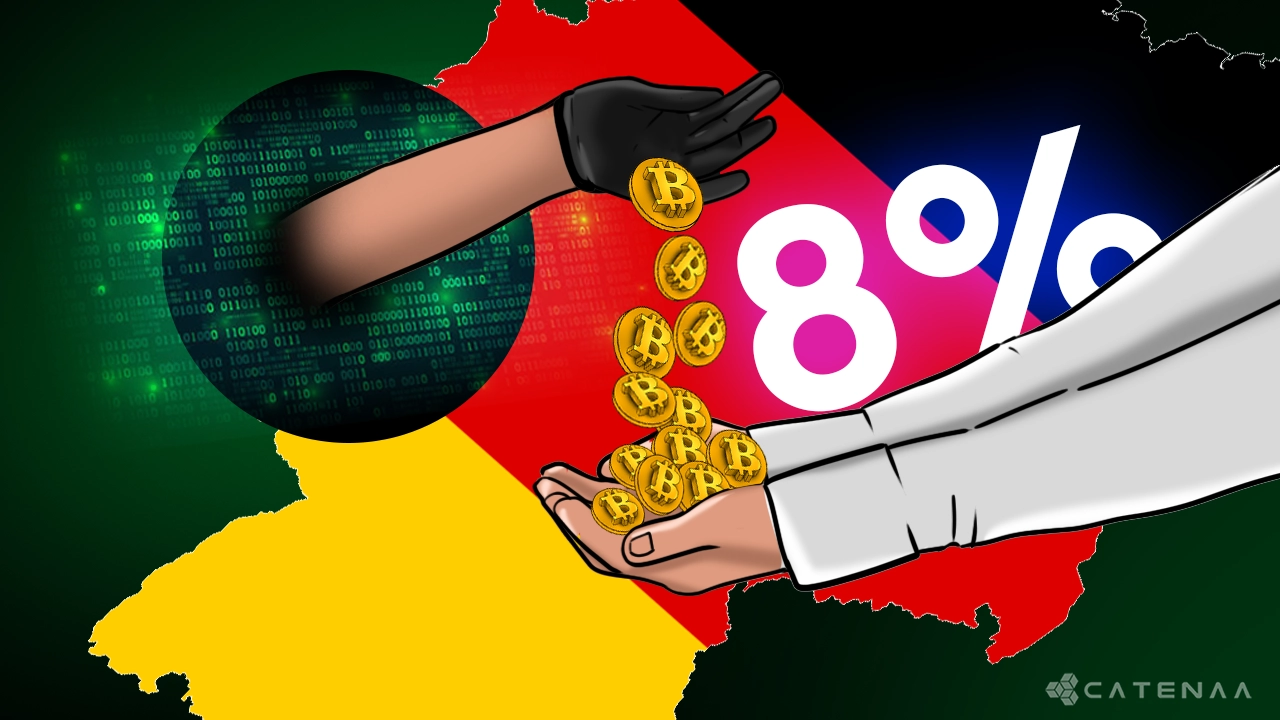

Catenaa, Sunday, June 22, 2025-Germany’s Financial Intelligence Unit (FIU) reported an 8.2% increase in anti-money laundering (AML) reports related to cryptocurrencies in 2024, signaling growing concerns over crypto role in financial crime.

The total number of suspicious activity reports (SARs) involving digital assets rose from 8,049 in 2023 to 8,711 last year, marking 3.3% of all SARs submitted to the FIU.

The rise reflects a 23.6% increase since 2020, with Bitcoin featuring in most reports, followed by Ethereum, XRP, Tether, and Litecoin.

German banks and credit institutions submitted over 6,000 of these reports, often linked to transactions involving trading platforms, mixers, and gambling sites. The FIU noted that traditional financial institutions have become primary monitors of crypto risks.

The agency warned that cryptocurrencies are increasingly integrated into complex, international money laundering networks that evade conventional controls, demanding advanced analytical tools. One case in 2024 involved a money laundering network using 44 bank accounts and eight crypto trading accounts.

Experts attribute the rise to expanding crypto adoption and a general increase in financial crime. Tobias Schweiger, CEO of anti-financial crime firm Hawk, told Decrypt that digital ledgers facilitate hiding illicit money flows, while detection tools struggle to keep pace.

He highlighted the potential impact of the EU’s MiCA regulation in strengthening anti-money laundering measures.

Schweiger predicts continued growth in crypto-related reports alongside enhanced AI-powered detection tools, which could enable financial institutions and regulators to better identify illicit activities.