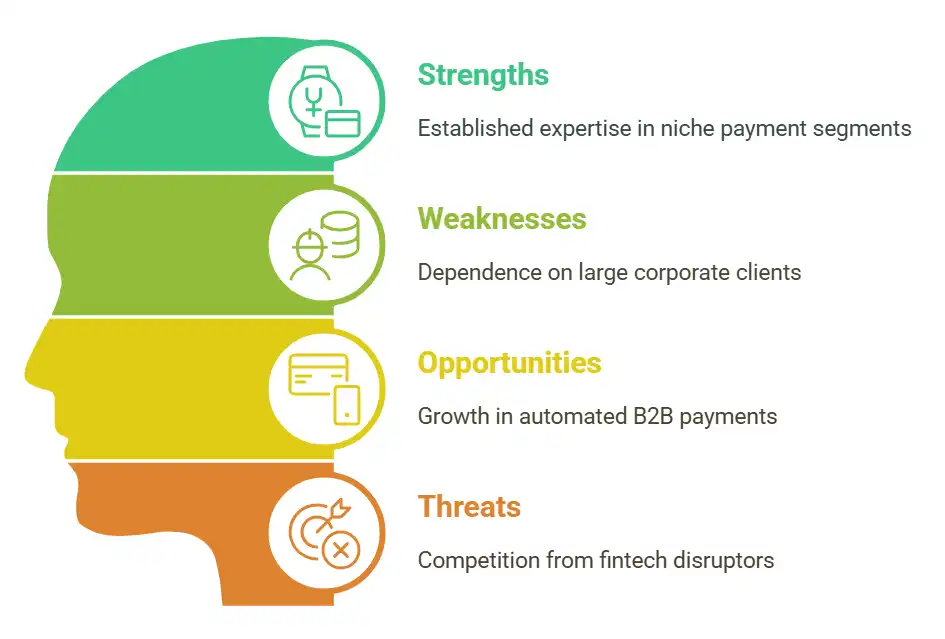

Competitive Landscape – SWOT Analysis

| Factor | Strengths | Weaknesses |

| Strengths | Established expertise in niche payment segments. | Relatively small compared to larger fintech firms. |

| Weaknesses | Dependence on large corporate clients. | Limited international presence. |

| Opportunities | Growth in automated B2B payments. | Expansion into new industries and geographies. |

| Threats | Competition from fintech disruptors (e.g., Fleetcor, WEX). | Regulatory compliance costs and cybersecurity risks. |

Regulatory & Technological Risks

Cass must comply with banking regulations, which may increase compliance costs and impact profitability. Cybersecurity risks and technological disruptions, such as blockchain, decentralized finance, and AI-driven payments, require continuous investments in security infrastructure. These challenges necessitate Cass’s innovation and adaptation to remain competitive.

Stock Performance & Valuation

Historical Stock Performance

Cass Information Systems (NASDAQ: CASS) has shown moderate and stable stock performance over different timeframes:

| Timeframe | Stock Performance |

| 1-Year | Slightly positive, with fluctuations due to macroeconomic conditions and interest rate trends. |

| 3-Year | Modest growth reflects consistent earnings but is facing pressure from fintech competition. |

| 5-Year | Modest growth reflects consistent earnings but is facing pressure from fintech competition. |

While Cass has outperformed broader markets during periods of economic stability, it has lagged behind high-growth fintech stocks due to its conservative business model.

Valuation Computation (Multiple Methods)

Below is a summary of Cass Information Systems’ valuation using different metrics and comparing them to industry averages.

| Valuation Method | Formula | Cass (CASS) | Industry Average | Computed Valuation | Comments |

| Price-to-Earnings (P/E) | Market Price / EPS | ~20x | ~22x | $42 – $46 | Fairly valued, slightly below peers |

| Price-to-Book (P/B) | Market Price / Book Value per Share | ~2.2x | ~3.0x | $40 – $44 | Lower valuation, indicating stability but lower growth |

| EV/EBITDA | (Market Cap + Debt – Cash) / EBITDA | ~12x | ~14x | $41 – $45 | Reflects solid earnings efficiency |

| PEG Ratio | P/E Ratio / EPS Growth Rate | ~1.8x | ~1.5x | $38 – $42 | Moderate growth expectations |

| Dividend Yield | Dividend per Share / Market Price | ~2.5% | ~1.5% | $40+ (income-focused) | Stronger yield than fintech peers |

| Discounted Cash Flow (DCF) (Estimated) | Present value of future cash flows | N/A | N/A | $45 – $50 | Suggests slight upside from current price (~$40) |

Cass is a stable but slower-growing fintech company with a fair valuation, lower than high-growth companies. Its P/E Ratio is fair, but slightly below peers. Its P/B Ratio is lower than high-growth fintech companies, suggesting a more conservative valuation. Its EV/EBITDA ratio is reasonable, but its moderate growth trajectory makes it less attractive.

Analyst Estimates & Growth Outlook

Analysts generally hold a neutral to slightly bullish view on CASS, citing steady financials but limited upside potential. Expected earnings projections include moderate mid-single-digit revenue growth and increased automation in B2B payments and higher interest income from its banking segment.

Investment Thesis

Bullish Case

- Stable and profitable business model with consistent revenue from payment processing.

- Strong balance sheet with minimal debt and reliable cash flow.

- Attractive dividend yield (~2.5%), appealing to income investors.

- Potential upside from AI-driven payment innovations and higher interest income.

Bearish Case

- Slower growth compared to fintech peers like Fleetcor and WEX.

- Limited international exposure and dependence on U.S. corporate clients.

- Regulatory and cybersecurity risks in the evolving financial services sector.

Risks & Challenges

Operational Risks

- Scalability and execution risks due to expansion of payment processing and information services.

- Failure to execute growth strategies could impact profitability and client retention.

- Operational disruptions could lead to reputational damage and financial losses.

Regulatory Risks

- Cass operates in a highly regulated environment, subject to anti-money laundering, data protection, and banking compliance rules.

- Regulatory changes could increase compliance costs.

- The banking subsidiary must adhere to financial institution regulations, exposing it to capital adequacy and reporting standards risks.

Macroeconomic Factors

- Inflation can increase operating costs and affect interest income.

- Economic downturns may lead to slower transaction volumes, affecting revenue growth.

Technological Risks

- Cybersecurity threats pose a significant risk.

- Continuous investment in digital transformation is necessary.

Competitive Threats

- Cass faces increasing competition from fintech disruptors and new AI-powered payment platforms.

Growth Outlook & Strategic Recommendations

Expansion Plans and Strategy

- Opportunities for growth through M&A in fintech firms offering AI-driven payment solutions.

- Diversification into international markets, mainly Europe and Asia.

- Broadening service offerings to include real-time payment processing and integrated financial analytics.

Investment in AI, Automation, and Advanced Payment Technologies

- AI-driven invoice automation for cost savings.

- Cloud-based payment solutions for scalability and security.

- Blockchain and real-time payment networks for speed and cost reduction.

Earnings Growth Prospects

- Mid-single-digit revenue growth (~5-7% CAGR) driven by increased corporate spending on automated payment solutions.

- Higher interest income from banking operations.

- Expansion into new industries like healthcare and e-commerce.

Strategic Recommendations for Investors

- Monitor M&A activity in fintech, digital transformation investments, economic conditions, and client adoption rates.

Conclusion & Investment Takeaways

Cass Information Systems, Inc. is a stable financial services company specializing in payment processing and information services. Its strengths include a consistent revenue stream, minimal debt, and a 2.5% dividend yield. However, it faces growth challenges from fintech competition, regulatory compliance, and technological innovation. Its slower revenue expansion (~5-7% CAGR) compared to high-growth fintech peers makes it less appealing to aggressive investors seeking rapid capital appreciation.

Investment Recommendation: Hold

Cass is a stable investment for income-focused and conservative investors due to its stable earnings and dividend reliability. However, it has limited growth prospects, suggesting investors seeking high returns may find better opportunities elsewhere. Future catalysts include M&A activity, AI-driven automation advancements, and interest rate fluctuations impacting banking revenue. Cass is a steady, defensive stock suitable for long-term, risk-averse investors.

All the information and analysis presented on the website is for informational and educational purposes only. Information provided in this report may be technically inaccurate or have errors. It is essential to conduct your own research and seek professional help and advice before making any investment decisions. We cannot be held responsible for any action taken based on the information provided on our platform.