Table of Contents

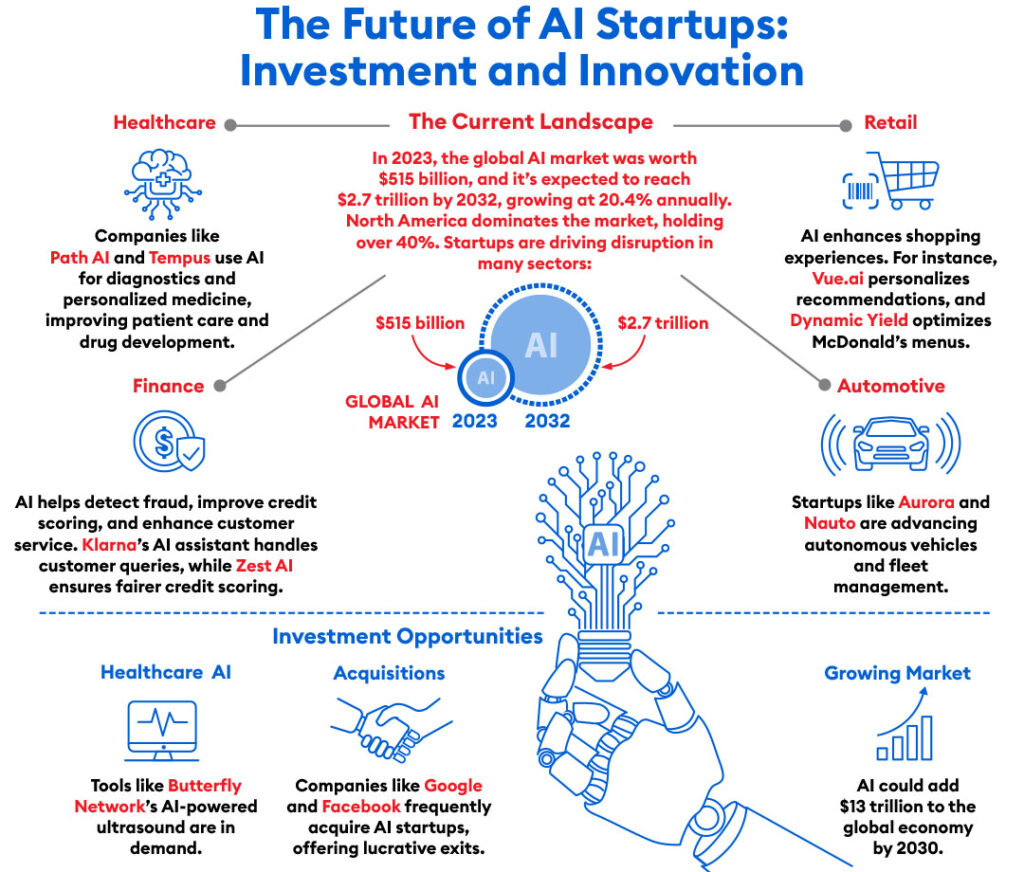

In recent years, artificial intelligence (AI) has transformed from a theoretical concept to a foundational technology reshaping industries and creating new opportunities across sectors. AI-driven startups are at the forefront of this revolution, leveraging advanced algorithms and machine learning to drive innovation in healthcare, finance, retail, and beyond. As these startups become more prevalent in the ecosystem, investors face exciting opportunities and potential challenges.

This article examines the current landscape of AI startups, identifies key players, highlights emerging trends, and explores the financial potential and obstacles shaping the future of AI-focused investments.

The Current Landscape of AI Startups

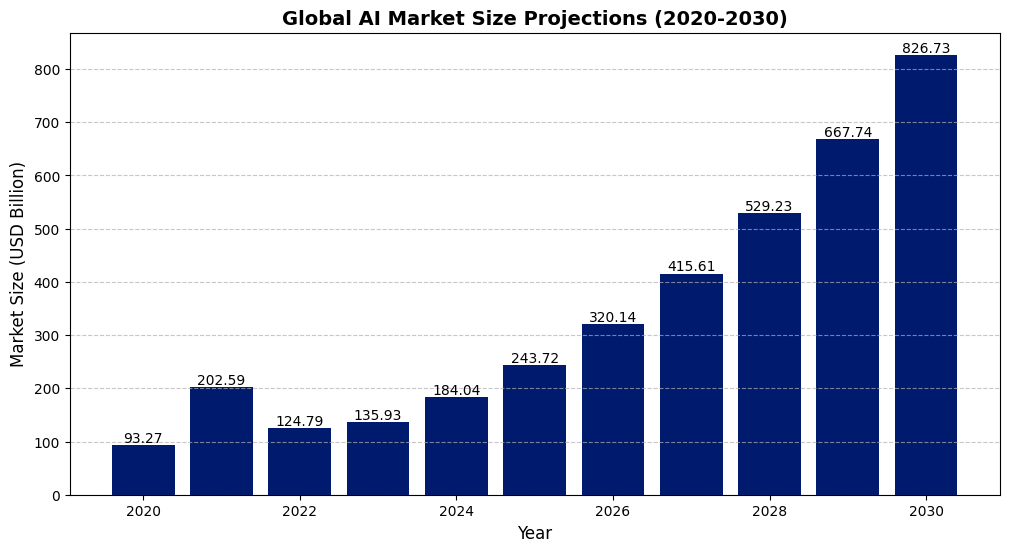

The global artificial intelligence (AI) market size was valued at USD 515.31 billion in 2023 and is projected to grow from USD 621.19 billion in 2024 to USD 2,740.46 billion by 2032, exhibiting a CAGR of 20.4% during the forecast period. North America dominated the global AI market with a share of 41.23% in 2023. 1

These startups are highly agile, often disrupting traditional business models and creating novel solutions. Key sectors where AI startups are particularly active include:

Healthcare:

AI startups in healthcare focus on diagnostics, personalized medicine, and medical imaging. For instance, PathAI uses machine learning to improve diagnostic accuracy in pathology, helping doctors better detect diseases like cancer from tissue samples. PathAI is dedicated to improving patient outcomes with AI-powered technology and collaboration with biopharma and pathology laboratories, aiming to provide invaluable insights for biomarker discovery and drug development and improve laboratory workflows. 2

Tempus, a cutting-edge technology company in healthcare, is transforming the field of personalized medicine by using artificial intelligence (AI) and multimodal data to support precision oncology and drug development. Through its partnership with major pharmaceutical companies like GSK, Tempus combines extensive clinical and molecular datasets to advance targeted therapies and improve patient outcomes. By integrating AI algorithms with real-world clinical data, Tempus enables researchers to analyze biomarkers, genetic profiles, and imaging data at an unprecedented scale, thereby advancing the development of precision treatments in oncology and beyond. Furthermore, Tempus is pushing the boundaries of liquid biopsy technologies, leveraging circulating tumor DNA (ctDNA) to monitor disease progression and personalize therapies for patients. As AI and real-world data continue to evolve, Tempus is positioned at the forefront of this transformative era, paving the way for more tailored and accessible healthcare solutions. 3

Financial Technology (FinTech):

AI is transforming finance by enabling fraud detection, algorithmic trading, and credit scoring. Klarna is revolutionizing the shopping and payment experience with the introduction of an AI-powered assistant that supports 150 million global consumers across various needs. Available through the Klarna app, this assistant enhances the customer journey by offering multilingual support in over 35 languages, real-time financial guidance, and 24/7 assistance for issues like refunds, returns, and account management. Designed in collaboration with OpenAI, the assistant not only improves consumer satisfaction but also aligns with Klarna’s mission to drive smarter, more efficient shopping experiences. Consumers benefit from features like personalized financial tracking, spending limit insights, and seamless communication in their native language, while still having the option to connect with live agents if needed. 4

This AI rollout marks a major milestone in Klarna’s vision to create a fully automated financial assistant that saves users time and fosters healthier financial habits. According to Klarna’s CEO, Sebastian Siemiatkowski, this technology elevates consumer experiences, enhances employee opportunities, and maximizes investor returns. With partners such as H&M, Nike, and Airbnb, Klarna is pushing boundaries in digital commerce, making shopping more accessible, intuitive, and customer-focused. 4

Additionally, Zest AI, a leader in lending technology, uses machine learning models to provide fairer credit scoring, addressing biases and improving access to credit for underserved populations. The survey revealed that 83% of respondents see AI and machine learning as essential to reducing bias, and 70% acknowledge racism in current scoring systems. This sentiment is strong enough that 65% of respondents would switch jobs to work for companies promoting racial equity. Zest AI’s survey calls for regulators to adapt, with 90% of respondents supporting broader AI adoption in credit scoring. Despite 77% believing the financial sector treats customers differently based on race and gender, only 15% think this bias exists within their own companies, a “blind spot” Zest AI believes the industry must address. According to Zest, AI tools now available can drive greater fairness and transparency in lending, offering a path toward a more equitable financial system. 5

Retail and E-commerce:

AI is enhancing recommendation engines and personalizing customer interactions. For example, Vue.ai uses computer vision to help fashion retailers automate product tagging, improve search accuracy, and offer personalized product recommendations. Dynamic Yield, acquired by McDonald’s, uses AI to personalize drive-thru menus based on factors like weather and time of day, demonstrating AI’s impact on customer experience.

Automotive and Mobility:

AI is a key driver in autonomous vehicles, with startups like Aurora and Wayve making strides in autonomous driving technologies. Nauto, a startup specializing in AI-driven fleet management, uses real-time data to improve safety and efficiency for commercial fleets.

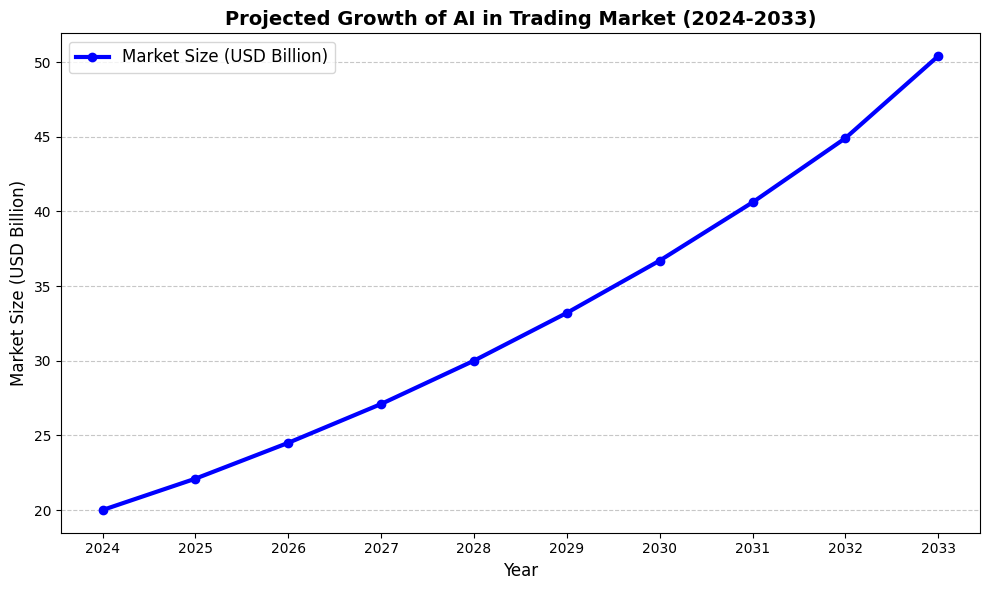

AI and the Acceleration of Trading Dynamics

The adoption of AI in financial trading is revolutionizing the industry, driving it to unprecedented levels of speed and efficiency. Bill Gates, in Business at the Speed of Thought, emphasizes the importance of leveraging technology to create near-instantaneous decision-making systems a principle perfectly illustrated by AI-driven trading. Modern trading bots harness vast datasets and execute complex strategies within fractions of a second, fundamentally altering how markets operate. This rapid pace of execution gives firms using advanced AI systems a significant edge over those relying on traditional methods.

Gates’ concept of a “digital nervous system,” where seamless information flow underpins competitive success, resonates strongly in this context. AI technology not only streamlines processes but also ensures real-time adaptability, embodying Gates’ vision of businesses achieving unparalleled agility and responsiveness in a fast-evolving marketplace.

Key Players in the AI Startup Ecosystem

Notable players in the AI startup space include both emerging companies and high-growth ventures that have captured the attention of investors. These startups are often characterized by unique technological innovations or proprietary algorithms that offer a competitive edge:

- OpenAI: Known for its language models, OpenAI’s GPT-4, DALL-E 3, and Sora have revolutionized natural language processing and generative AI. Their API is used by businesses across industries for customer support automation, content generation, and data analysis, making AI accessible to a broad range of enterprises. 6

- UiPath: Specializing in robotic process automation (RPA), UiPath streamlines repetitive tasks in enterprise environments. The platform has been adopted by banks, insurance companies, and other corporations to automate back-office processes, from compliance to invoice processing.

- Nuro: Focusing on last-mile delivery, Nuro’s self-driving vehicles have been piloted by major companies like Domino’s Pizza, emphasizing the growing trend of contactless delivery in logistics.7

- DataRobot: As an end-to-end machine learning platform, DataRobot automates the process of building and deploying models, helping companies in sectors like finance, healthcare, and retail extract value from their data without needing deep technical expertise. 8

Investment Opportunities and Potential Returns for Startups

Investment in AI startups presents substantial growth potential. Early-stage investments in AI startups can yield high returns as these companies scale and attract larger valuations. For example:

- Sector-specific Returns: Startups in healthcare AI, such as those focused on diagnostics and imaging, are highly sought after due to rising demand for faster, more accurate healthcare solutions. Investors in companies like Butterfly Network, which developed a handheld ultrasound device powered by AI, have seen substantial returns as demand for accessible diagnostic tools grows. 9

- Partnership and Acquisition Opportunities: Large companies often acquire AI startups to strengthen their own AI capabilities. Google’s acquisition of DeepMind and Facebook’s acquisition of Groq highlights the appetite for advanced AI technology in big tech, offering lucrative exit opportunities for investors. 10

- Growing Market Demand: The AI market’s rapid growth is driving demand for innovative startups. A McKinsey report estimates that AI could deliver $13 trillion in additional global economic activity by 2030, underscoring the vast market potential for AI startups across sectors.

Legal and Regulatory Challenges Facing AI Startups

The rapid growth of AI has often outpaced existing legal frameworks, creating a complex environment for startups to navigate. Some prominent legal issues include:

- Data Protection and Privacy: AI systems require extensive datasets, often containing sensitive personal information. Startups must comply with regulations like Europe’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) to avoid penalties and maintain public trust.

- Fairness and Bias: Algorithmic bias poses a significant challenge in industries such as healthcare and finance, where ensuring fairness is essential. Regulatory frameworks like the EU Artificial Intelligence Act—the first global initiative to regulate AI are driving startups to prioritize the development of transparent and equitable systems. By establishing harmonized rules for AI development, marketing, and usage, the Act aims to create a trustworthy AI ecosystem that safeguards fundamental rights, promotes fairness, and fosters innovation. 11

- Accountability and Liability: Determining responsibility for errors or failures in AI applications, such as autonomous vehicles, poses legal dilemmas. Startups in these domains must address liability concerns to instill confidence in their technology.

- Global Regulatory Complexity: Startups aiming for international markets must adhere to differing regulations across countries, requiring comprehensive compliance strategies to operate effectively.

Balancing innovation with adherence to these evolving legal frameworks is essential for AI startups to mitigate risks and maintain credibility.

Emerging Trends and New Developments in Startups

AI startups are continually evolving, with several new trends emerging in recent years:

- Explainable AI (XAI): With AI impacting sensitive areas, startups like Fiddler AI focus on explainable AI, which helps organizations understand, trust, and manage their AI models. This trend is especially crucial in regulated industries like healthcare and finance, where transparency is key. 12

- Edge AI: Companies such as Kneron and Edge Impulse are developing AI models that run on edge devices, allowing for faster data processing without relying on cloud computing. Edge AI is particularly relevant in IoT, enabling real-time data analysis on devices such as smart home products and industrial sensors. 13

- AI for Social Good: Startups like Hala Systems use AI for humanitarian purposes, such as detecting and warning of potential airstrikes in conflict zones. Other startups, like Blue River Technology, apply AI in precision agriculture to reduce chemical use and increase crop yields, aligning with sustainable development goals. 14

The Path Forward: Strategic Considerations for Investors

For investors, the key to success in AI startup investment lies in strategic due diligence and aligning with the right opportunities. Some considerations include:

- Focus on Differentiated Technologies: Invest in startups with unique, scalable solutions and intellectual property, like patents or proprietary algorithms. Companies like Cerebras, which builds specialized AI hardware to accelerate deep learning, have attracted significant attention for their unique approach. 15

- Consider Ethical AI and Transparency: Startups that prioritize ethical AI and transparency in their algorithms can better navigate regulatory hurdles. Companies such as Civis Analytics focus on transparent, ethical data usage, appealing to impact-focused investors. 16

- Support Sustainable Innovation: AI has a substantial carbon footprint, and startups focused on energy-efficient models or sustainable applications are gaining traction. Hugging Face, for example, is working on making machine learning models more efficient and accessible, reducing both environmental and financial costs. 17

The future of AI startups is rich with potential. From healthcare and finance to retail and mobility, these startups are transforming industries and creating unique investment opportunities. However, success in AI investing requires careful consideration of both technical potential and ethical considerations. Investors who focus on startups with scalable, differentiated technology, a commitment to transparency, and sustainable business practices are well-positioned to capture the value that AI innovation will bring in the years to come. With AI expected to add trillions to the global economy, those who invest wisely in this space stand to benefit significantly from the next wave of technological advancement.

Graph Citations:

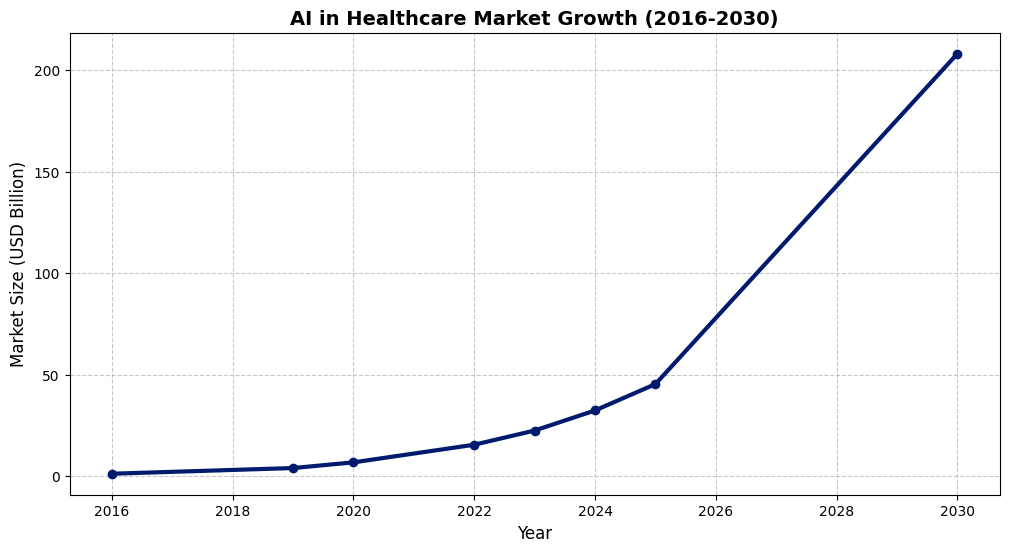

AI in Healthcare Market Growth (2016 – 2030):

- Precedence Research. (2025). Artificial Intelligence in E-commerce Market [Dataset]. Retrieved from Precedence Research

Projected Growth of AI in Trading Market (2024 – 2033):

- Precedence Research. (2025). Artificial Intelligence in E-commerce Market [Dataset]. Retrieved from Precedence Research

Global AI Market Size Projections (2020 – 2030):

- Precedence Research. (2025). Artificial Intelligence in E-commerce Market [Dataset]. Retrieved from Precedence Research

- AI Startups: https://www.fortunebusinessinsights.com/industry-reports/artificial-intelligence-market-100114[↩]

- AI Startups: https://www.pathai.com/[↩]

- AI Startups: https://www.tempus.com/resources/content/articles/using-data-and-ai-ml-to-achieve-precision-medicine/?srsltid=AfmBOork5FPBti3LHjZm2n32Aa7v9PS4HLu52c6_cIZRQH91ubuvY6_G[↩]

- AI Startups: https://www.klarna.com/international/press/klarna-ai-assistant-handles-two-thirds-of-customer-service-chats-in-its-first-month/[↩][↩]

- AI Startups: https://aimagazine.com/machine-learning/zest-ai-ai-could-resolve-issues-bias-credit-scoring[↩]

- AI Startups: https://imaginovation.net/blog/gpt-4-openai-for-businesses/[↩]

- AI Startups: https://dominos.gcs-web.com/news-releases/news-release-details/dominosr-and-nuro-launch-autonomous-pizza-delivery-road-robot[↩]

- AI Startups: https://www.uipath.com/rpa/robotic-process-automation[↩]

- AI Startups: https://www.butterflynetwork.com/?srsltid=AfmBOooTtLbA8DgfRlgpbFnCAJNyRFmvjSpm5ktYi3l370WlkwdTqzDO[↩]

- AI Startups: https://www.ft.com/content/f4f73815-6fc2-4016-bd97-4bace459e95e[↩]

- AI Startups: https://www.ey.com/en_ch/insights/forensic-integrity-services/the-eu-ai-act-what-it-means-for-your-business[↩]

- AI Startups: https://www.fiddler.ai/[↩]

- AI Startups: https://www.kneron.com/[↩]

- AI Startups: https://www.halasystems.com/[↩]

- AI Startups: https://cerebras.ai/press-release/cerebras-enables-faster-training-of-industrys-leading-largest-ai-models[↩]

- AI Startups: https://www.civisanalytics.com/platform/[↩]

- AI Startups: https://huggingface.co/models[↩]