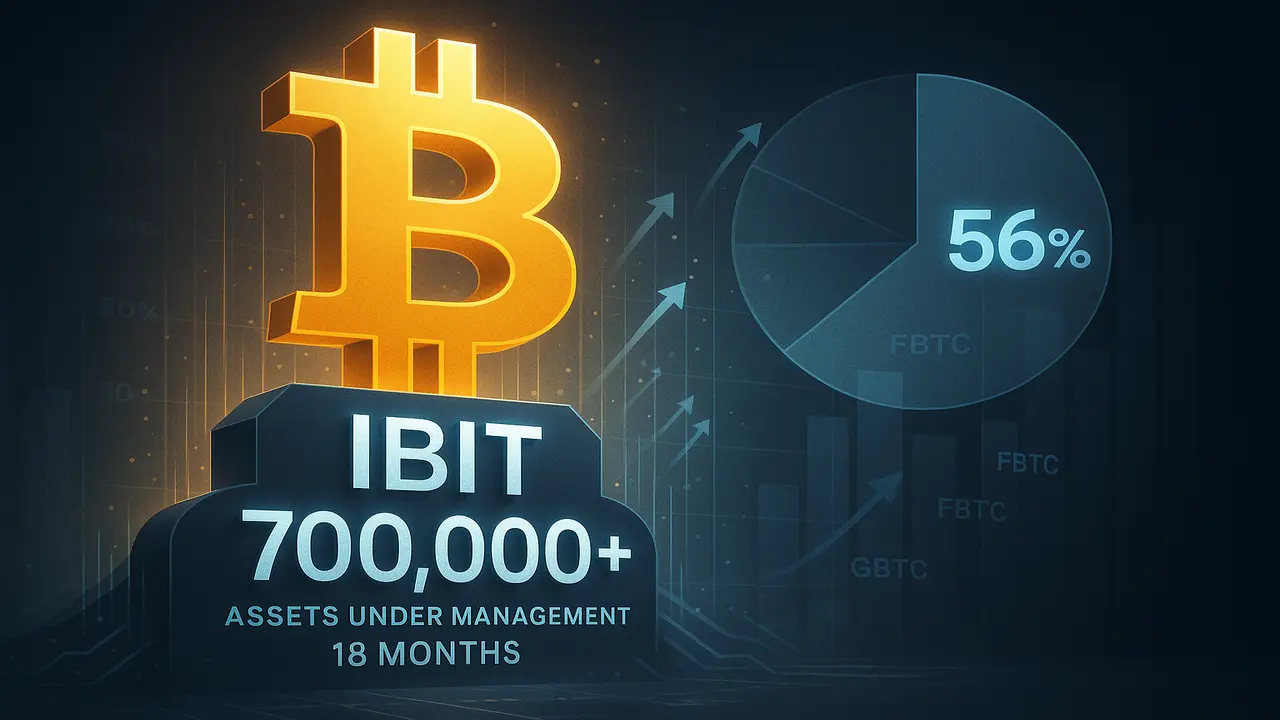

Catenaa, Wednesday, July 09, 2025- BlackRock’s IBIT spot Bitcoin exchange-traded fund has surpassed 700,000 bitcoins ($76 billion) in assets under management (AUM) just 18 months after its January 2024 launch, solidifying its position as the dominant US spot Bitcoin ETF.

IBIT’s holdings reached 698,919 BTC by July 3, with an additional 1,510 BTC net inflow on July 7, pushing it beyond the milestone, according to data from the fund’s official page and K33’s Head of Research, Vetle Lunde.

The fund accounts for about 56% of the total 1.25 million BTC held by all U.S. spot Bitcoin ETFs combined, valued at roughly $135 billion.

Industry experts however have hailed IBIT’s rapid growth.

Nate Geraci, president of NovaDius Wealth Management, called the achievement “ridiculous” given the short timeframe. IBIT is BlackRock’s third highest revenue-generating ETF among nearly 1,200 funds, trailing by just $9 billion behind the top performer, according to Bloomberg analyst Eric Balchunas.

IBIT overtook Grayscale’s GBTC fund in assets more than a year ago and has maintained a commanding lead since.

Fidelity’s FBTC now ranks second with over 200,000 BTC, while GBTC’s bitcoin holdings have shrunk by about 70% following its conversion from a private placement to a public ETF.

The broader US spot Bitcoin ETF market crossed the $50 billion inflow mark recently, with IBIT leading the charge, accounting for $52.9 billion of net inflows since the ETFs’ 2024 debut.

Reports said that on July 7 alone, IBIT represented roughly 80% of the $2.9 billion in trading volume.