Catenaa, Wednesday, April 09, 2025-European stocks plunged Wednesday morning after US President Donald Trump’s sweeping reciprocal tariffs took effect, triggering sharp declines across sectors and deepening investor unease over a mounting global trade conflict.

The pan-European Stoxx 600 index dropped 2.9% in early trade, with healthcare, mining and energy stocks leading losses.

France’s CAC 40 and Germany’s DAX both shed more than 2.5%, while the FTSE 100 also fell 2.5%, erasing gains from a brief rally Tuesday.

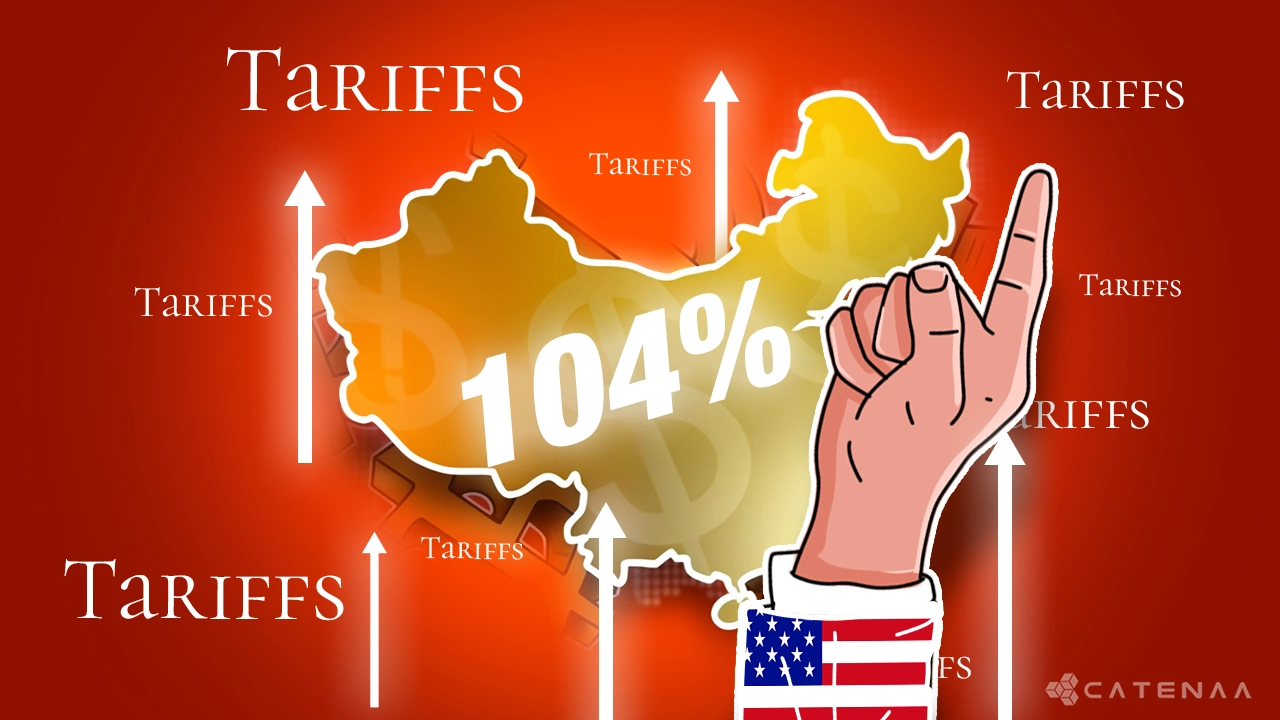

The market downturn followed Trump’s escalation of trade actions, including a 104% tariff on Chinese goods and a pledge to impose major tariffs on pharmaceuticals.

The US also tripled tariffs on low-value foreign packages, impacting dozens of countries.

Europe’s luxury, mining and auto sectors bore the brunt.

Deutsche Bank slashed target prices for 19 firms, including Kering, Burberry, and LVMH, citing economic uncertainty and weakened global demand. Mining giants BHP and Rio Tinto were also downgraded.

Auto stocks sank as tariffs hit the export-reliant industry. Shares of Valeo tumbled 7.2%, while Stellantis, BMW and Porsche dropped more than 3%.

Government bond yields reflected investor flight to safety. Short-term German bund yields declined, while U.S. Treasury yields spiked across the board.

Meanwhile, European pharmaceutical giants warned of a possible investment shift to the US amid regulatory pressures and tariff fears.

Trump’s tariff campaign has unsettled global markets, pushing South Korea’s Kospi into bear territory and bringing the S&P 500 within 1.35% of the same threshold.