AI and Machine Learning

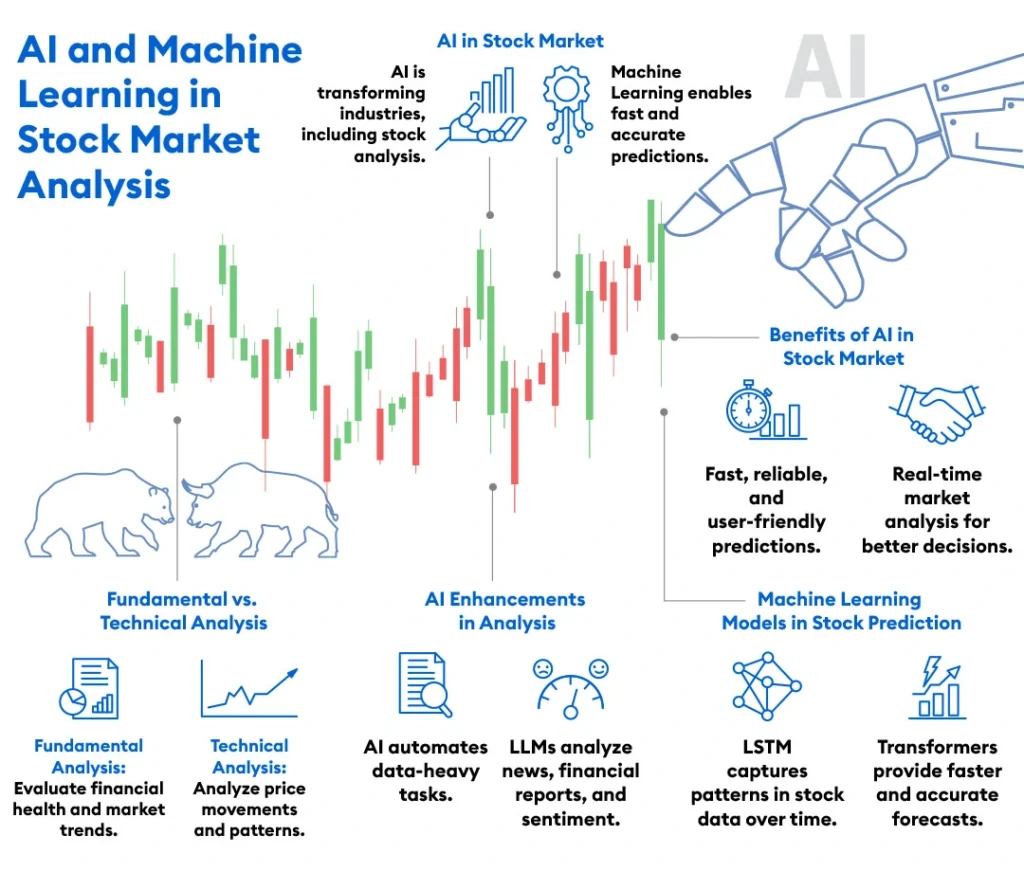

Artificial intelligence(AI) has become a prominent topic in recent times, not just within technical industries but across various sectors such as healthcare, logistics, automotive, education, retail, and finance.

AI refers to the science and engineering of making intelligent machines, particularly intelligent computer programs, capable of performing complex tasks that historically humans could do such as making decisions and solving problems.

AI is an umbrella term that encompasses various computational strategies, including Machine Learning, Robotics, Natural Language Processing and Cognitive Computing.

Among these, Machine Learning is particularly widespread across industries. Machine learning focuses on developing statistical algorithms that can learn from data and make predictions or decisions for unseen data without explicit instructions.

A key Machine Learning approach is the Artificial Neural Network, which serves as the foundation for many of today’s complex model architectures. This method is inspired by the structure and the function of biological neural networks in animal brains.

With the rise of AI, many industries have undergone significant transformation and improvement. One of the key areas where AI has made a notable impact is the stock market analysis.

Stock Analysis

Stock analysis 1 involves evaluating a specific trading instrument, an investment sector, or even the entire market to predict future trends and activities. This process is crucial for making informed decisions about buying and selling stocks.

To evaluate stocks, analysts typically rely on financial statements, stock price movements and market indicators. This data comes from various sources and is often in different formats, some of which are structured(like spreadsheets) and others unstructured(like news articles). Traditionally, analyzing this vast amount of data requires financial expertise and considerable time investment.

When trading stocks, the timing of decisions is critical, especially in markets where prices fluctuate rapidly. Because of this, automated trading strategies have become increasingly popular.

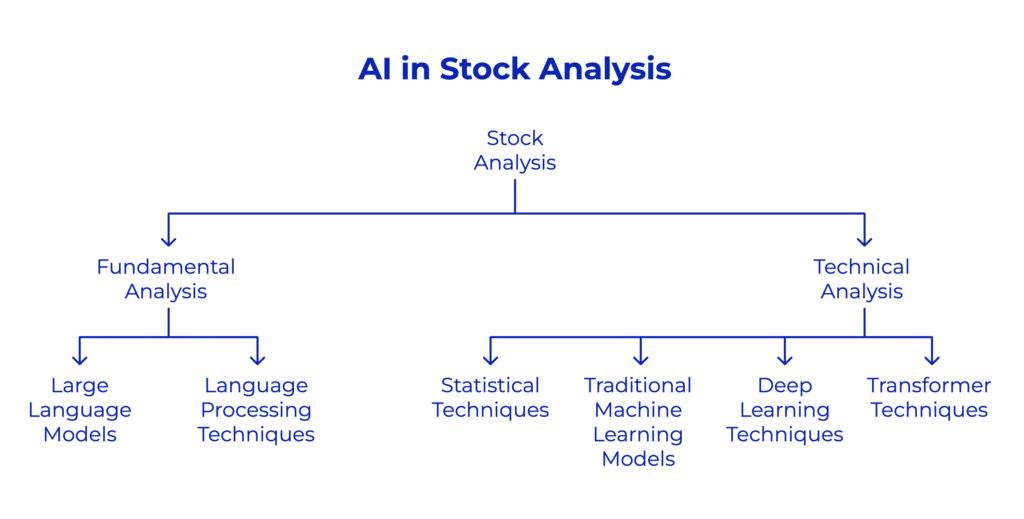

Types of stock analysis.

There are two main types of stock analysis. which are fundamental analysis and technical analysis

Fundamental analysis focuses on understanding factors that influence stock prices. This analysis is typically used when making long-term investment decisions. Investors look at a company’s financial health, the state of its business sector, the effectiveness of its management and its strategic initiatives.

Key data sources for fundamental analysis include financial statements, quarterly earning reports and other company disclosures. In today’s fast-paced market, keeping track of current trends is also vital, so investors might also look at news feeds, Google trends and social media activities (e.g. X fka Twitter).

Technical analysis, on the other hand, examines the current and past movement of stock prices and trading volumes to predict future trends. This method often uses charts to visualize trends and is particularly effective when price movements are driven by supply and demand.

However, since technical analysis doesn’t account for external factors as stock splits, mergers or unexpected events(eg. terrorist attacks), relying solely on past data can carry significant risks.

How AI has Improved stock analysis

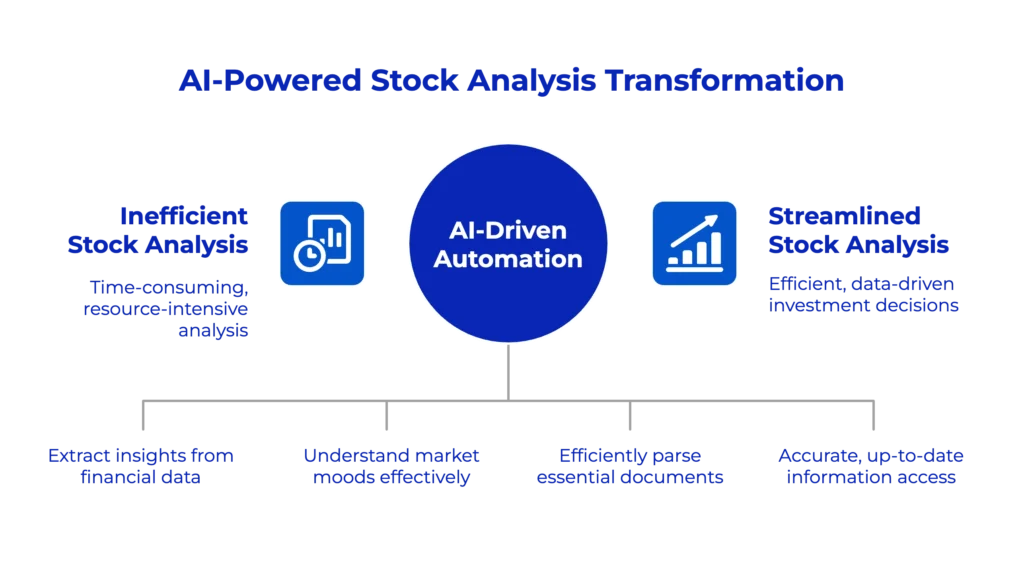

AI has greatly enhanced both fundamental and technical analysis by automating the labor-intensive aspects of these processes.

Fundamental Analysis

In fundamental analysis, traditionally investors have to sift through massive amounts of financial reports, articles, and social media posts which is both time-consuming and resource-intensive.

Why Large Language Models have redefined Fundamental Analysis

With AI, particularly models known as Large Language Models (LLMs), this analysis has become much more easier. These models, trained on vast amounts of text data can summarize and extract insights from content. Leading tech companies have developed these models, some of which are available as paid services, while others are freely accessible.

These AI models can analyze the sentiment of news and social media, helping investors to understand the market moods. Additionally, they can also assist in parsing financial statements, earning reports and other essential documents making the analysis process more efficient.

The training of an LLM consists of multiple phases 2. The initial phase is known as pre-training, where the LLM learns from a large, diverse dataset-often containing trillions of words with a goal of developing a broad language understanding of the model. This process is both massively computationally expensive and it needs huge amounts of data.

After pre-training, there is a technique called fine-tuning where the pre-trained model is further adjusted using specialized datasets to perform better on specific tasks which were not covered during pre-training. This approach is advantageous because it allows the model to be customized for particular needs, such as financial analysis, using smaller datasets while benefiting from the general knowledge acquired during pre-training.

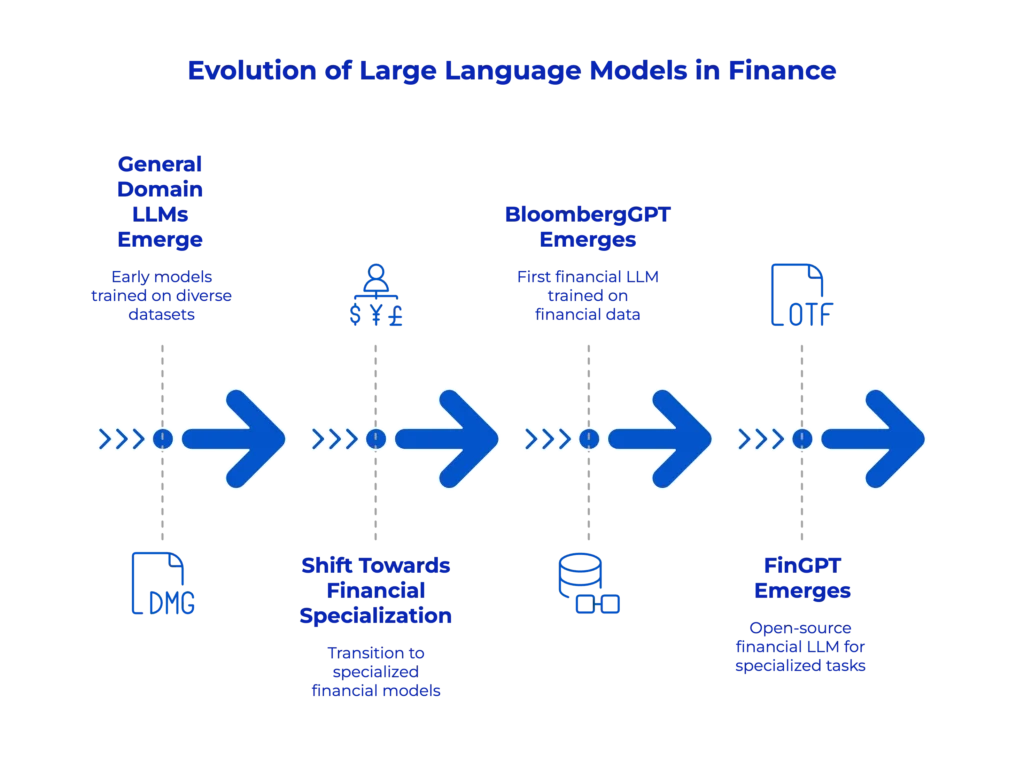

There are multiple LLMs available that are specifically trained or fine-tuned for finance-related tasks. For instance, BloombergGPT 3 is the first such financial LLM. It is trained both on a large general corpus and a substantial financial corpus which includes data collected from web news, filings, press releases and proprietary Bloomberg data. Another example is FinGPT 4, an open-source model which is finetuned for specialized text instructions to enhance its capabilities (instruction finetuning).

These LLMs support a diverse set of natural language processing tasks in the financial industry. According to the research paper of the FinGPT 5, potential applications include Robo-advisors that provide personalized financial advice, quantitative trading that produces trading signals for informed decision-making, and portfolio optimization, which uses numerous economic indicators and investor profiles to construct optimal investment portfolios. Other applications mentioned include financial sentiment analysis, risk management, fraud detection, credit scoring, and forecasting for mergers and acquisitions.

The following timeline shows the evolution of LLM releases from the general domain to the financial domain. These details are taken from the research paper “A Survey of Large Language Models in Finance (FinLLMs)’ 6

Training an LLM that has billions of parameters is a resource-consuming task that only high-tech companies can typically afford. Finetuning also requires a significant amount of computational resources. Since data related to investment decisions changes rapidly over time, it is not feasible to frequently train or fine-tune models on the latest data. Therefore, a method called Retrieval Augmented Generation is commonly used, where facts are retrieved from an external knowledge base and fed into the LLM to generate more accurate, up-to-date information for the users. The knowledge base can be updated regularly, allowing the system to stay current with new information

Technical Analysis

Technical analysis involves analyzing price charts, finding patterns and trends, and forecasting potential price changes. This process can be time-consuming and requires specialized skills in reading price charts, understanding technical indicators and applying pre-defined rules. However these rules may not always apply uniformly across all markets, and sometimes market-specific details need to be considered, which may not be accounted for in existing rules.

Moving Average and Auto-Regressive Models

Before the advent of machine learning, researchers used models like the Moving average and Auto-regressive models for forecasting future stock prices. In Auto-Regressive models, the predictions are based solely on past values in the price series, assuming that a value of a particular time step depends linearly on its previous time steps. In Moving average models the predictions are made based on the errors of the previous time steps and average the value of the time series assuming that a time step’s value depends on a linear combination of the error terms plus the average of the time series. ARIMA is a model that combines both approaches.

These traditional models come with multiple assumptions, and if the assumptions are violated, the models may not produce accurate predictions. For example, AR and MA models assume a linear relationship between current and past time steps limiting their ability to model complex non-linear patterns in the real-world stock data. Additionally, they assume stationarity, meaning that the statistical properties of the time series remain consistent over time. For instance, if we consider two-time windows of the same length, we would expect the same distribution in both windows.

Machine Learning

Machine learning, however, allows us to train models that can identify patterns from past data specific to a given market. Since It is challenging for a human to identify new patterns from large volumes of data quickly, automating this task using machine learning provides a significant advantage by delivering fast and accurate predictions in dynamic and volatile environments. Machine learning models also have the capacity to understand non-linear patterns in the data.

In the early stages, researchers used traditional Machine Learning techniques like decision trees, support vector regression and random forests for stock market predictions. However, due to the stock market’s complexity and dynamic nature, these methods struggled to make accurate forecasts.

With the advancements in neural network-based model architectures, more sophisticated models have been employed for making forecasts. Recently, neural network-based solutions have become widely used, achieving higher accuracy in predictions compared to classical machine learning algorithms.

Recurrent Neural Networks

One widely used deep learning algorithm is Long Short Term Memory(LSTM), a type of Recurrent Neural Network(RNN), specifically designed for time series forecasting. LSTM models can consider both short-term and long-term relationships within time series data, overcoming the limitation of the traditional machine learning models in capturing long-term dependencies.

However, a drawback of neural-network based approaches is their lack of interpretability where these models act as a black box, making it difficult to understand the logic behind their predictions.

Transformers

Recent research has introduced a new architecture called Transformer models, which have shown state-of-the-art results in various language processing tasks. These models have also been applied to other time series prediction tasks, demonstrating more accurate results by offering faster predictions and a better mechanism for capturing long-term dependencies, known as the attention mechanism. Some studies 7 have followed Transformer-based models for stock analysis, and these models have significantly outperformed other classic methods, potentially yielding excess earnings for investors.

This table shows the advantages and disadvantages of different machine learning models typically used for stock market predictions. 8

| Techniques | Advantages | Disadvantages | |

| 1 | Artificial neural network | Better performance compared to regression. Suitable for large datasets and complex patterns. | Low interpretability Requires more data. Requires careful parameter tuning |

| 2 | Support vector machine | Generalizes well Handles high-dimensional data | Exaggerates minor fluctuations in the training data which decrease the predictive ability |

| 3 | Hidden Markov model | Useful for optimization and pattern recognition | Complex evaluation, decoding, and learning. HMM assumes that the future depends only on the current state. |

| 4 | ARIMA | Robust and efficient for stationary data. Simple to implement and interpret. | Assumes stationarity. May be less effective for short-term forecasts. |

| 5 | Time series linear model | Integrates data to fit ideal linear models. | Limited by linear assumptions. Fails to capture seasonal trends. |

| 6 | LSTM | Good for both long-term and short-term forecasts. Can model both linear and non-linear relationships in data. | Low interpretability. Requires more data Prone to overfitting. |

As per the analysis above, AI and machine learning have significantly enhanced the automation of both technical and fundamental stock analysis. With continuous technological advancements, these processes have become more accurate, reliable, and user-friendly. Large language models (LLMs) are expected to drive future innovations, as they possess human-like language understanding and the ability to efficiently retrieve relevant information from vast knowledge bases. This combination makes stock forecasting and analysis faster and more effective, paving the way for even greater advancements in the field.

AI has had a significant impact on stock analysis. Additionally, ongoing research in this field continues to evolve with the latest technological trends, consistently providing faster and more accurate predictions for stock analysis tasks.

This advancement has significantly impacted the trading process by replacing manual data analysis, which is both time- and resource-consuming.

- Stock Analysis: https://www.investopedia.com/terms/s/stock-analysis.asp[↩]

- Intro to Large Language Models: https://www.youtube.com/watch?v=zjkBMFhNj_g[↩]

- Introducing BloombergGPT: https://www.bloomberg.com/company/press/bloomberggpt-50-billion-parameter-llm-tuned-finance/[↩]

- FInGPT: https://github.com/AI4Finance-Foundation/FinGPT[↩]

- FinGPT: Open-Source Financial Large Language Models: https://arxiv.org/abs/2306.06031[↩]

- FinLLM: https://arxiv.org/abs/2402.02315[↩]

- Transformer for Stock Price Forecasting: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4729648[↩]

- ML techniques for stock prediction: https://www.researchgate.net/publication/341482418_A_Survey_on_Stock_Market_Prediction_Using_Machine_Learning_Techniques [↩]