Catenaa, Wednesday, March 12, 2025- Bitcoin tumbled below $80,000 on Monday night, extending a sharp decline as investors reacted to President Donald Trump’s bitcoin reserve plan, trade war fears, and recession concerns.

Ether plunged to a 16-month low near $1,800, with the broader cryptocurrency market suffering heavy losses.

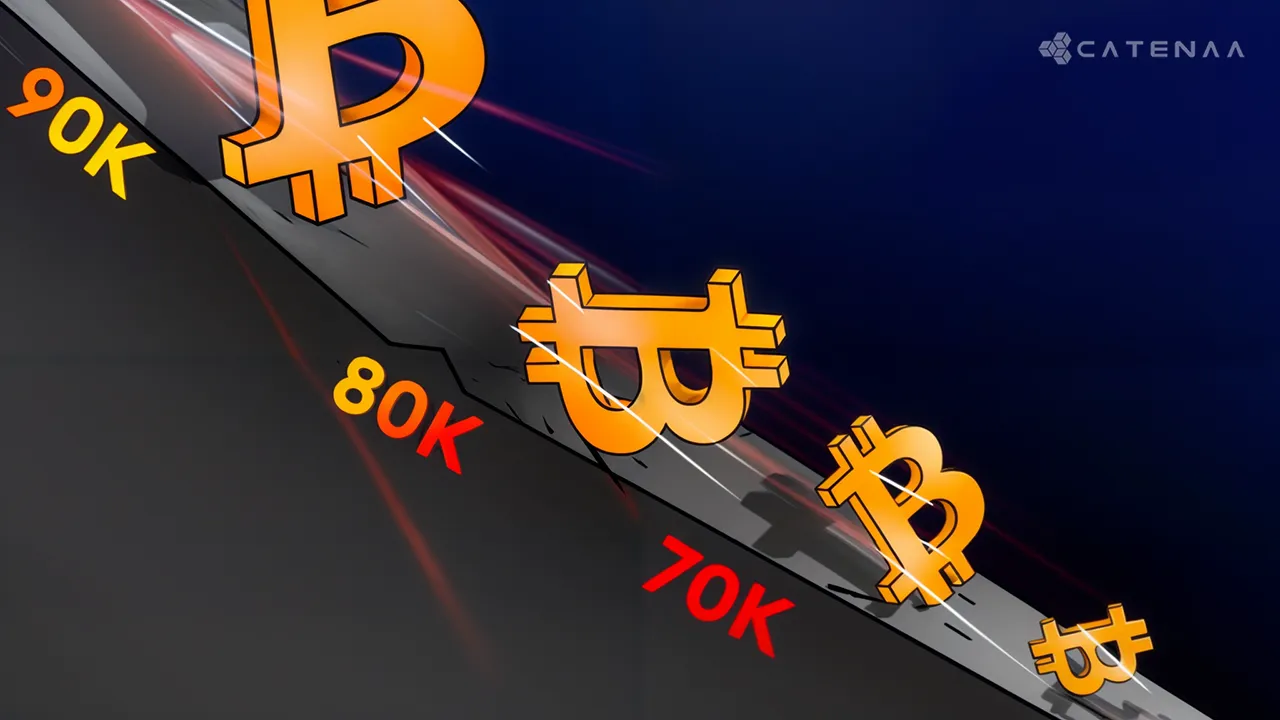

Bitcoin briefly fell below $77,000 before rebounding to $78,250, marking a 5% drop in 24 hours, according to market data.

Ether, the second-largest cryptocurrency, slid 11% to $1,820, its lowest since October 2023. Dogecoin led losses among major cryptocurrencies, plummeting 14%, while XRP and Cardano declined over 10%.

The US stock market also faced a sell-off, with the Dow Jones Industrial Average closing down 2.08%, the S&P 500 dropping 2.7%, and the Nasdaq Composite shedding 4%—its worst day since September 2022.

Market jitters intensified after Trump’s comments on economic uncertainty. “The market crash is okay,” he said, refusing to rule out a potential recession linked to tariff policies. His administration recently doubled tariffs on Chinese imports to 20% and signaled possible levies on Canadian and Mexican goods, heightening investor anxiety.

Arthur Hayes, co-founder of BitMEX, urged patience, predicting bitcoin could bottom around $70,000, a typical 36% pullback in a bull market. Analysts say upcoming Federal Reserve signals will be key, with the March 19 FOMC meeting closely watched for hints of rate cuts that could stabilize risk assets.