The Magnificent Seven of Silicon Valley

Adapted from a classic Western film, the term Magnificent Seven now describes seven dominant technology stocks, showcasing their substantial influence on the global economy and the technology sector.

The concept first appeared in a 1960 film, “Seven Samurai,” where a group of seven gunmen defend a small village from Bandits. In the financial world, the term was repurposed by Bank of America analyst Michael Hartnett in 2023 to describe Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

These companies are known for their market dominance, innovative technology, and impact on consumer behavior and the economy. The shift from film to finance showcases the power and impact of top tech companies in today’s world, seen as pioneers pushing the boundaries of technology and molding the digital future. 1

Riding the Digital Wave: The Dual Impact of Silicon Valley’s Titans on Market Seas

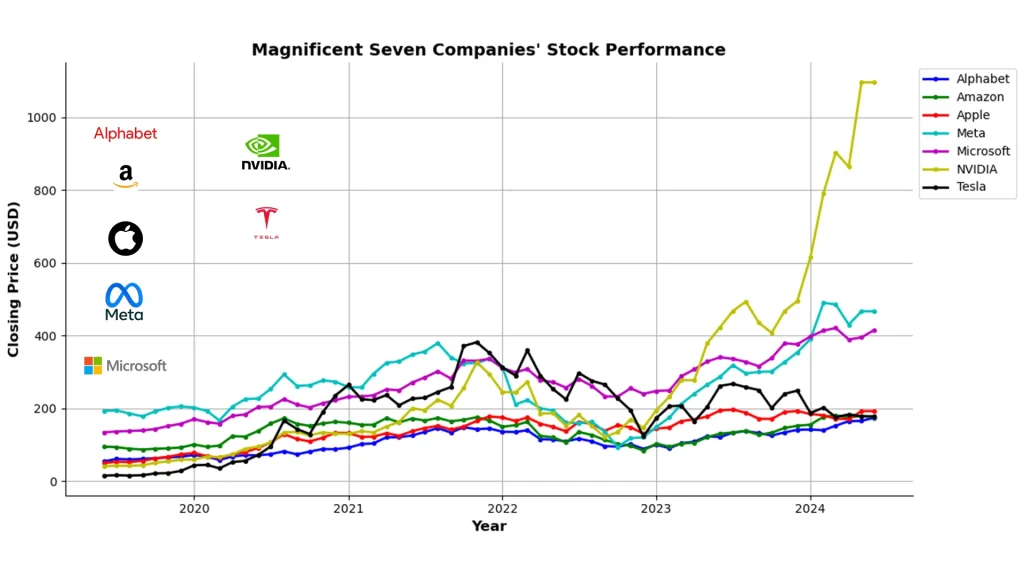

The “Magnificent Seven” are marking the S&P 500’s new high. Since October 2022, these stocks have witnessed a remarkable collective surge of almost 117%, significantly outperforming the other 493 companies in the index.

This group’s significant impact on the S&P 500’s historic closing was attributed to their remarkable price gains and the index’s market capitalization-weighted structure, magnifying larger companies’ power. As a result, the market value of these seven tech giants has increased by over 60% since October 2022, significantly impacting the index’s overall performance.

The significant impact of the “Magnificent Seven” tech stocks on the S&P 500’s performance has both positive and negative aspects. In late 2022, their underperformance weighed down the index, but subsequent comeback has played a crucial role in the S&P 500’s recent gains, making up more than 60% of its returns in the past year. Even though Tesla’s valuation has fallen since Octo3gb ber 2022, it has significantly contributed to the S&P 500’s performance by surging 64% in the past year.

On the contrary, stocks such as Royal Caribbean and General Electric have experienced substantial growth of 212% and over 160% since October 2022. However, due to their smaller size, their influence on the index has been minimal, with each contributing less than 1% to its movement.

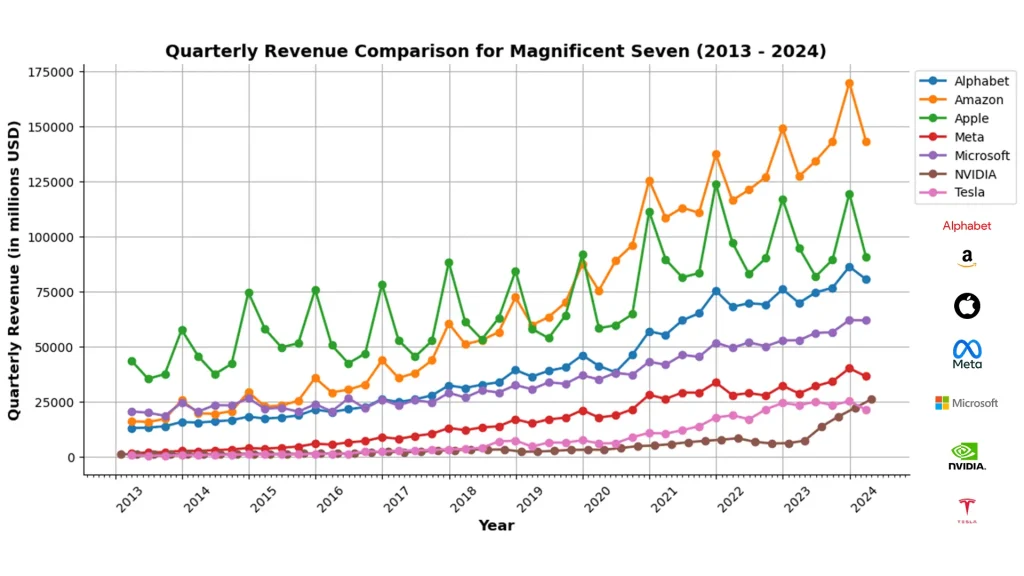

Within the Magnificent Seven, there is a significant range in performance; Nvidia has seen a remarkable 417% surge, whereas Amazon’s growth is more conservative at 38%. Microsoft, being the top stock in the index, has a significant influence with a 79% increase, outshining Meta’s 198% growth since October 2022. 2

The significant presence of Big Tech in the S&P 500 provides valuable insights into market trends, corporate achievements, and overall economic well-being. When the S&P 500 rises, it usually indicates positive trends. However, the true market volatility can be hidden if gains are concentrated in a few large companies. This situation is familiar; during the 1980s, major corporations such as IBM, Exxon, and General Electric were market leaders, although not as dominant as today’s tech giants. 3

An interesting instance of this situation occurred in March when a banking crisis led to a drop in many stocks, but the S&P 500 finished the month 3% higher.

This was due to the buzz of innovations in artificial intelligence and their potential impact on tech profitability. This demonstrates how the movements of the S&P 500 can occasionally conceal wider market challenges, underscoring the significance of delving deeper into indicators to grasp the market’s actual condition.

Investment Implications and Strategic Diversification

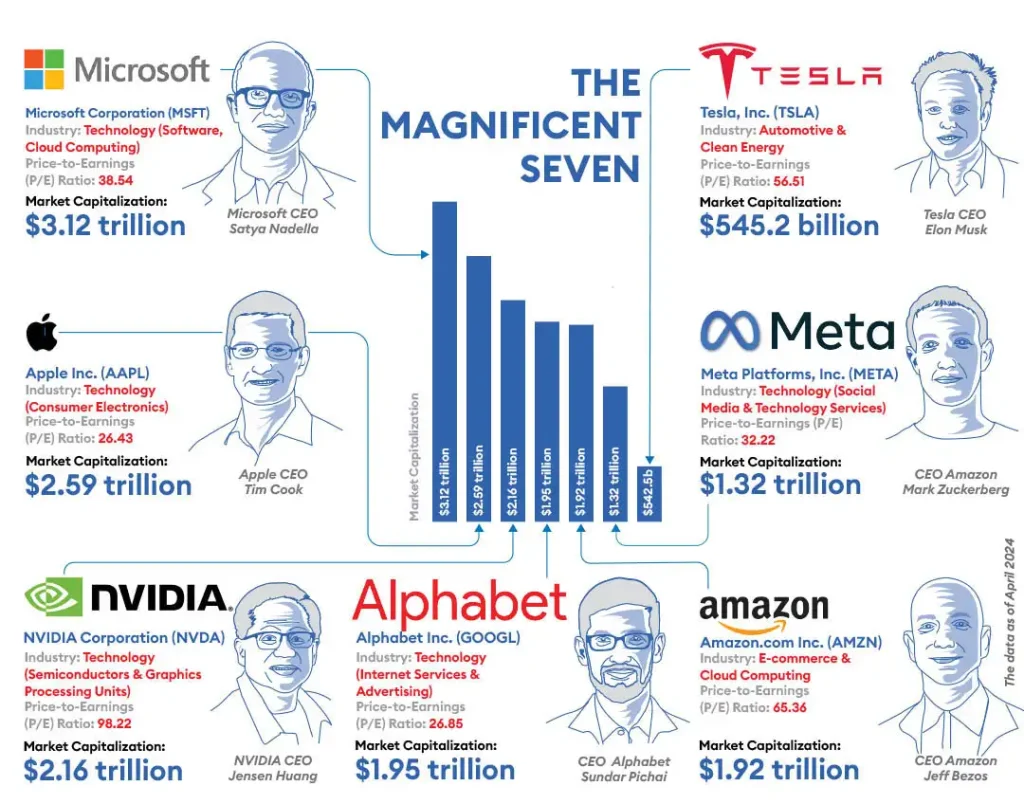

The significant increase in the Magnificent Seven’s success prompts concerns regarding market concentration and the longevity of their dominance. 4 Their forward price-to-earnings ratio is approximately 35x, significantly surpassing the broader S&P 500. Excluding the Magnificent Seven, which is around 15.5x.

Investors should be mindful of the risks related to high expectations and economic uncertainties that could affect the performance of these tech giants.

Driving Future S&P 500 Performance of Magnificent Seven

The Magnificent Seven have not only taken over the current market landscape but are also poised to influence the future direction of the S&P 500.

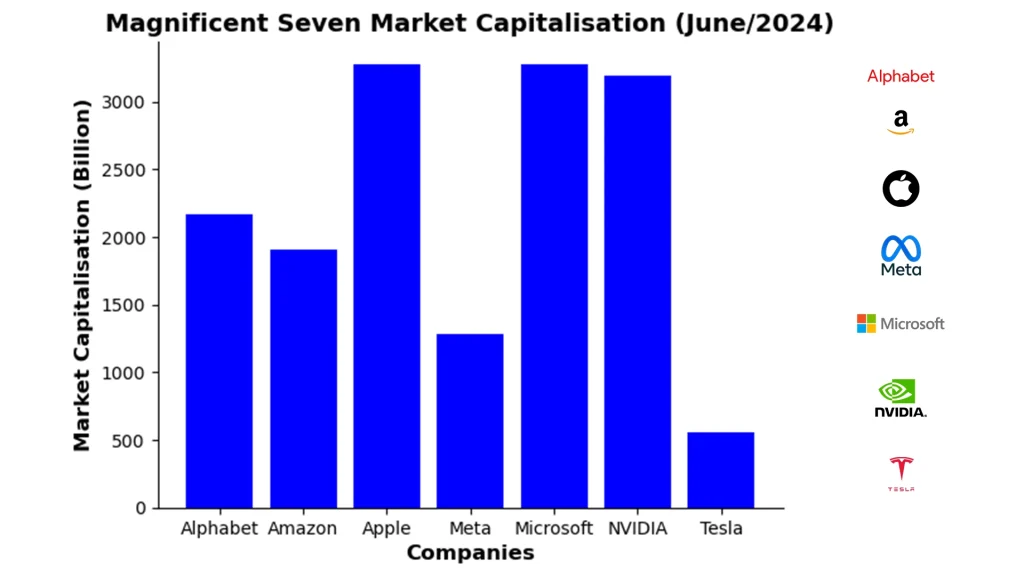

As of early 2024, the combined market cap of these tech giants is approaching $12 trillion, representing a substantial portion of the index and contributing to 29% of its market cap. 5 Their combined 71% increase, which outshines the meager 6% from the rest of the stocks, highlights their significant impact on the index. The focus on market cap and performance highlights the significant impact these companies have on shaping the future direction of the S&P 500, driven by their strong growth rates and strategic moves into cutting-edge technologies such as artificial intelligence and electric vehicles.

ESG Consideration: A New Paradigm of Growth

ESG factors are now crucial in the realm of investing, impacting how decisions are made and how companies are valued. The Magnificent Seven, with their substantial resources, have been integrating ESG principles steadily into their business models.

Take Tesla’s strides in electric vehicles as an example, highlighting a strong dedication to environmental sustainability. This commitment has played a major role in its stock performance, which has surged by 103% in the initial three quarters of 2023. These companies are investing significantly in Artificial Intelligence (AI) and other technologies, which are expected to fuel future growth and support broader ESG objectives by potentially addressing global issues like energy efficiency, health care, and digital security. 6

Future Disruptive Technologies And Innovation of Magnificent Seven

The Magnificent Seven’s significant influence over the market is evident as they drive and shape the future of disruptive technologies.

This segment delves into their significant contributions to blockchain, cryptocurrency, artificial intelligence (AI), and machine learning, showcasing how these companies lead innovation rather than just keeping up with technological advancements.

1. Blockchain and Cryptocurrency: The New Frontier

The Magnificent Seven have various degrees of participation in blockchain and cryptocurrency, but their technological ecosystems and platforms play a crucial role in advancing these technologies. As an illustration, Microsoft’s Azure blockchain services offer a foundation for developing blockchain applications, demonstrating the company’s dedication to bolstering the infrastructure of this evolving digital ledger technology.

Just as companies such as Apple and Amazon have not invested directly in cryptocurrencies, they are now looking into how blockchain technology can improve customer experiences and supply chain operations. This shows they acknowledge its potential to shake up traditional business models.

2. AI and Machine Learning: Leading the Charge

The Magnificent Seven are paving the way for AI and machine learning innovation. Nvidia has positioned itself as a major player in the field of AI, as its GPUs are widely used in AI research and development worldwide. In Q2, Nvidia experienced a significant 171% year-on-year growth in data center revenue, mainly fueled by its progress in AI technologies. Google (Alphabet) and Microsoft have significantly impacted the advancement of AI and machine learning. They have introduced cloud-based AI services and open-source platforms that make AI tools accessible to developers and researchers. 7

Tesla’s focus on autonomous vehicles is deeply rooted in machine learning and AI, utilizing its cars as data collection points to enhance its self-driving algorithms over time. Apple’s integration of AI into all its products, such as Siri and facial recognition in iPhones, demonstrates a dedication to integrating AI into consumer technology to improve user experiences and efficiency in operations.

Strategic Movements and Impact on Investors Due to Magnificent Seven

Investors and analysts keep a close eye on the strategic decisions made by these companies, such as venturing into new technological fields like AI, cloud computing, and digital services. Alphabet recently reached a $2 trillion market capitalization 8, highlighting the staggering value attributed to its wide range of services such as online advertising, search, Android, and YouTube, despite facing regulatory limitations and competition.

These companies constantly evolve through innovation, market expansion, and strategic acquisitions, offering both opportunities and risks for investors. Being able to steer market trends, impact consumer behavior, and mold the future of technology and business models are essential factors in investment portfolios. Nevertheless, focusing on market dominance and the possibility of regulatory assessment demands a prudent and well-informed investment strategy.

In conclusion, the “Magnificent Seven” persists in shaping market dynamics, fostering innovation, and securing substantial market value. Investors can engage in the growth of the digital economy and technological innovations with these companies. Meanwhile, to successfully navigate the investment landscape around these industry leaders, investors must deeply understand their market positions, growth drivers, and possible obstacles.

Graph Citations:

Yahoo Finance

- Alphabet Inc. Stock Market Growth: Retrieved from Yahoo Finance. For statistical analysis and visualization, usage is subject to Yahoo Finance Terms of Use.

- NVIDIA Corporation (NVDA) Stock Market Growth: Retrieved from Yahoo Finance. For statistical analysis and visualization, usage is subject to Yahoo Finance Terms of Use.

- Apple Inc. (AAPL) Stock Market Growth: Retrieved from Yahoo Finance. For statistical analysis and visualization, usage is subject to Yahoo Finance Terms of Use.

- Amazon Stock Market Growth: Retrieved from Yahoo Finance. For statistical analysis and visualization, usage is subject to Yahoo Finance Terms of Use.

- Meta Stock Market Growth: Retrieved from Yahoo Finance. For statistical analysis and visualization, usage is subject to Yahoo Finance Terms of Use.

- Microsoft Stock Market Growth: Retrieved from Yahoo Finance. For statistical analysis and visualization, usage is subject to Yahoo Finance Terms of Use.

- Tesla Stock Market Growth: For statistical analysis and visualization, usage is subject to Yahoo Finance Terms of Use.

Macrotrends

- Alphabet Inc. Revenue: Retrieved from Macrotrends. For statistical analysis and visualization, usage is subject to Macrotrends Terms of Use.

- NVIDIA Corporation (NVDA) Revenue: Retrieved from Macrotrends. For statistical analysis and visualization, usage is subject to Macrotrends Terms of Use.

- Apple Inc. (AAPL) Revenue: Retrieved from Macrotrends. For statistical analysis and visualization, usage is subject to Macrotrends Terms of Use.

- Amazon Revenue: Retrieved from Macrotrends. For statistical analysis and visualization, usage is subject to Macrotrends Terms of Use.

- Meta Revenue: Retrieved from Macrotrends. For statistical analysis and visualization, usage is subject to Macrotrends Terms of Use.

- Microsoft Revenue: Retrieved from Macrotrends. For statistical analysis and visualization, usage is subject to Macrotrends Terms of Use.

- Tesla Revenue: Retrieved from Macrotrends. For statistical analysis and visualization, usage is subject to Macrotrends Terms of Use.

- Magnificent Seven: https://onstrategy.eu/the-magnificent-7/[↩]

- Magnificent Seven: https://www.linkedin.com/pulse/rise-magnificent-seven-d%C3%A9j%C3%A0-partners-xk7qe/[↩]

- Magnificent Seven: https://www.nytimes.com/interactive/2024/01/22/business/magnificent-seven-stocks-tech.html[↩]

- Magnificent Seven: https://www.capitalgroup.com/institutional/insights/articles/magnificent-seven-chart-diversify.html[↩]

- Magnificent Seven: https://finance.yahoo.com/news/one-chart-shows-how-the-magnificent-7-have-dominated-the-stock-market-in-2023-203250125.html[↩]

- Magnificent Seven: https://get.ycharts.com/resources/blog/the-magnificent-seven-stocks/[↩]

- Magnificent Seven: https://www.cnbc.com/2024/02/21/nvidias-data-center-business-is-booming-up-over-400percent-since-last-year-to-18point4-billion-in-fourth-quarter-sales.html[↩]

- Magnificent Seven: https://finance.yahoo.com/news/google-hits-2-trillion-market-cap-152843213.html[↩]