Table of Contents

- Overview of the cryptocurrency market as of late 2023

- The Resilience of Major Cryptocurrencies

- What Factors Influenced the Cryptocurrency Market?

- The impact of global events on crypto markets

- The Role of Institutional Investors

- Challenges and Risks in the Crypto Market

- Expert Predictions and Future Trajectories in the Crypto Market

Overview of the cryptocurrency market as of late 2023

In late 2023, the cryptocurrency landscape will be marked by significant developments. Bitcoin’s current price is trading above forty thousand, indicating a substantial shift in the market.

Despite Bitcoin’s resilience, a decline in market cap dominance suggests a growing interest in alternative coins. Once in the grip of a “crypto winter,” the crypto market has transitioned to a summer phase, fueled by a waning concern for a hard landing in the U.S. economy and a renewed appetite for risk-on assets. Regulatory scrutiny from the SEC on crypto exchanges persists, but regulatory clarity is emerging amidst this. Notably, leading asset managers, including BlackRock, are seeking approval for Bitcoin spot exchange-traded funds, potentially serving as a bullish catalyst.

The top cryptocurrencies, Bitcoin and Ethereum, dominate the market with market caps of $719.2 billion and $244.8 billion, respectively. Bitcoin boasts a 123% year-over-year return, while Ethereum follows closely with a 68% return. Despite regulatory uncertainties, significant cryptocurrencies are experiencing positive momentum. Ethereum’s recent transition to a proof-of-stake system enhances its environmental profile compared to Bitcoin. While both are poised for new highs, Ethereum’s unique blockchain functionality sets it apart as a greener investment in 2023.1

The Resilience of Major Cryptocurrencies

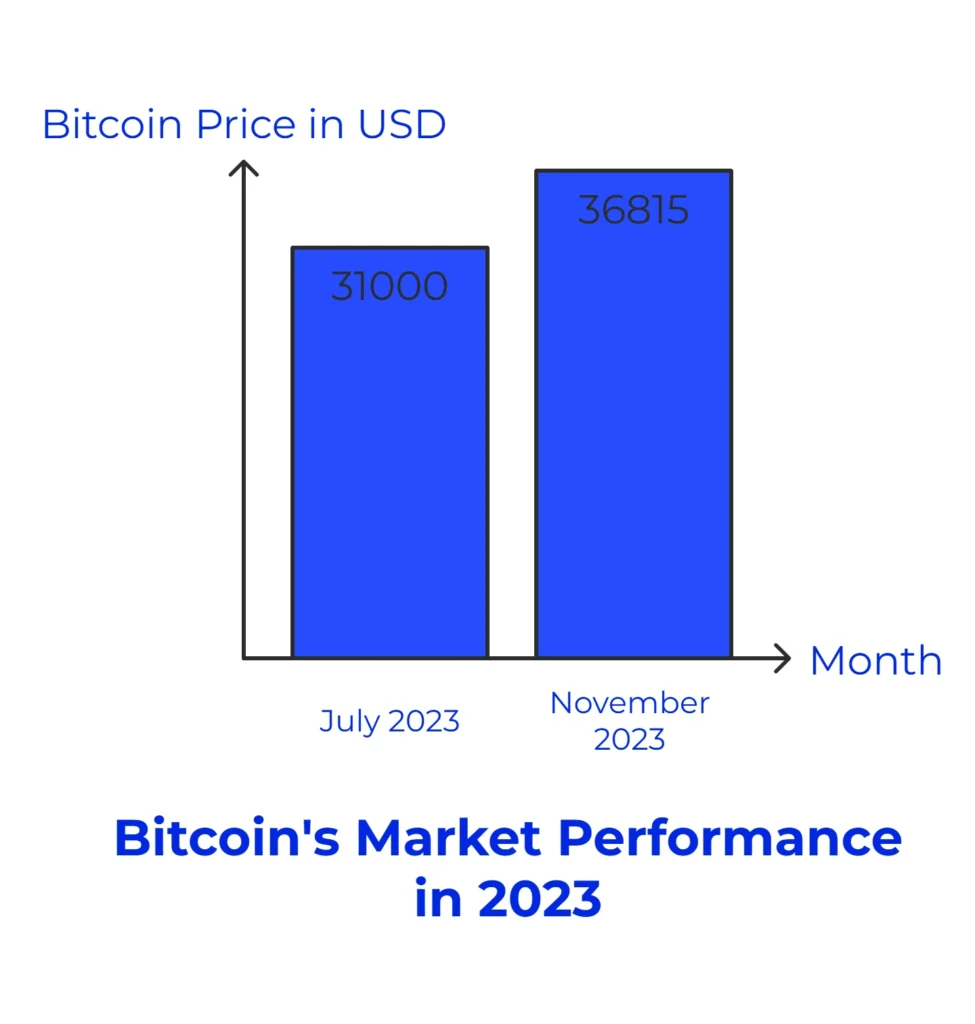

Despite facing a significant setback with a 65% loss in market value throughout the past year, Bitcoin (BTC) exhibited remarkable resilience in the opening months of 2023. In July, BTC surged, reaching $31,000, and by November 9, 2023, it soared to $36,815, with a market capitalization of $719.29 billion and a market volume of $25.05 billion—an 18-month high. Nonetheless, the journey to recovery remains extensive, with BTC currently experiencing a nearly 50% decline from its peak. Bitcoin witnessed a significant drop below the $20,000 mark in the initial months of the year, owing to the escalating banking crisis in the United States. However, various contributing factors, such as the depreciation of the dollar index and a moderation in inflation, have collectively played a pivotal role in the resurgence of Bitcoin and other digital currencies.

Consequently, the recent financial turmoil in the United States has heightened interest in and enthusiasm for cryptocurrencies.

What Factors Influenced the Cryptocurrency Market?

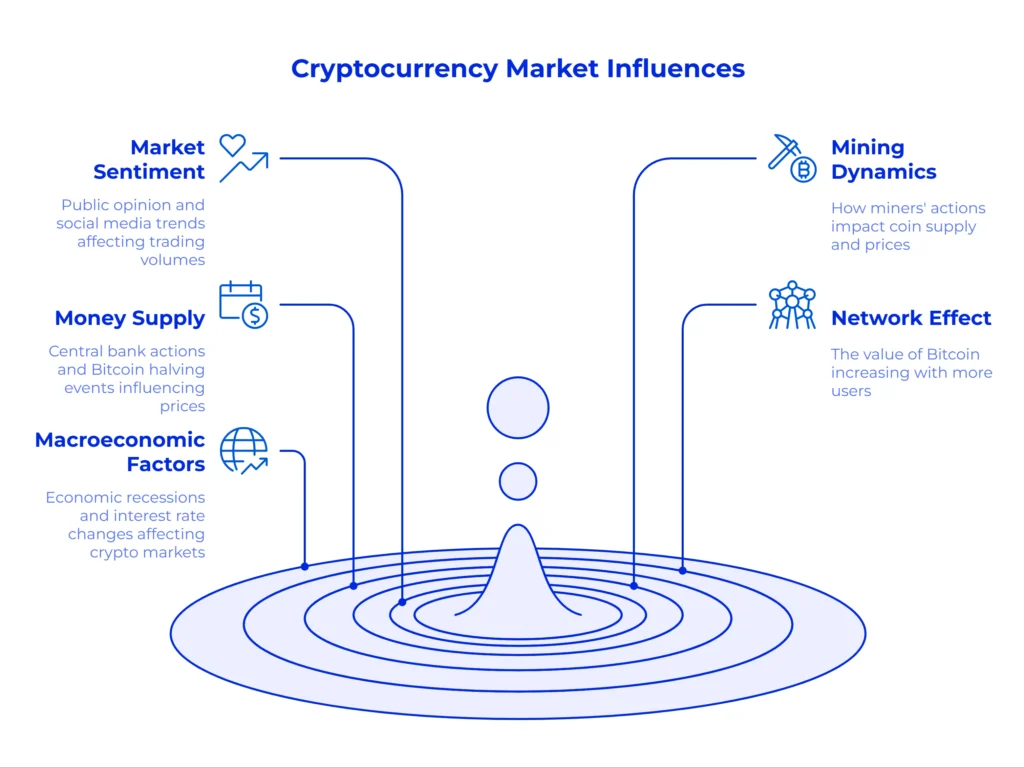

- Market Sentiment and Social Media Impact: Cryptocurrency markets exhibit cyclic price movements influenced by overall sentiment. CNN’s “Fear and Greed Index” gauges sentiment using indicators like Bitcoin volatility. Social media hype, exemplified by the PEPE meme coin’s 300% surge post-Twitter trend, significantly affects trading volumes.

- Mining Dynamics: Bitcoin mining, involving powerful computers processing transactions and creating new coins, shapes market dynamics. Miners’ coin management impacts prices; holding coins reduces supply, supporting prices, while sales increase supply, potentially lowering prices.

- Money Supply Dynamics: Growth in the money supply, linked to central bank actions, is a pivotal factor influencing Bitcoin prices. The supply-and-demand dynamic and periodic Bitcoin halving events amplify this impact.

- The Network Effect: Bitcoin’s value lies in its network size; widespread adoption and active participation increase its perceived value. Rising prices attract more participants, fostering a positive feedback loop.

- Macroeconomic Influences: As an alleged hedge against macroeconomic factors, cryptocurrencies are not immune. Economic recessions may limit investments, and interest rate changes impact crypto markets, as seen with the Federal Reserve’s rate hikes affecting high-risk assets last year.

The impact of global events on crypto markets

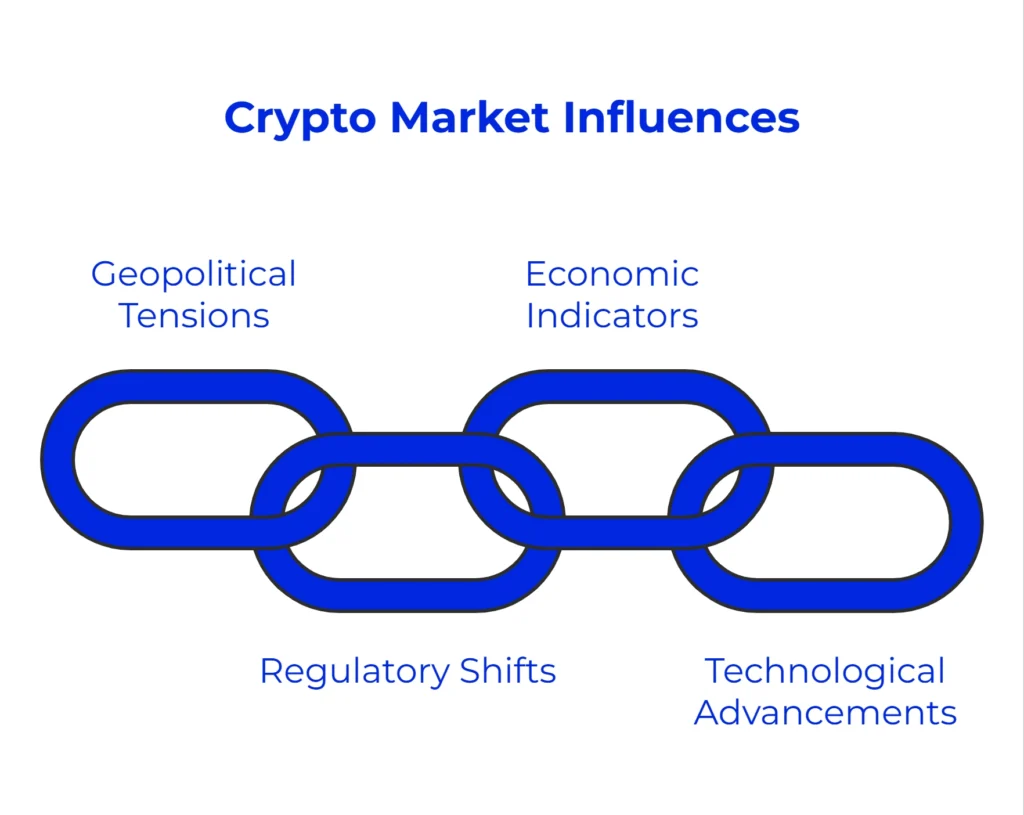

Global events, spanning geopolitical tensions to regulatory shifts, significantly heighten cryptocurrency market volatility. This increased instability complicates the forecasting of market fluctuations in futures trading. Global happenings directly influence investor sentiment and risk appetite; positive events, like institutional crypto adoption, boost confidence and trading activity, while negative occurrences, such as regulatory crackdowns, erode trust and decrease trading volumes.

Economic indicators, like interest rates or GDP growth, indirectly impact crypto. Government actions worldwide, particularly regarding regulations, create uncertainty and trading. Technological advancements, such as blockchain adoption, fueled market optimism, stimulating increased cryptocurrency trading.

The Role of Institutional Investors

The surge in institutional involvement in the crypto market has become a pivotal force, reshaping the landscape of digital assets. Institutional investors, including major financial institutions and large-scale investors, have increasingly recognized the potential for higher returns offered by cryptocurrencies than traditional investment assets. This heightened interest has spurred the adoption of diverse investment strategies, such as holding cryptocurrencies on balance sheets, investing in crypto ETFs, and leveraging crypto for hedging and payments. As institutional players enter the crypto sphere, their expertise, and sophisticated trading strategies enhance liquidity, market stability, and efficiency. The expanding institutional footprint has prompted greater regulatory scrutiny, improving market integrity and transparency. Noteworthy examples include BlackRock and Fidelity’s recent SEC filings for bitcoin spot ETFs and the establishment of the Canton Network by Goldman Sachs, BNP Paribas, and Deloitte.

Motivated by factors such as the potential for higher returns, diversification, and hedging opportunities, institutional investors are reshaping their portfolios to include cryptocurrencies. The precise regulatory frameworks and the provision of crypto-related services by major financial institutions contribute to the growing acceptance of digital assets. Fueled by Fear of Missing Out (FOMO) and competitive pressures, institutions respond to evolving investor demands, catering to the increasing interest from high-net-worth individuals and institutional clients. Recognizing the long-term transformative potential of cryptocurrencies, institutional investors view them as a hedge against traditional financial systems.

With an optimistic future perspective, the adoption by institutions significantly influences the crypto market’s direction, fostering stability, expansion, and broader acceptance.

Challenges and Risks in the Crypto Market

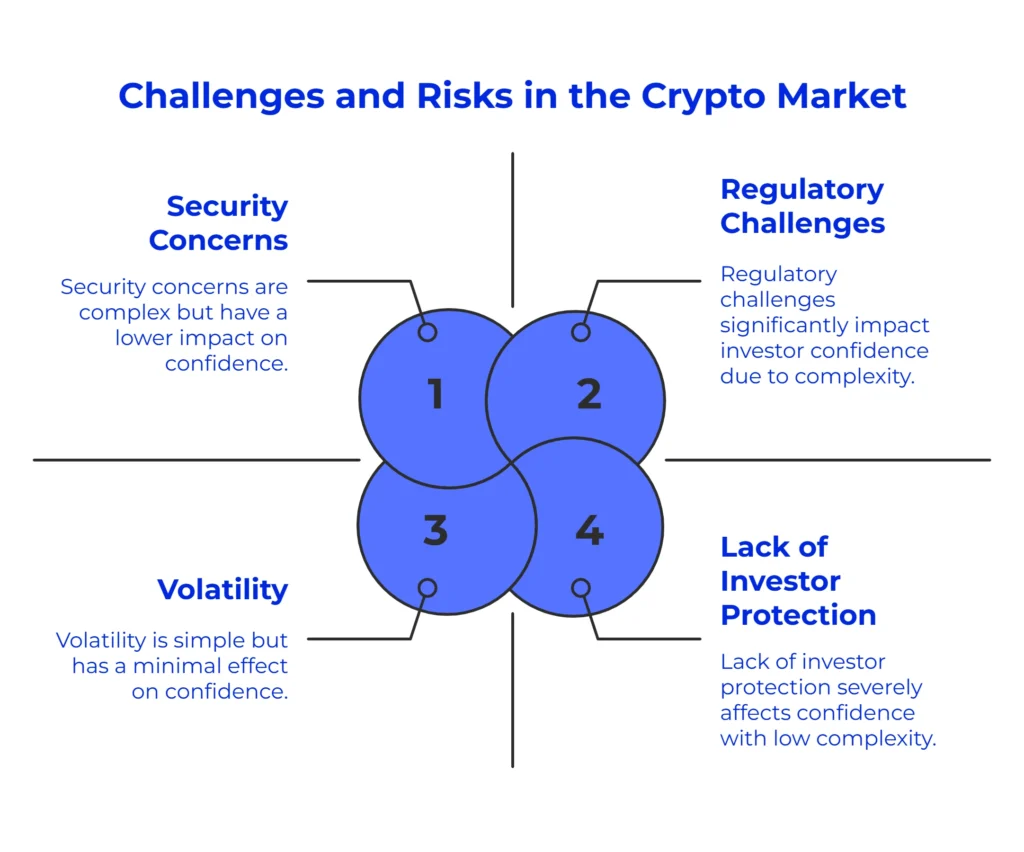

The intersection of volatility, regulatory challenges, and security concerns in cryptocurrency significantly impacts investor confidence. The legal classification of crypto assets remains a complex issue with no universal consensus, leading to potential difficulties in obtaining freezing injunctions and complicating asset-tracing and recovery efforts.

The security features of crypto assets, particularly when stored in cold wallets, enhance personal fund security but pose challenges in insolvency proceedings due to the near-impossibility of recovery without the owner’s cooperation. Furthermore, the treatment of creditors in the crypto industry lacks safety nets, such as investor protection funds, common in traditional securities markets, amplifying uncertainties in fund distribution. The inherent volatility of cryptocurrencies, exemplified by Bitcoin, adds complexity to distribution challenges, compounded by the need to deliver funds to diverse creditors across different jurisdictions. Despite the increasing adoption of crypto by large institutions, the industry’s structural flaws pose risks not only to its stability but also to the broader financial system, creating a climate of fear, uncertainty, and doubt among financial supervisors and regulators. In conclusion, addressing these challenges is crucial not just for crypto investors but also for the stability of the traditional financial system.

Expert Predictions and Future Trajectories in the Crypto Market

Bitcoin enthusiasts are buzzing with optimism and lofty predictions for their beloved cryptocurrency. Following a recent mini-bull run, global discussions are ablaze regarding Bitcoin’s potential trajectory, with some foreseeing an astonishing valuation of $10 million by 2025. This ambitious figure has been touted by prominent figures in the crypto world, gaining attention and speculation. Notably, Standard Chartered, a leading British Multinational Bank, has revised its BTC price prediction to 0,000 to 0,000 by the end of 2024, attributing it to increased profitability for BTC miners.

The crypto market’s trajectory faces various potential scenarios influenced by rising interest rates and inflation. Global central banks’ efforts to combat inflation have led to a sell-off of riskier assets like cryptocurrencies.

Regulatory uncertainty adds to investor caution, as clear guidelines are lacking. Economic measures, particularly interest rate hikes by the U.S. Federal Reserve, have played a significant role in recent market fluctuations. The correlation between crypto and equity markets underscores their inherent connection. Sudden decisions by major financial institutions and impactful news can also swiftly shape the market’s direction.

- Forbes: https://www.forbes.com[↩]