Catenaa, Tuesday, June 03, 2025-Meta shareholders have overwhelmingly rejected a proposal to add Bitcoin to the tech giant’s balance sheet, dealing a blow to advocates seeking wider corporate crypto adoption.

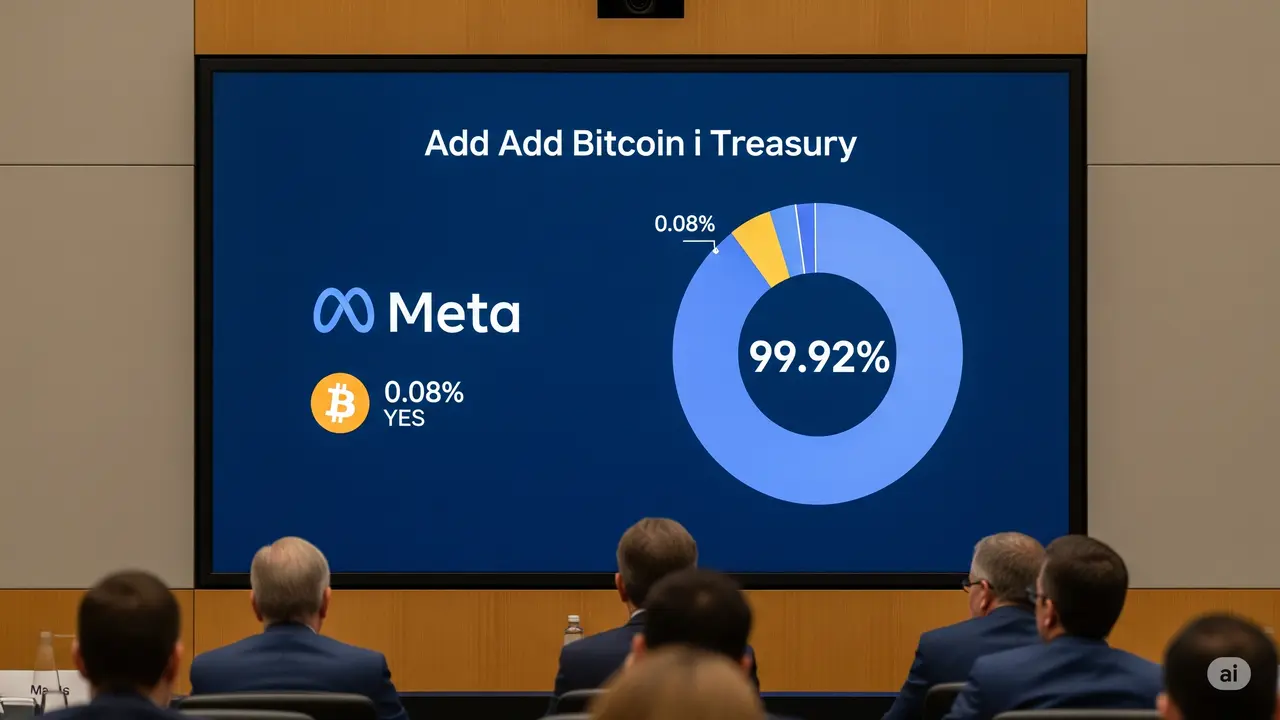

The motion, filed by Bitcoin advocate Ethan Peck, garnered only 0.08% of votes in favor, while nearly 5 billion shares opposed the measure, according to a May 28 regulatory filing.

Peck, who submitted the proposal on behalf of his family’s Meta shares, urged the company to allocate a portion of its 72 billion in cash reserves to Bitcoin as a hedge against inflation.

He cited debasement of cash and underperforming bond yields as reasons to seek alternative asset preservation strategies. His proposal leaned on guidance from BlackRock, which previously suggested a 2% Bitcoin allocation for long-term investors.

Meta CEO Mark Zuckerberg, who controls about 61% of the company’s voting power, is believed to have voted against the plan, effectively sealing its defeat.

Peck has led similar campaigns at Microsoft and Amazon. Microsoft shareholders rejected a similar proposal in December, while Amazon is set to vote on a measure proposing a 5% Bitcoin allocation in the coming months.

Despite Meta’s resistance, a growing number of public firms are integrating Bitcoin into their treasuries.

GameStop, Marathon Digital, and Tesla are among the 116 companies with Bitcoin on their balance sheets, while MicroStrategy remains the largest holder with 580,250 BTC valued at over $60.9 billion.

The push toward Bitcoin treasury strategies comes as digital asset firms raise billions to follow MicroStrategy’s aggressive crypto acquisition playbook.