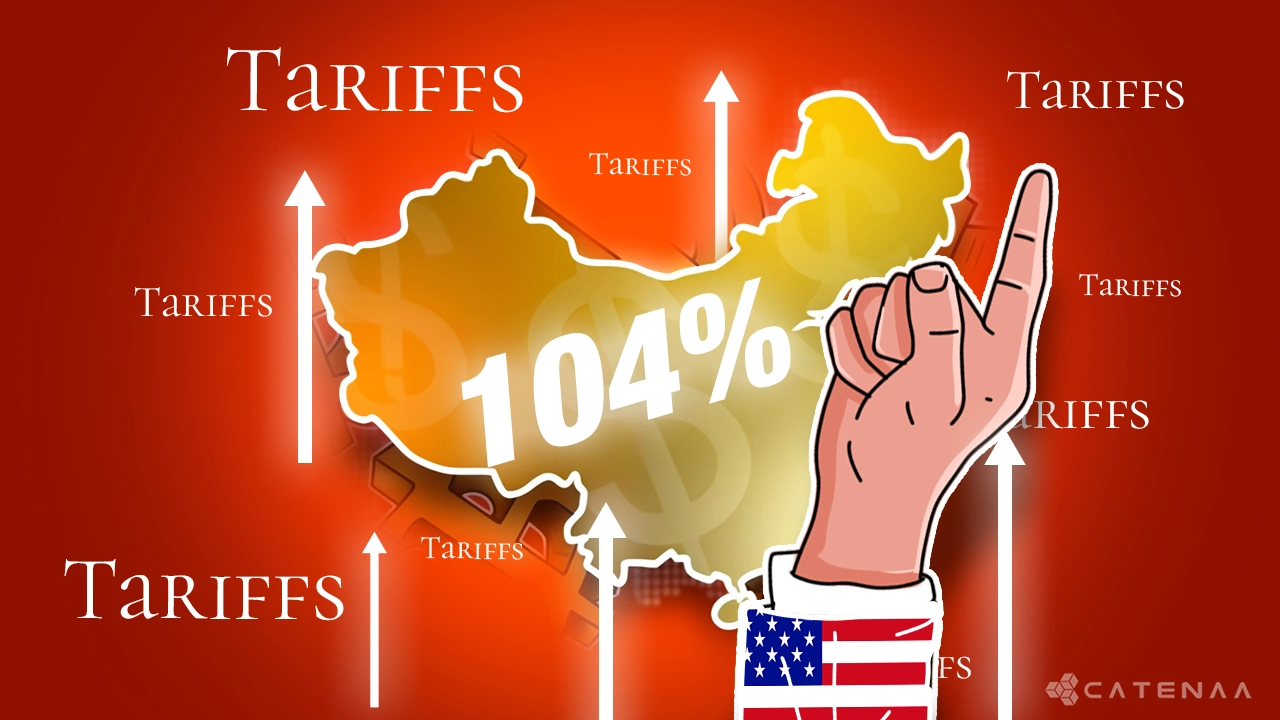

Catenaa, Wednesday, April 09, 2025-The White House yesteday April 8 announced that the US would increase tariffs on China to 104%, escalating the trade conflict between the two nations.

The move follows China’s refusal to reverse retaliatory tariffs on US goods, prompting President Donald Trump to impose a further 50% increase. This decision sent US markets into a tailspin, with major indexes, including the Nasdaq, S&P 500, and Dow Jones Industrial Average, all posting significant losses.

Bitcoin also felt the impact, dropping over 3% as investor confidence in both traditional and digital markets waned. The escalating tariffs and the potential for a broader economic downturn have sparked concerns over the long-term effects of Trump’s aggressive trade policies.

Critics argue that the tariff hikes may drive the US closer to a recession and strain international alliances, though Trump remains firm in defending the tariffs as a necessary “medicine” to address trade imbalances.

While the tariffs have had immediate negative effects on markets, some in the crypto industry, including Binance CEO Richard Teng, believe the situation could lead to increased interest in cryptocurrencies as a store of value during times of economic uncertainty. The debate continues as Trump’s trade policies continue to reshape the economic landscape.