NEW YORK, Friday, July 19, 2024 – Nine governments collectively hold $32.3 billion in Bitcoin, representing 2.5% of its total supply, according to Bitcoin Treasuries.

These holdings have been largely acquired through law enforcement seizures, sparking concerns about potential market manipulation.

The U.S. tops the list with 213,246 BTC, valued at approximately $13.4 billion, much of which was seized from the Silk Road dark web marketplace. China follows with 190,000 BTC worth $11.9 billion, confiscated from the Plus Token scam. The UK holds 61,000 BTC, linked to a £5 billion investment fraud case.

Ukraine has 46,351 BTC, a mix of police seizures and war effort donations. El Salvador, the first country to adopt Bitcoin as legal tender, holds 5,800 BTC.

Bhutan, involved in significant Bitcoin mining operations, holds 621 BTC. Venezuela, Finland, and Georgia also hold smaller amounts of Bitcoin.

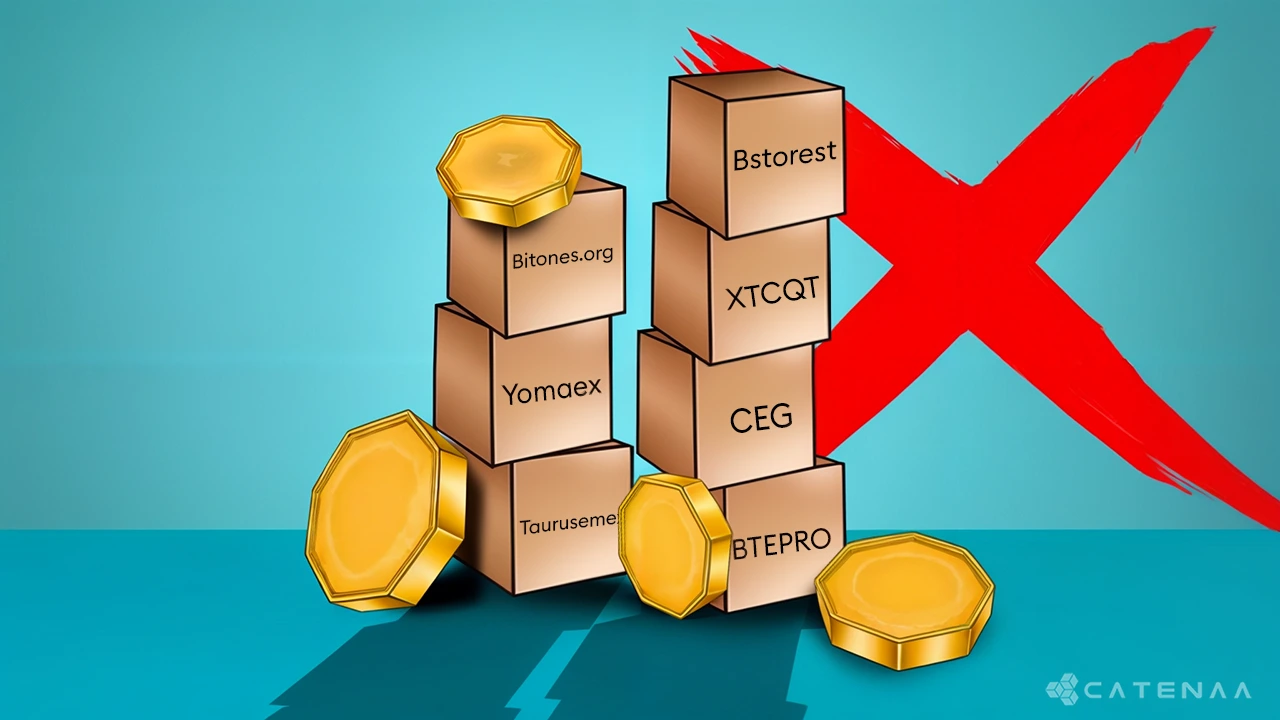

Germany recently sold 50,000 BTC worth $3 billion, causing Bitcoin prices to drop by 15%.

The action is seen as highlighting the potential for governments to impact Bitcoin markets significantly.

Independent German MP Joana Cotar criticized the government’s approach, suggesting it lacked strategic foresight.

There are concerns that coordinated actions by these governments could further destabilize the market. Eric Vander Wal, CEO of Uprising Labs, warned that large-scale sell-offs could manipulate prices and create negative market sentiment.

Despite the potential risks, some experts argue that international regulatory frameworks could help stabilize the market and prevent manipulation.