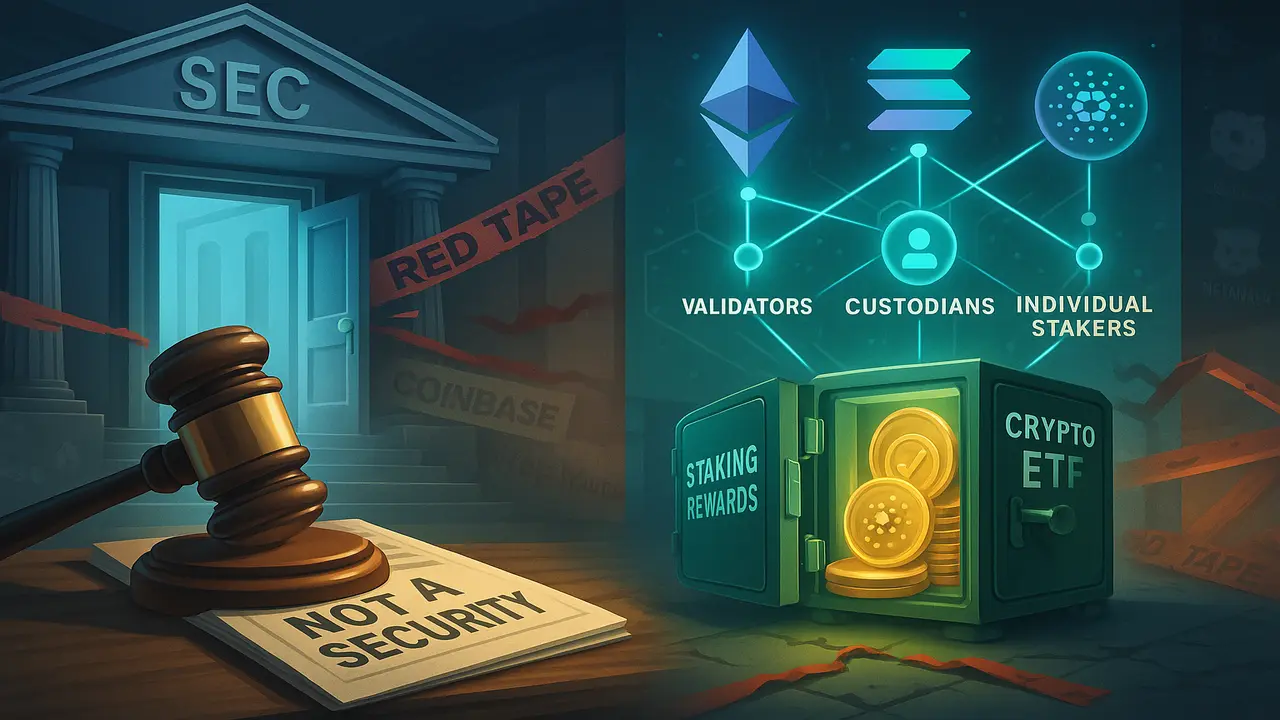

Catenaa, Friday, May30, 2025-The US Securities and Exchange Commission’s Division of Corporation Finance said yesterday (Thursday) that proof-of-stake blockchain staking activities do not constitute securities transactions, marking a significant regulatory shift for the crypto sector.

The complete SEC Statement can be seen here.

In its formal guidance, the division stated that participants involved in staking “covered crypto assets” on proof-of-stake networks are not required to register such activities under the Securities Act.

The decision applies to individual staking, third-party services such as node operators and custodians, and other ancillary staking models, including custodial arrangements that stake on behalf of asset owners.

“The Division’s view is that these activities do not involve an offering of securities,” the statement read.

The position was determined through the application of the Howey Test, a legal standard used to assess whether transactions qualify as investment contracts.

The ruling clears a path for US -based staking service providers and exchange-traded funds to legally integrate staking features. Rebecca Rettig, chief legal officer at Jito Labs, noted that the development opens doors for ETF products to include staking rewards as part of their returns.

The new guidance comes as the agency continues its post-Gensler pivot toward clarifying digital asset policy following its earlier crackdowns on Kraken, Coinbase and MetaMask staking services.