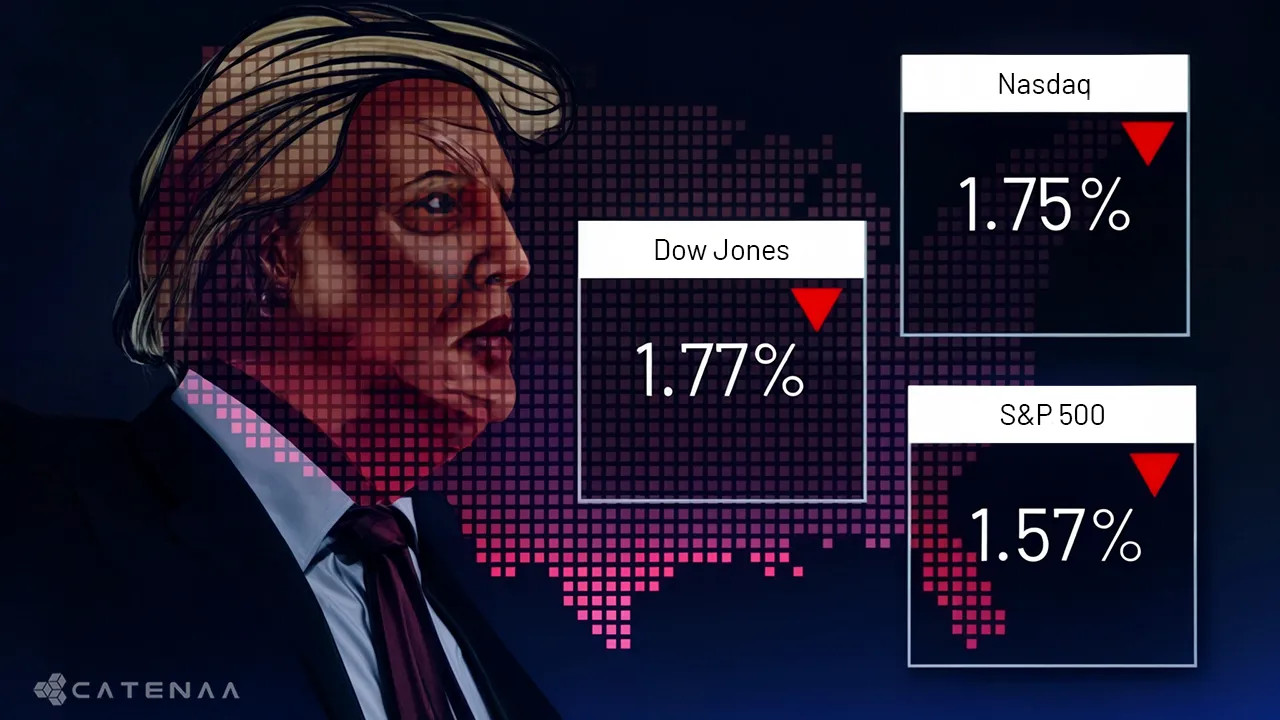

Catenaa, Wednesday, March 05, 2025-Tensions between the world’s largest economies escalated as China and Canada retaliated against the latest round of US tariffs, raising fears of a full-scale trade war.

The crypto market, already under pressure, saw a significant 12% drop in market value on Tuesday, as investors reassessed their exposure to risk amid mounting economic uncertainty.

On Monday, Canadian Prime Minister Justin Trudeau confirmed that a 25% tariff would be imposed on $20.8 billion worth of US imports starting March 5.

This move is a direct response to President Donald Trump’s decision to extend 25% tariffs on Canadian and Mexican goods, along with 10% duties on Canadian energy products.

The Canadian tariffs will not apply to goods in transit, mitigating immediate disruption.

Meanwhile, China unveiled retaliatory measures by imposing 10%-15% import duties on various US agricultural products, including chicken, wheat, and soybeans.

Beijing also blacklisted 25 US firms, citing national security concerns, particularly regarding defense contractors linked to arms sales to Taiwan.

This action came as the US imposed a 10% tariff on Chinese imports, further deepening trade hostilities.

The global crypto market, which had seen a brief surge following Trump’s proposal to create a US strategic crypto reserve, reversed its gains as trade tensions intensified.

Bitcoin and Ethereum experienced sharp declines, while smaller altcoins suffered even greater losses.